Answered step by step

Verified Expert Solution

Question

1 Approved Answer

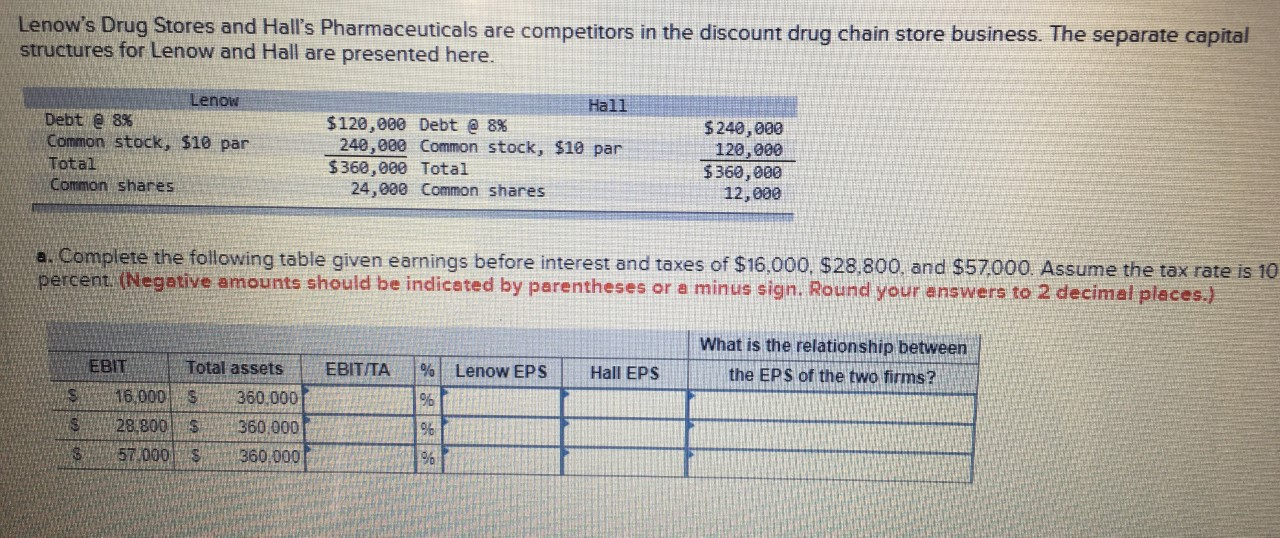

Lenow's Drug Stores and Hall's Pharmaceuticals are competitors in the discount drug chain store business. The separate capital Structures for Lenow and Hall are presented

