Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let assume that today is January 1st,2018. The rate of inflation is expected to be 4% throughout 2018. However, increased government deficits and renewed vigor

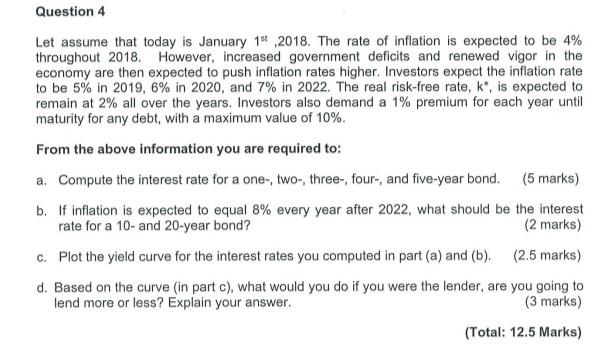

Let assume that today is January 1st,2018. The rate of inflation is expected to be 4% throughout 2018. However, increased government deficits and renewed vigor in the economy are then expected to push inflation rates higher. Investors expect the inflation rate to be 5% in 2019,6% in 2020 , and 7% in 2022 . The real risk-free rate, k, is expected to remain at 2% all over the years. Investors also demand a 1% premium for each year until maturity for any debt, with a maximum value of 10%. From the above information you are required to: a. Compute the interest rate for a one-, two-, three-, four-, and five-year bond. (5 marks) b. If inflation is expected to equal 8% every year after 2022 , what should be the interest rate for a 10 - and 20 -year bond? (2 marks) c. Plot the yield curve for the interest rates you computed in part (a) and (b). (2.5 marks) d. Based on the curve (in part c), what would you do if you were the lender, are you going to lend more or less? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started