Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lester and Stephen formed a partnership with capital contributions of P300,000 and P700,000, respectively. During its first year of operations, the partnership earned a

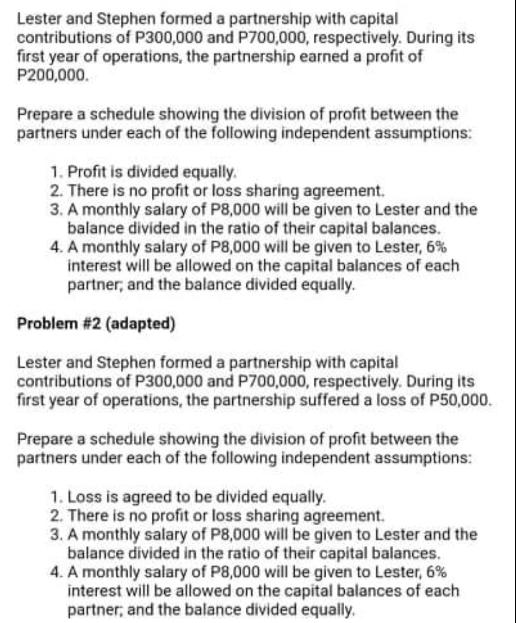

Lester and Stephen formed a partnership with capital contributions of P300,000 and P700,000, respectively. During its first year of operations, the partnership earned a profit of P200,000. Prepare a schedule showing the division of profit between the partners under each of the following independent assumptions: 1. Profit is divided equally. 2. There is no profit or loss sharing agreement. 3. A monthly salary of P8,000 will be given to Lester and the balance divided in the ratio of their capital balances. 4. A monthly salary of P8,000 will be given to Lester, 6% interest will be allowed on the capital balances of each partner, and the balance divided equally. Problem #2 (adapted) Lester and Stephen formed a partnership with capital contributions of P300,000 and P700,000, respectively. During its first year of operations, the partnership suffered a loss of P50,000. Prepare a schedule showing the division of profit between the partners under each of the following independent assumptions: 1. Loss is agreed to be divided equally. 2. There is no profit or loss sharing agreement. 3. A monthly salary of P8,000 will be given to Lester and the balance divided in the ratio of their capital balances. 4. A monthly salary of P8,000 will be given to Lester, 6% interest will be allowed on the capital balances of each partner, and the balance divided equally.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed workings for the questions Problem 1 Assumption 1 Profit is divided equally Le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started