Question: Let P = (0.7, 100, 15) be a risky prospect. State 2 could be thought of as the occurrence of an accident which imposes

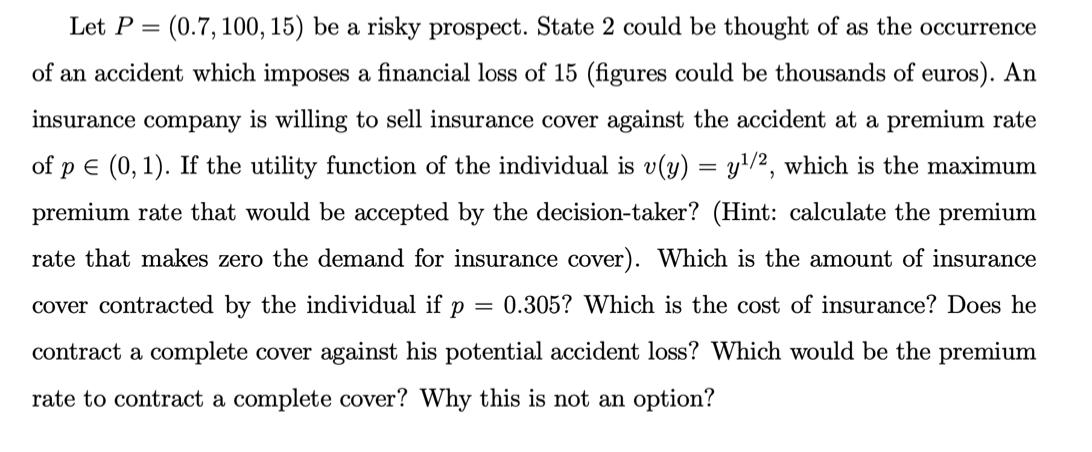

Let P = (0.7, 100, 15) be a risky prospect. State 2 could be thought of as the occurrence of an accident which imposes a financial loss of 15 (figures could be thousands of euros). An insurance company is willing to sell insurance cover against the accident at a premium rate of p (0, 1). If the utility function of the individual is v(y) = y/2, which is the maximum premium rate that would be accepted by the decision-taker? (Hint: calculate the premium rate that makes zero the demand for insurance cover). Which is the amount of insurance cover contracted by the individual if p = 0.305? Which is the cost of insurance? Does he contract a complete cover against his potential accident loss? Which would be the premium rate to contract a complete cover? Why this is not an option? Let P = (0.7, 100, 15) be a risky prospect. State 2 could be thought of as the occurrence of an accident which imposes a financial loss of 15 (figures could be thousands of euros). An insurance company is willing to sell insurance cover against the accident at a premium rate of p (0, 1). If the utility function of the individual is v(y) = y/2, which is the maximum premium rate that would be accepted by the decision-taker? (Hint: calculate the premium rate that makes zero the demand for insurance cover). Which is the amount of insurance cover contracted by the individual if p = 0.305? Which is the cost of insurance? Does he contract a complete cover against his potential accident loss? Which would be the premium rate to contract a complete cover? Why this is not an option?

Step by Step Solution

There are 3 Steps involved in it

The individual will purchase insurance if the expected utility with insurance denoted as Uinsurance ... View full answer

Get step-by-step solutions from verified subject matter experts