Answered step by step

Verified Expert Solution

Question

1 Approved Answer

let me know if additional info is required to help. Co. has the following defined benefit pension plan balances on January 1, 2020. $4,632,000 Projected

let me know if additional info is required to help.

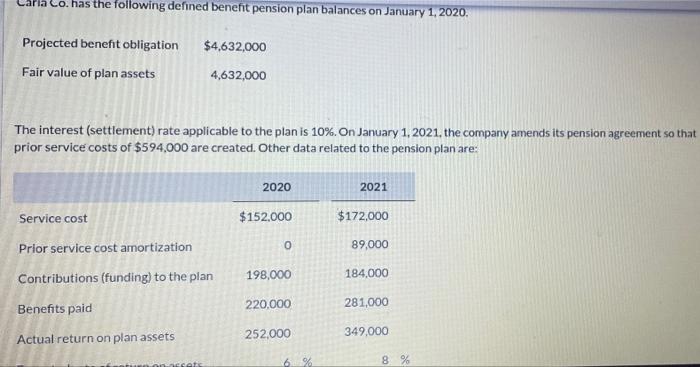

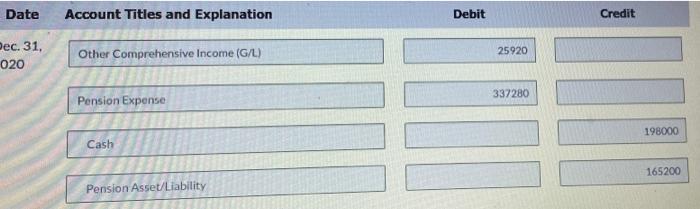

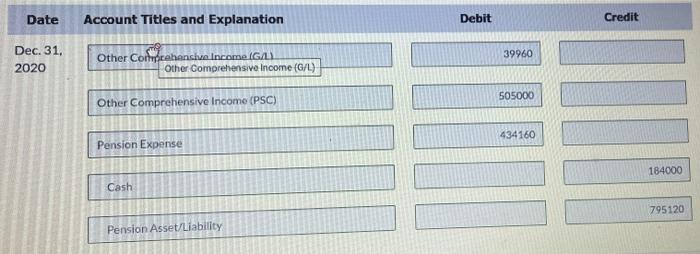

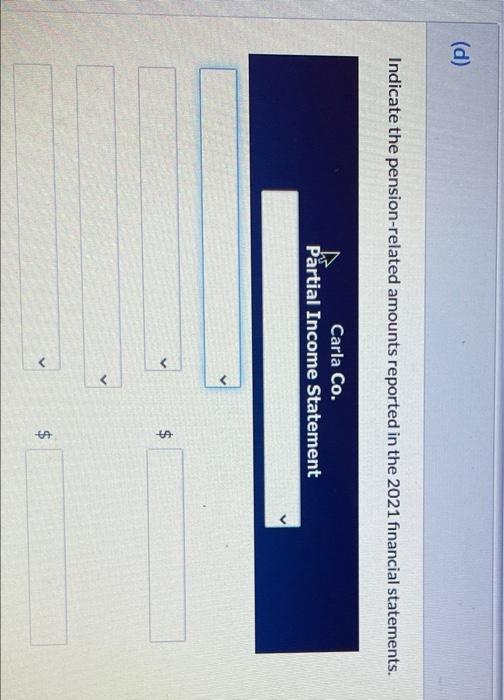

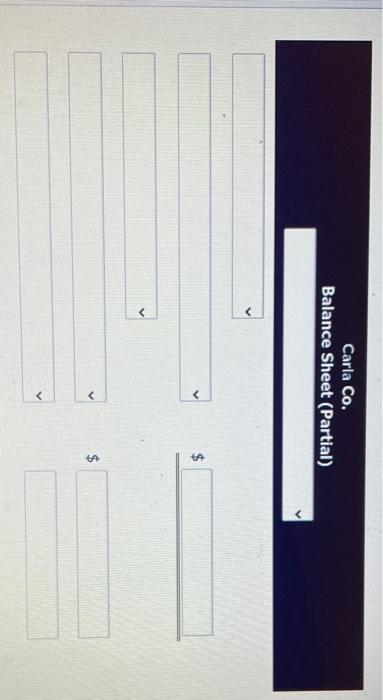

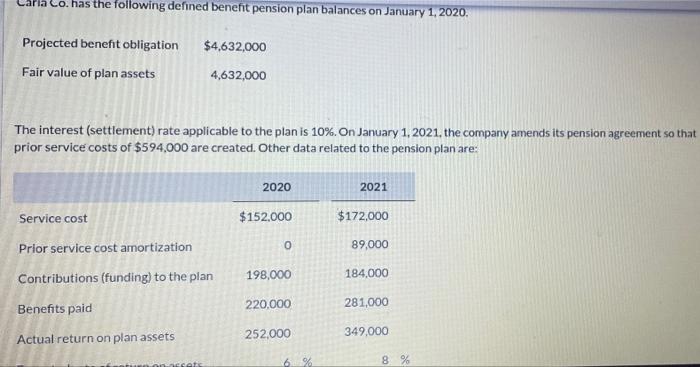

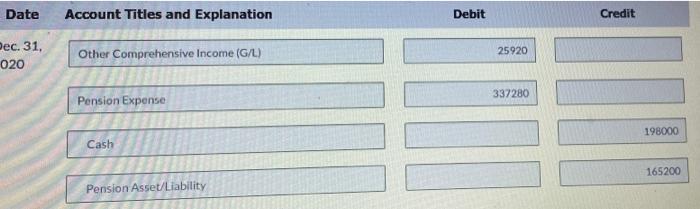

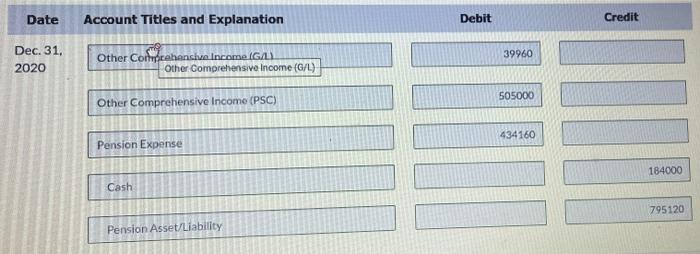

Co. has the following defined benefit pension plan balances on January 1, 2020. $4,632,000 Projected benefit obligation Fair value of plan assets 4,632,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $594,000 are created. Other data related to the pension plan are: 2020 2021 $172,000 Service cost $152.000 0 89.000 Prior service cost amortization Contributions (funding) to the plan Benefits paid 198,000 184,000 220,000 281,000 252,000 349,000 Actual return on plan assets 8 % set Date Account Titles and Explanation Debit Credit 25920 ec. 31. 020 Other Comprehensive Income (G/L) 337280 Pension Expense 198000 Cash 165200 Pension Asset/Liability Date Account Titles and Explanation Debit Credit 39960 Dec. 31. 