Answered step by step

Verified Expert Solution

Question

1 Approved Answer

_lesource/content/4/FM%20Assignment%202.pdf sheets. 10. Total: 2 Questions (50 marks) Question 1 (25 marks) You are a security analyst in ABC Investment Company Limited and are asked

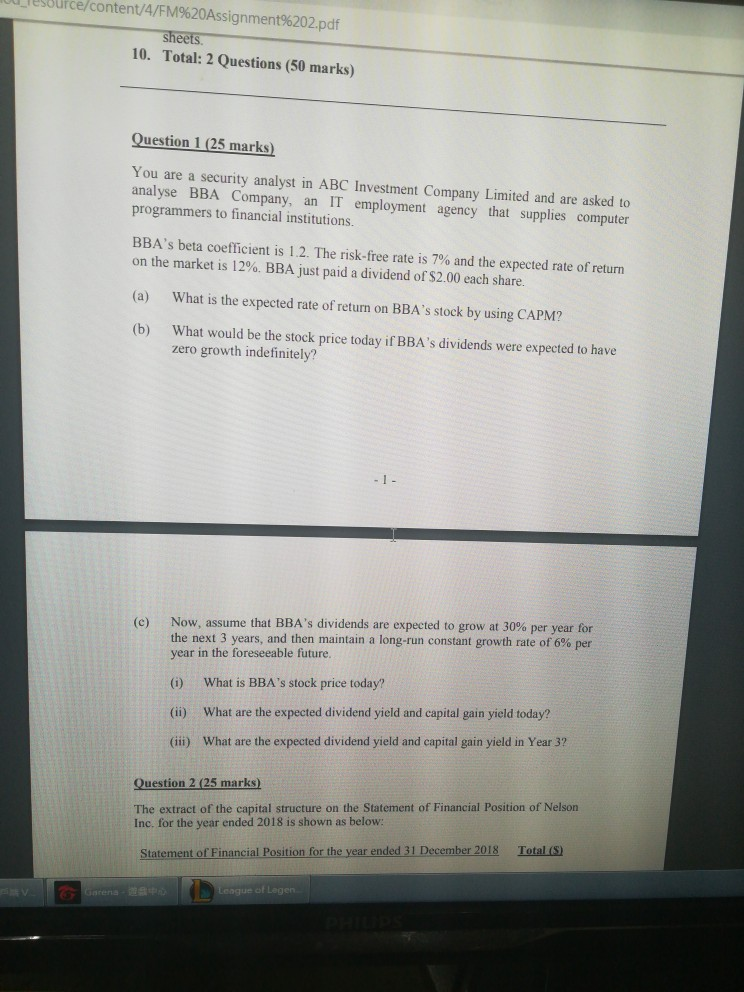

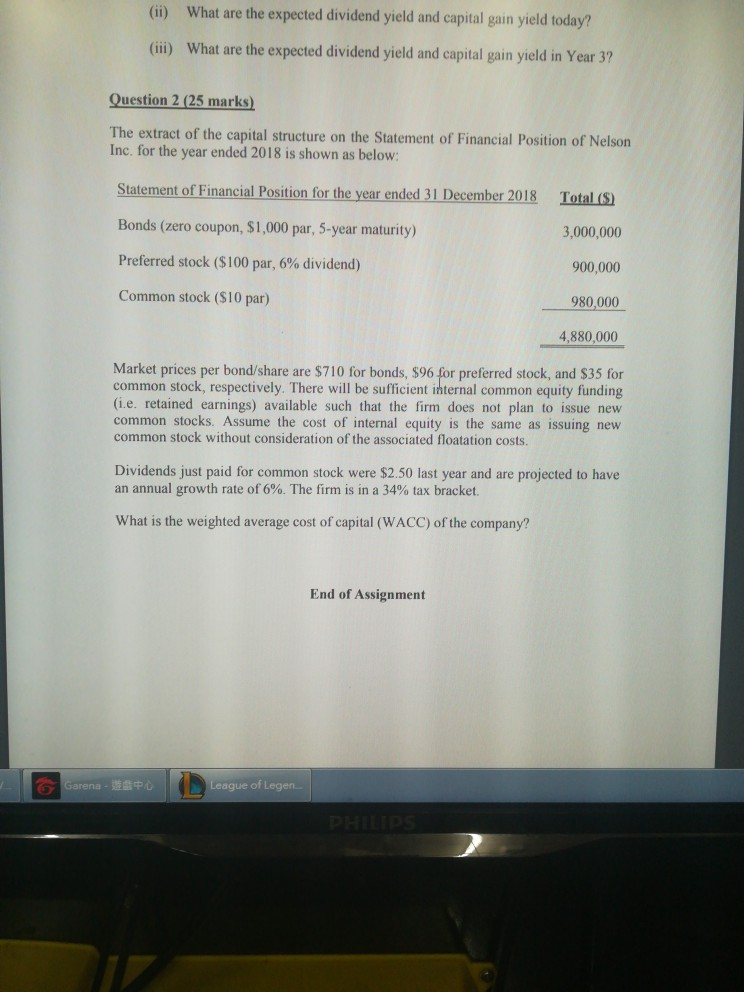

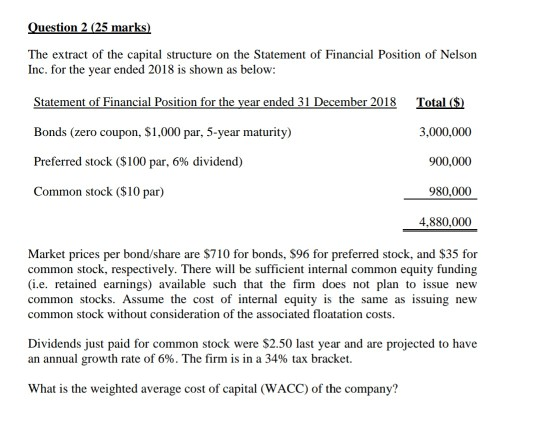

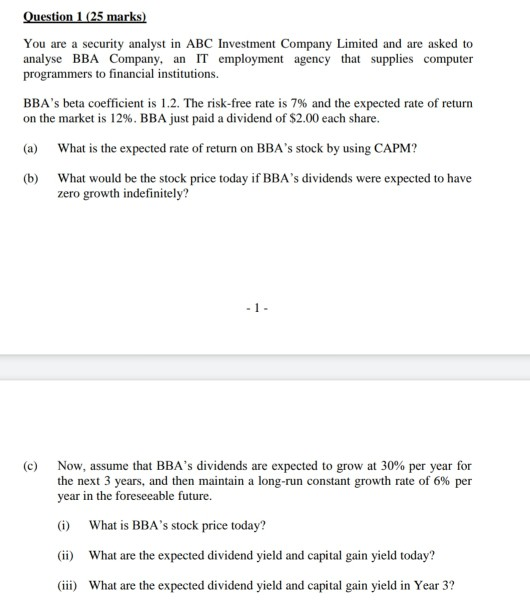

_lesource/content/4/FM%20Assignment%202.pdf sheets. 10. Total: 2 Questions (50 marks) Question 1 (25 marks) You are a security analyst in ABC Investment Company Limited and are asked to analyse BBA Company, an IT employment agency that supplies computer programmers to financial institutions. BBA's beta coefficient is 1.2. The risk-free rate is 7% and the expected rate of return on the market is 12%. BBA just paid a dividend of $2.00 each share. (a) What is the expected rate of return on BBA's stock by using CAPM? (b) What would be the stock price today if BBA's dividends were expected to have zero growth indefinitely? Now, assume that BBA's dividends are expected to grow at 30% per year for the next 3 years, and then maintain a long-run constant growth rate of 6% per year in the foreseeable future. (i) What is BBA's stock price today? (ii) What are the expected dividend yield and capital gain yield today? (iii) What are the expected dividend yield and capital gain yield in Year 3? Question 2 (25 marks) The extract of the capital structure on the Statement of Financial Position of Nelson Inc. for the year ended 2018 is shown as below: Statement of Financial Position for the year ended 31 December 2018 Total (S) G astena-29 League of Legen (ii) What are the expected dividend yield and capital gain yield today? (iii) What are the expected dividend yield and capital gain yield in Year 3? Question 2 (25 marks) The extract of the capital structure on the Statement of Financial Position of Nelson Inc. for the year ended 2018 is shown as below: Statement of Financial Position for the year ended 31 December 2018 Total (S) Bonds (zero coupon, $1,000 par, 5-year maturity) 3,000,000 Preferred stock ($100 par, 6% dividend) 900,000 Common stock ($10 par) 980,000 4.880,000 Market prices per bond/share are $710 for bonds, $96 for preferred stock, and $35 for common stock, respectively. There will be sufficient internal common equity funding (i.e. retained earnings) available