Question

Leonard (a 58-year-old man) is a resident of South Africa working in advertising. The following information relates to the 2022/2023 year of assessment: Gross salary

Leonard (a 58-year-old man) is a resident of South Africa working in advertising. The following information relates to the 2022/2023 year of assessment:

Gross salary R450,000

Interest from local bank R28,900

Interest from foreign bank R57,600

Interest from tax free investment R18,000

Dividends local investment R12,000

Dividends from foreign investment R55,000

Contributed R17,500 to pension fund, his employer contributed an equal amount.

Additional information you might find useful:

Required:

Calculate Leonards tax liability for the year of assessment. NB: Where an amount has nil effect, indicate the reason for this.

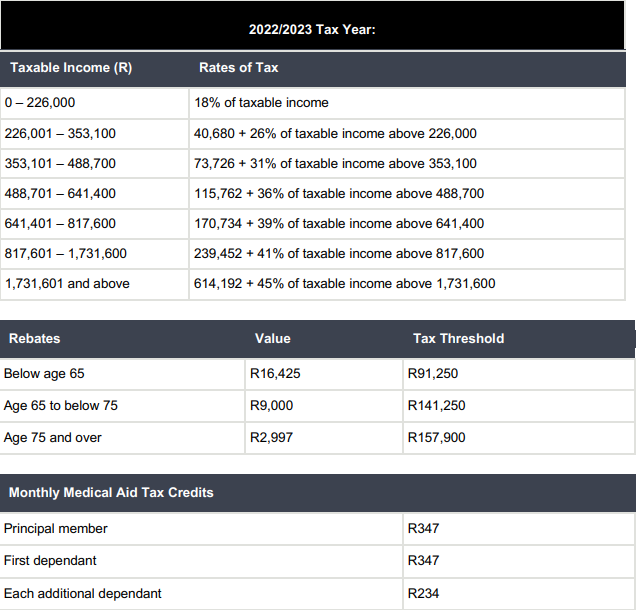

2022/2023 Tax Year: \begin{tabular}{|l|l|} \hline Taxable Income (R) & Rates of Tax \\ \hline 0226,000 & 18% of taxable income \\ \hline 226,001353,100 & 40,680+26% of taxable income above 226,000 \\ \hline 353,101488,700 & 73,726+31% of taxable income above 353,100 \\ \hline 488,701641,400 & 115,762+36% of taxable income above 488,700 \\ \hline 641,401817,600 & 170,734+39% of taxable income above 641,400 \\ \hline 817,6011,731,600 & 239,452+41% of taxable income above 817,600 \\ \hline 1,731,601 and above & 614,192+45% of taxable income above 1,731,600 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Rebates & Value & Tax Threshold \\ \hline Below age 65 & R16,425 & R91,250 \\ \hline Age 65 to below 75 & R9,000 & R141,250 \\ \hline Age 75 and over & R2,997 & R157,900 \\ \hline \end{tabular} Monthly Medical Aid Tax Credits \begin{tabular}{l|l} \hline Principal member & R347 \\ \hline First dependant & R347 \\ \hline Each additional dependant & R234 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started