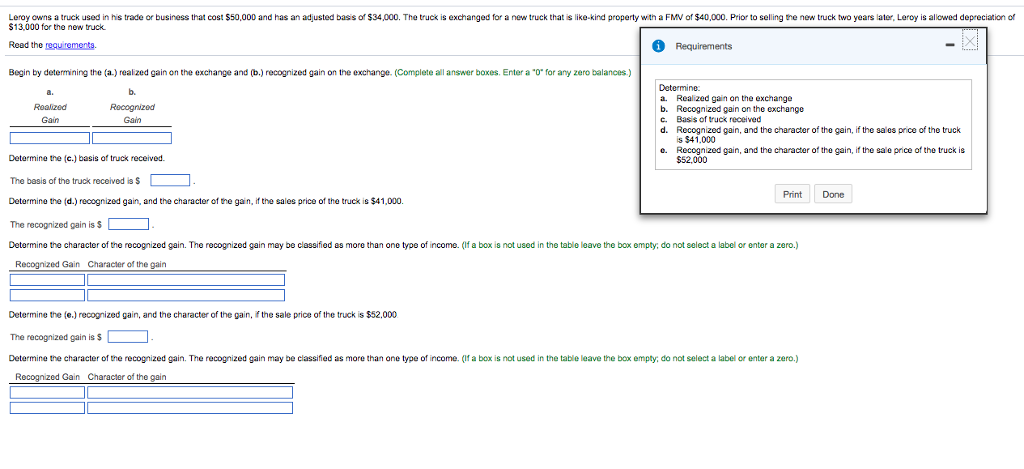

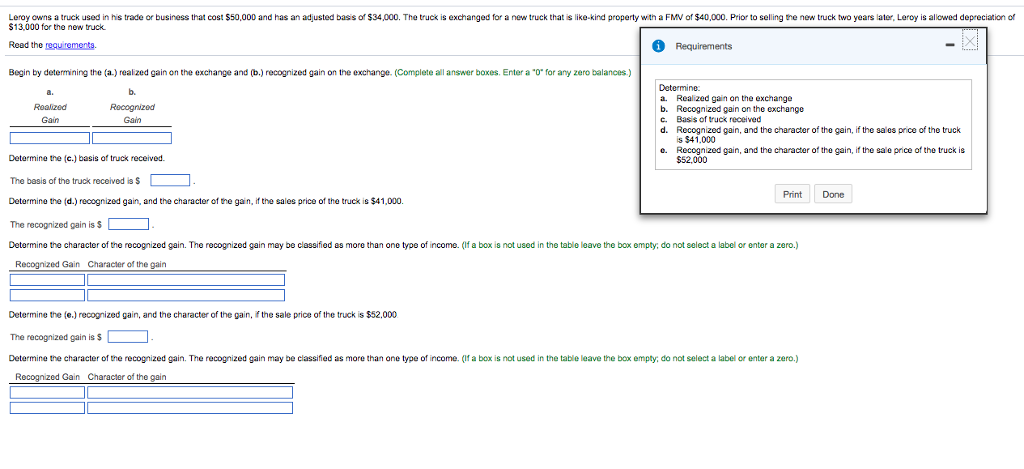

Leroy owns a truck used in his trade or business that cost $50,000 and has an adjusted basis of $34,000. The truck is exchanged for a new truck that is like-kind property with a FMV af $40,000. Prior to selling the new truck two years later, Leroy is allowed depreciation of $13,000 for the new truck Read the requirements. Begin by determining the (a.) real zed gain on the exchange and (b.) recognized gain on the exchange. (Complete all answer boxes. Enter a "0 for any zero balances.) Requirements Determine a. Realized gain an the exchange b. Recognized gain on the exchange c. Basis of truck received d. Recognized gain, and the character of the gain, if the sa es price of the truck b. Roaized Gain Gain s $41.000 Recognized gain, and the character of the gain, if the sale price of the truck is $52,000 e. Determine the (c.) basis of truck received The basis of the truck received is S Determine the (d.) recognized gain, and the character of the gain, if the sales price of the truck is $41,000. The recognized gain is $ Determine the character of the recognized gain. The recognized gain may be classified as more than one type of income. (f a box is not used in the table leave the box empty, do not select a label or enter a zero.) Print Done Recognized Gain Character of the gain Determine the (e.) recognized gain, and the character of the gain, if the sale price of the truck is $52,000 The recognized gain is S Determine the character of the recognized gain. The recognized gain may be classified as more than ane type of income. (If a box is not used in the table leave the box empty, do not select a label or enter a zero.) Recognized Gain Character of the cain Leroy owns a truck used in his trade or business that cost $50,000 and has an adjusted basis of $34,000. The truck is exchanged for a new truck that is like-kind property with a FMV af $40,000. Prior to selling the new truck two years later, Leroy is allowed depreciation of $13,000 for the new truck Read the requirements. Begin by determining the (a.) real zed gain on the exchange and (b.) recognized gain on the exchange. (Complete all answer boxes. Enter a "0 for any zero balances.) Requirements Determine a. Realized gain an the exchange b. Recognized gain on the exchange c. Basis of truck received d. Recognized gain, and the character of the gain, if the sa es price of the truck b. Roaized Gain Gain s $41.000 Recognized gain, and the character of the gain, if the sale price of the truck is $52,000 e. Determine the (c.) basis of truck received The basis of the truck received is S Determine the (d.) recognized gain, and the character of the gain, if the sales price of the truck is $41,000. The recognized gain is $ Determine the character of the recognized gain. The recognized gain may be classified as more than one type of income. (f a box is not used in the table leave the box empty, do not select a label or enter a zero.) Print Done Recognized Gain Character of the gain Determine the (e.) recognized gain, and the character of the gain, if the sale price of the truck is $52,000 The recognized gain is S Determine the character of the recognized gain. The recognized gain may be classified as more than ane type of income. (If a box is not used in the table leave the box empty, do not select a label or enter a zero.) Recognized Gain Character of the cain