2020 Other Comprehensive Income (GAL Other Comprehensive Income (G/L) 505000 Other Comprehensive Income (PSC) 434160 Pension Expense 184000 Cash 795120 Pension Asset/Liability (d) Indicate the pension-related amounts reported in the 2021 financial statements. Carla Co. Partial Income Statement $ HA $ Carla Co. Balance Sheet (Partial) $ $ Co. has the following defined benefit pension plan balances on January 1, 2020. $4,632,000 Projected benefit obligation Fair value of plan assets 4,632,000 The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $594,000 are created. Other data related to the pension plan are: 2020 2021 $172,000 Service cost $152.000 0 89.000 Prior service cost amortization Contributions (funding) to the plan Benefits paid 198,000 184,000 220,000 281,000 252,000 349,000 Actual return on plan assets 8 % set Date Account Titles and Explanation Debit Credit 25920 ec. 31. 020 Other Comprehensive Income (G/L) 337280 Pension Expense 198000 Cash 165200 Pension Asset/Liability Date Account Titles and Explanation Debit Credit 39960 Dec. 31. 2020 Other Comprehensive Income (GAL Other Comprehensive Income (G/L) 505000 Other Comprehensive Income (PSC) 434160 Pension Expense 184000 Cash 795120 Pension Asset/Liability (d) Indicate the pension-related amounts reported in the 2021 financial statements. Carla Co. Partial Income Statement $ HA $ Carla Co. Balance Sheet (Partial) $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started