Question: let me know how to get those 2 higlighted #? Required information [The following information applies to the questions displayed below.] Lone Star Company is

![[The following information applies to the questions displayed below.] Lone Star Company](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ec20d71a63f_93466ec20d68b7fc.jpg)

let me know how to get those 2 higlighted #?

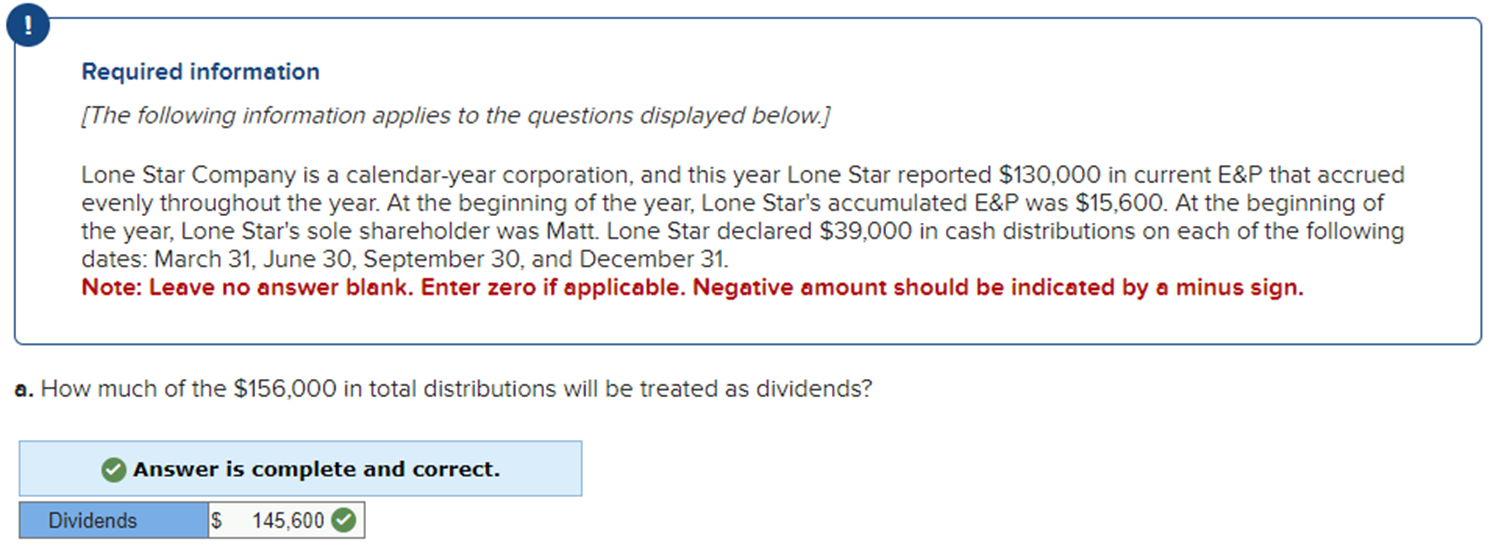

Required information [The following information applies to the questions displayed below.] Lone Star Company is a calendar-year corporation, and this year Lone Star reported $130,000 in current E\&P that accrued evenly throughout the year. At the beginning of the year, Lone Star's accumulated E\&P was $15,600. At the beginning of the year, Lone Star's sole shareholder was Matt. Lone Star declared $39,000 in cash distributions on each of the following dates: March 31, June 30, September 30, and December 31. Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign. a. How much of the $156,000 in total distributions will be treated as dividends? Matt received a total $97,500($39,000+$19,500+$19,500+$19,500) and $92,300 will be treated as dividends ($39,000+$19,500+$17,550+ $16,250 ) and the remaining $5,200 is a return of capital. Matt received the entire March 31st distribution which is treated as a dividend. Matt also received half of the remaining distributions ($117,0001/2=$58,500). The June 30 distribution of $19,500 is also treated as a dividend, whereas 90% of the September 30 distribution is a dividend (90%$19,500=$17,550) and the remaining $1,950 is a return of capital. The final distribution of $19,500 resulted in a $16,250 dividend and a $3,250 return of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts