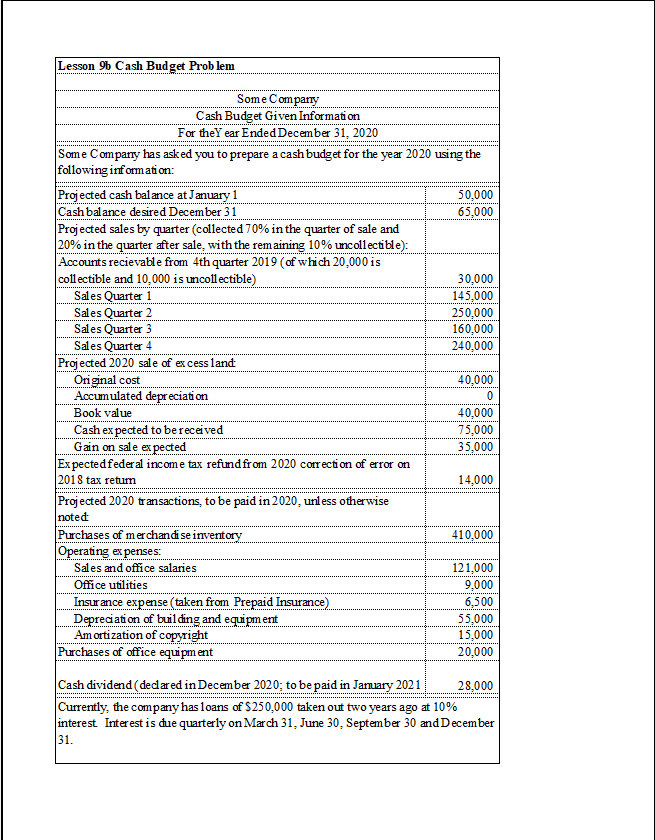

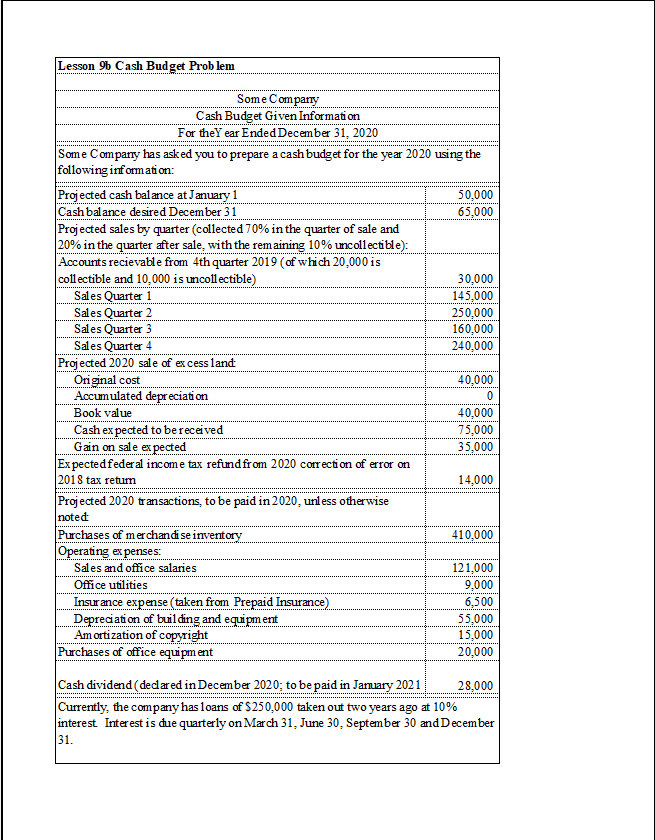

Lesson 9b Cash Budget Problem Some Company Cash Budget Given Informati For the Year Ended December 31, 2020 Some Company has asked you to prepare a cash budget for the year 2020 using the following information: Projected cash balance at January 1 50,000 Cash balance desired December 31 65,000 Projected sales by quarter (collected 70% in the quarter of sale and 20% in the quarter after sale, with the remaining 10% uncollectible): Accounts recievable from 4th quarter 2019 (of which 20,000 is collectible and 10,000 is uncollectible) 30,000 Sales Quarter 1 145,000 Sales Quarter 2 250,000 Sales Quarter 3 160,000 Sales Quarter 4 240,000 Projected 2020 sale of excess land Original cost 40,000 Accumulated depreciation Book value 40,000 Cash expected to be received 75.000 Gain on sale expected 35,000 Expected federal income tax refund from 2020 correction of error on 2018 tax retum 14,000 Projected 2020 transactions to be paid in 2020, unless otherwise noted Purchases of merchandise inventory 410,000 Operating expenses Sales and office salaries 121,000 Office utilities 9,000 Insurance expense (taken from Prepaid Insurance) 6,500 Depreciation of building and equipment 55,000 Amortization of copyright 15,000 Purchases of office equipment 20,000 Cash dividend (dedared in December 2020; to be paid in January 2021 28.000 Currently, the company has loans of $250,000 taken out two years ago at 10% interest Interest is due quarterly on March 31, June 30. September 30 and December Lesson 9b Cash Budget Problem Some Company Cash Budget Given Informati For the Year Ended December 31, 2020 Some Company has asked you to prepare a cash budget for the year 2020 using the following information: Projected cash balance at January 1 50,000 Cash balance desired December 31 65,000 Projected sales by quarter (collected 70% in the quarter of sale and 20% in the quarter after sale, with the remaining 10% uncollectible): Accounts recievable from 4th quarter 2019 (of which 20,000 is collectible and 10,000 is uncollectible) 30,000 Sales Quarter 1 145,000 Sales Quarter 2 250,000 Sales Quarter 3 160,000 Sales Quarter 4 240,000 Projected 2020 sale of excess land Original cost 40,000 Accumulated depreciation Book value 40,000 Cash expected to be received 75.000 Gain on sale expected 35,000 Expected federal income tax refund from 2020 correction of error on 2018 tax retum 14,000 Projected 2020 transactions to be paid in 2020, unless otherwise noted Purchases of merchandise inventory 410,000 Operating expenses Sales and office salaries 121,000 Office utilities 9,000 Insurance expense (taken from Prepaid Insurance) 6,500 Depreciation of building and equipment 55,000 Amortization of copyright 15,000 Purchases of office equipment 20,000 Cash dividend (dedared in December 2020; to be paid in January 2021 28.000 Currently, the company has loans of $250,000 taken out two years ago at 10% interest Interest is due quarterly on March 31, June 30. September 30 and December