Answered step by step

Verified Expert Solution

Question

1 Approved Answer

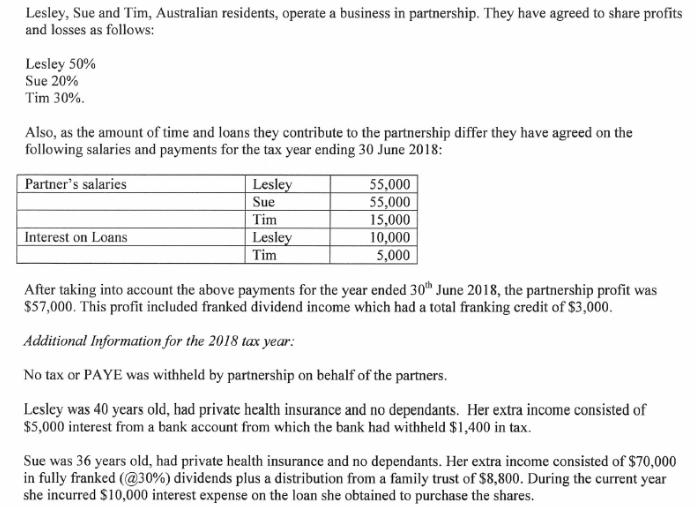

Lesley, Sue and Tim, Australian residents, operate a business in partnership. They have agreed to share profits and losses as follows: Lesley 50% Sue

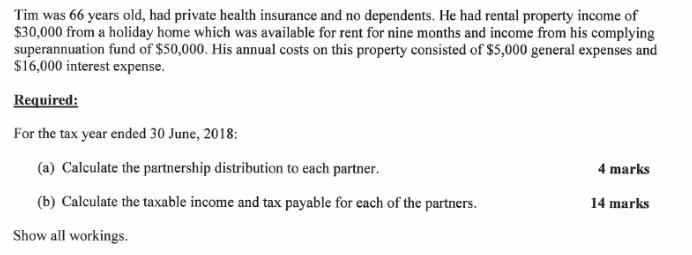

Lesley, Sue and Tim, Australian residents, operate a business in partnership. They have agreed to share profits and losses as follows: Lesley 50% Sue 20% Tim 30%. Also, as the amount of time and loans they contribute to the partnership differ they have agreed on the following salaries and payments for the tax year ending 30 June 2018: Partner's salaries Lesley Sue 55,000 55,000 15,000 10,000 5,000 Tim Interest on Loans Lesley Tim After taking into account the above payments for the year ended 30th June 2018, the partnership profit was $57,000. This profit included franked dividend income which had a total franking credit of $3,000. Additional Information for the 2018 tax year: No tax or PAYE was withheld by partnership on behalf of the partners. Lesley was 40 ycars old, had private health insurance and no dependants. Her extra income consisted of $5,000 interest from a bank account from which the bank had withheld $1,400 in tax. Sue was 36 years old, had private health insurance and no dependants. Her extra income consisted of $70,000 in fully franked (@30%) dividends plus a distribution from a family trust of $8,800. During the current year she incurred $10,000 interest expense on the loan she obtained to purchase the shares. Tim was 66 years old, had private health insurance and no dependents. He had rental property income of $30,000 from a holiday home which was available for rent for nine months and income from his complying superannuation fund of $50,000. His annual costs on this property consisted of $5s,000 general expenses and $16,000 interest expense. Required: For the tax year ended 30 June, 2018: (a) Calculate the partnership distribution to each partner. 4 marks (b) Calculate the taxable income and tax payable for each of the partners. 14 marks Show all workings.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6369c53117876_241393.pdf

180 KBs PDF File

6369c53117876_241393.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started