such that the firm does not plan to issue new common stocks. Assume the cost of internal equity is the same as issuing new common stock without consideration of the associated floatation costs. Dividends just paid for common stock were $2.50 last year and are projected to have an annual growth rate of 6%. The firm is in a 34% tax bracket. What is the weighted average cost of capital (WACC) of the company? End of Assignment G Garena - SP League of Legend Question 2 (25 marks) The extract of the capital structure on the Statement of Financial Position of Nelson Inc. for the year ended 2018 is shown as below: Statement of Financial Position for the year ended 31 December 2018 Total ($) Bonds (zero coupon, $1,000 par, 5-year maturity) 3,000,000 Preferred stock ($100 par, 6% dividend) 900,000 Common stock ($10 par) 980,000 4.880,000 Market prices per bond/share are $710 for bonds, $96 for preferred stock, and $35 for spectively. There will be sufficient internal common equity funding (i.e. retained earnings) available such that the firm does not plan to issue new common stocks. Assume the cost of internal equity is the same as issuing new common stock without consideration of the associated floatation costs. Dividends just paid for common stock were $2.50 last year and are projected to have an annual growth rate of 6%. The firm is in a 34% tax bracket. What is the weighted average cost of capital (WACC) of the company? Question 1 (25 marks) You are a security analyst in ABC Investment Company Limited and are asked to analyse BBA Company, an IT employment agency that supplies computer programmers to financial institutions. BBA's beta coefficient is 1.2. The risk-free rate is 7% and the expected rate of return on the market is 12%. BBA just paid a dividend of $2.00 each share. (a) What is the expected rate of return on BBA's stock by using CAPM? (b) What would be the stock price today if BBA's dividends were expected to have zero growth indefinitely? (c) Now, assume that BBA's dividends are expected to grow at 30% per year for the next 3 years, and then maintain a long-run constant growth rate of 6% per year in the foreseeable future. (1) What is BBA's stock price today? (ii) What are the expected dividend yield and capital gain yield today? (iii) What are the expected dividend yield and capital gain yield in Year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started