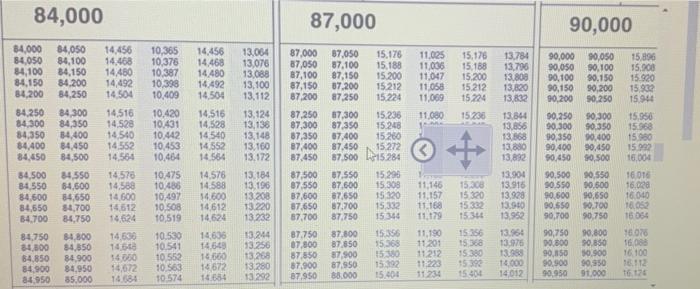

> Les 3. You and your significant other plan to file your taxes as married filing jointly. Use the taxable income you found in the previous problem and the tax table below to determine what you will need to pay in federal taxes. > Les 84,000 87,000 90,000 84,050 84,100 84,150 84.200 84,250 14.456 14,468 14480 14,492 14.504 10,365 10,376 10,387 10,398 10,409 14,456 14.468 14 480 14.492 14.504 84,000 84,050 84,100 84,150 84.200 84.250 84.300 84,350 84,400 84,450 13,064 13,076 13.088 13,100 13.112 13,124 13,138 13,148 13.160 13.172 11.025 11.005 11,047 11.050 11.069 11.080 15,176 15.188 15.200 15.212 15.224 15238 84 300 84,350 84,400 84,450 84,500 14,516 14,528 14,540 14 552 14.564 10.420 10.431 10,442 10,453 10,464 10,475 10.486 10,497 10.508 10,519 87,000 87,050 87,100 87,150 87,200 87.250 87,300 87.350 87,400 87.450 87,500 87.550 37,600 87.650 87,700 87.750 07,800 87.550 87.900 87.950 14,516 14.528 14540 14,552 14,564 14578 14,588 14.600 14612 14.624 14.530 14.50 14.00 14,672 14184 87.050 15,176 87,100 15.188 87,150 15.200 67,200 15212 87.250 15.224 17.300 15.236 87,350 15.248 67.400 15.260 87.450 15.272 87.500 15284 87.550 15290 87.600 15.308 67,650 15320 87.700 15,332 87.750 15:36 87,800 15:56 87.850 1536 87.900 15350 87,950 152192 88.000 15.404 13.784 13,700 13.800 13,820 13,832 13.864 13.856 13.868 13880 13,892 13.904 13.916 13,928 13.90 13.952 90,000 90050 90,050 90,100 90,100 90.150 90,150 90,200 90,200 90.250 90.250 90,300 90.300 90.350 90,350 90,400 90,400 90,450 90,450 90,500 90.500 90.550 90.550 90,500 90.600 90,650 90.550 $0.700 90,700 90.750 90,750 90.800 90.800 90.350 90,150 $0.900 90.900 90,950 90.950 91.000 15896 15.000 15.920 15.902 15.94 15.958 15.960 15.980 15.992 16,004 16.016 16.028 16.000 16.05 16 054 960 16.00 16.100 16.112 16.14 84,500 34.550 84,600 84,650 84.700 84,750 84,800 64.850 84.900 84.950 11.146 11.157 11.169 11,179 84.550 84,600 84,650 84,700 84,750 84,800 84,850 84,900 84.950 85.000 14.576 14 588 14.600 14612 14.624 14695 1459 16.000 16672 184 13.184 13.196 13.20 13.220 13.232 13.244 13.256 13.268 13,280 13292 15.300 15320 1533 15:34 15.350 153 15.380 45392 15404 10.530 10.541 10552 10.563 10 574 11,190 11 201 11 212 11.223 11234 13 96 13.976 13.983 14.000 14 012 mp to: SUBMISSION Q ATTACHMENTS 0% 5 5. Use your tax owed from problem 3 to determine if you would have a tax balance or a tax refund if $14,525.65 was withheld from your paychecks for federal income taxes. How much is the tax balance or tax refund? 6. Use the assessment rate and the property tax rate of the house chosen in problem 1 to > Les 3. You and your significant other plan to file your taxes as married filing jointly. Use the taxable income you found in the previous problem and the tax table below to determine what you will need to pay in federal taxes. > Les 84,000 87,000 90,000 84,050 84,100 84,150 84.200 84,250 14.456 14,468 14480 14,492 14.504 10,365 10,376 10,387 10,398 10,409 14,456 14.468 14 480 14.492 14.504 84,000 84,050 84,100 84,150 84.200 84.250 84.300 84,350 84,400 84,450 13,064 13,076 13.088 13,100 13.112 13,124 13,138 13,148 13.160 13.172 11.025 11.005 11,047 11.050 11.069 11.080 15,176 15.188 15.200 15.212 15.224 15238 84 300 84,350 84,400 84,450 84,500 14,516 14,528 14,540 14 552 14.564 10.420 10.431 10,442 10,453 10,464 10,475 10.486 10,497 10.508 10,519 87,000 87,050 87,100 87,150 87,200 87.250 87,300 87.350 87,400 87.450 87,500 87.550 37,600 87.650 87,700 87.750 07,800 87.550 87.900 87.950 14,516 14.528 14540 14,552 14,564 14578 14,588 14.600 14612 14.624 14.530 14.50 14.00 14,672 14184 87.050 15,176 87,100 15.188 87,150 15.200 67,200 15212 87.250 15.224 17.300 15.236 87,350 15.248 67.400 15.260 87.450 15.272 87.500 15284 87.550 15290 87.600 15.308 67,650 15320 87.700 15,332 87.750 15:36 87,800 15:56 87.850 1536 87.900 15350 87,950 152192 88.000 15.404 13.784 13,700 13.800 13,820 13,832 13.864 13.856 13.868 13880 13,892 13.904 13.916 13,928 13.90 13.952 90,000 90050 90,050 90,100 90,100 90.150 90,150 90,200 90,200 90.250 90.250 90,300 90.300 90.350 90,350 90,400 90,400 90,450 90,450 90,500 90.500 90.550 90.550 90,500 90.600 90,650 90.550 $0.700 90,700 90.750 90,750 90.800 90.800 90.350 90,150 $0.900 90.900 90,950 90.950 91.000 15896 15.000 15.920 15.902 15.94 15.958 15.960 15.980 15.992 16,004 16.016 16.028 16.000 16.05 16 054 960 16.00 16.100 16.112 16.14 84,500 34.550 84,600 84,650 84.700 84,750 84,800 64.850 84.900 84.950 11.146 11.157 11.169 11,179 84.550 84,600 84,650 84,700 84,750 84,800 84,850 84,900 84.950 85.000 14.576 14 588 14.600 14612 14.624 14695 1459 16.000 16672 184 13.184 13.196 13.20 13.220 13.232 13.244 13.256 13.268 13,280 13292 15.300 15320 1533 15:34 15.350 153 15.380 45392 15404 10.530 10.541 10552 10.563 10 574 11,190 11 201 11 212 11.223 11234 13 96 13.976 13.983 14.000 14 012 mp to: SUBMISSION Q ATTACHMENTS 0% 5 5. Use your tax owed from problem 3 to determine if you would have a tax balance or a tax refund if $14,525.65 was withheld from your paychecks for federal income taxes. How much is the tax balance or tax refund? 6. Use the assessment rate and the property tax rate of the house chosen in problem 1 to