Question

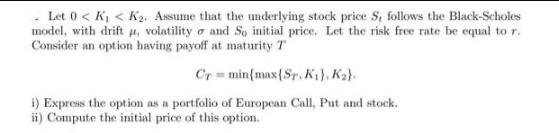

Let 0 < K < K. Assume that the underlying stock price S, follows the Black-Scholes model, with drift , volatility and So initial

Let 0 < K < K. Assume that the underlying stock price S, follows the Black-Scholes model, with drift , volatility and So initial price. Let the risk free rate be equal to r. Consider an option having payoff at maturity T Cr=min(max(Sr. K), K). i) Express the option as a portfolio of European Call, Put and stock. ii) Compute the initial price of this option.

Step by Step Solution

3.38 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

It seems like there may be a typo in your question as you mentioned 0 K K which doesnt make sense Ill assume you meant that 0 K S0 where S0 is the ini...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction to the Mathematics of Financial Derivatives

Authors: Ali Hirsa, Salih N. Neftci

3rd edition

012384682X, 978-0123846822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App