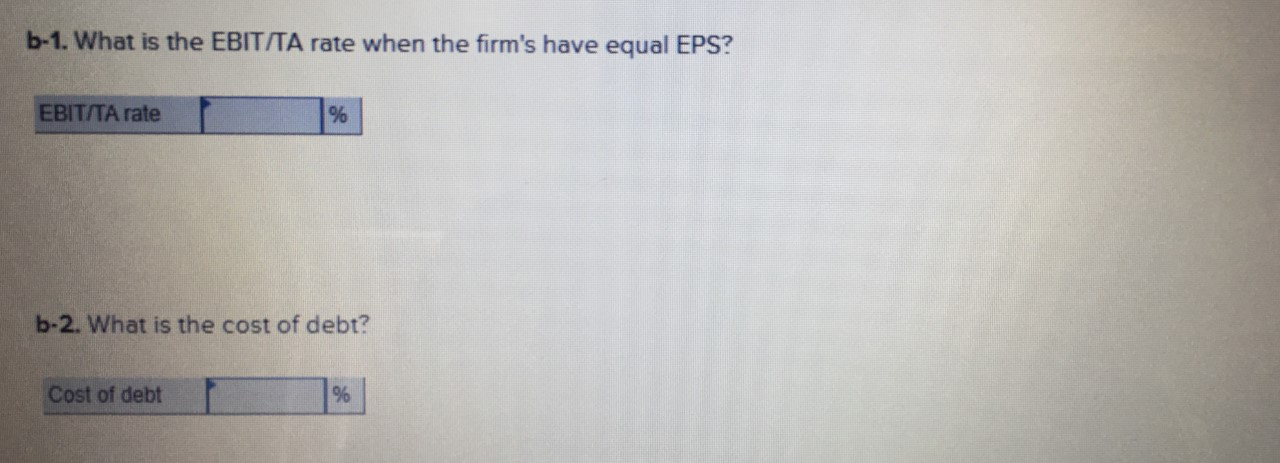

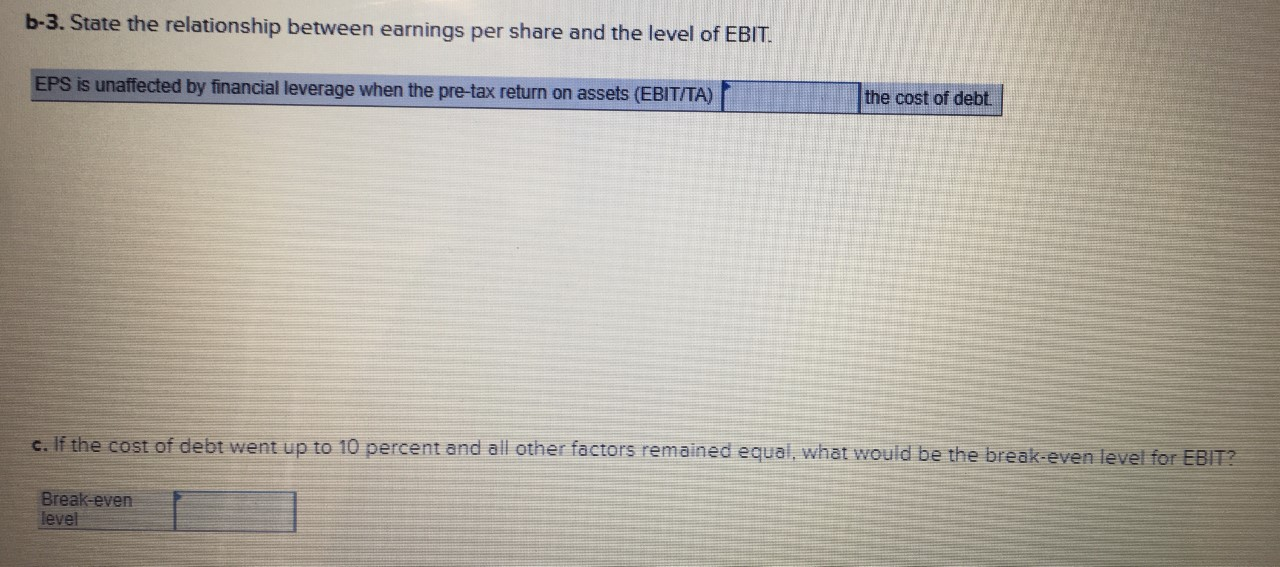

Lenow's Drug Stores and Hall's Pharmaceuticals are competitors in the discount drug chain store business. The separate capital Structures for Lenow and Hall are presented here. Lenow Debt @ 8% Common stock, $10 par Total Common shares $120,000 Debt @ 8% 240,000 Common stock, $10 par $360,000 Total 24,000 Common shares $ 240,000 120,000 $360,000 12,000 a. Complete the following table given earnings before interest and taxes of $16,000, $28,800, and $57.000. Assume the tax rate is 10 percent. (Negative amounts should be indicated by parentheses or a minus sign. Round your answers to 2 decimal places.) What is the relationship between the EPS of the two firms? EBIT/TA % Lenow EPS Hall EPS Total assets 16.000 $ 360,000 28,8005 360,000 57.000 $ 360,000 b-1. What is the EBIT/TA rate when the firm's have equal EPS? EBIT/TA rate % b-2. What is the cost of debt? Cost of debt Cost of debt % b-3. State the relationship between earnings per share and the level of EBIT. EPS is unaffected by financial leverage when the pre-tax return on assets (EBIT/TA) the cost of debt c. If the cost of debt went up to 10 percent and all other factors remained equal, what would be the break-even level for EBIT? Break-even level

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started