Question: + Leon's has a total asset turnov X 5 Connect Connect Ch 04-Fall 2020 MGMT 3100 x ation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims.mheducation.com ORA Q> Connect Saved ? KB Calculating

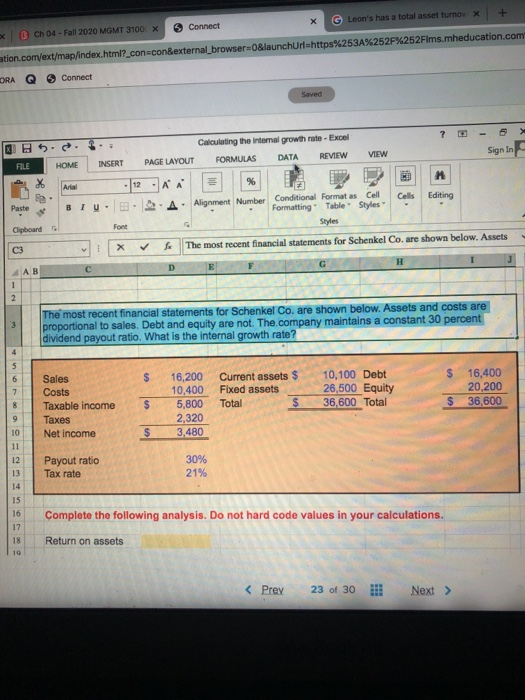

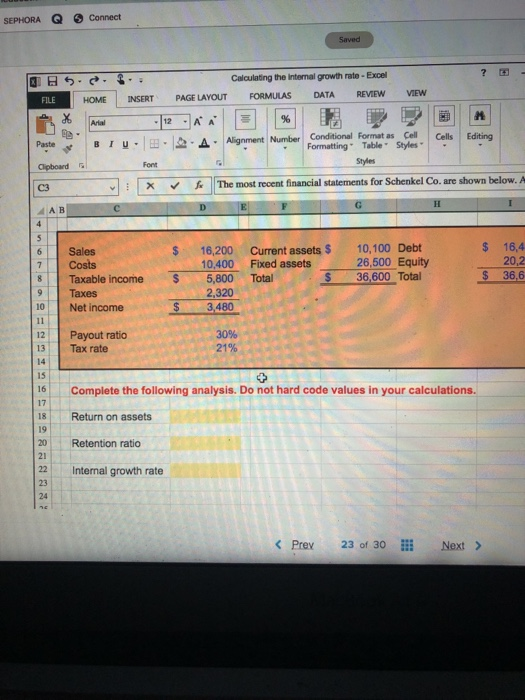

+ Leon's has a total asset turnov X 5 Connect Connect Ch 04-Fall 2020 MGMT 3100 x ation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fims.mheducation.com ORA Q> Connect Saved ? KB Calculating the intemal growth rate - Excel FORMULAS DATA REVIEW VIEW Sign In FILE HOME INSERT PAGE LAYOUT M Antal Cells Editing Paste BIU- - FAA % A - Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font CS The most recent financial statements for Schenkel Co. are shown below. Assets D H E AB 1 2 The most recent financial statements for Schenkel Co. are shown below. Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 30 percent dividend payout ratio. What is the internal growth rate? 4 5 6 7 $ Sales Costs Taxable income Taxes Net Income Current assets $ Fixed assets Total $ 16,200 10,400 5,800 2,320 3,480 10,100 Debt 26,500 Equity 36,600 Total 8 $ 16,400 20,200 $ 36,600 $ 9 $ 10 11 Payout ratio Tax rate 30% 21% 12 13 14 15 16 17 18 10 Complete the following analysis. Do not hard code values in your calculations. Return on assets SEPHORA Connect Saved H. Calculating the Internal growth rate - Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW FILE HOME INSERT X Arial 12 Cells Editing Paste BIU. -A A % A. Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font C3 X The most recent financial statements for Schenkel Co. are shown below. A D E G H 4 4 5 6 $ $ 7 Sales Costs Taxable income Taxes Net income Current assets $ Fixed assets Total $ 16,200 10,400 5,800 2,320 3,480 10,100 Debt 26,500 Equity 36,600 Total 16,4 20,2 36,6 $ 8 9 $ $ 10 11 12 13 Payout ratio Tax rate 30% 21% 14 15 16 Complete the following analysis. Do not hard code values in your calculations. Return on assets 17 18 19 20 21 22 Retention ratio Internal growth rate 23 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts