Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let S be the current price of a stock. Suppose that the stock price a year from now, denoted by S may take three

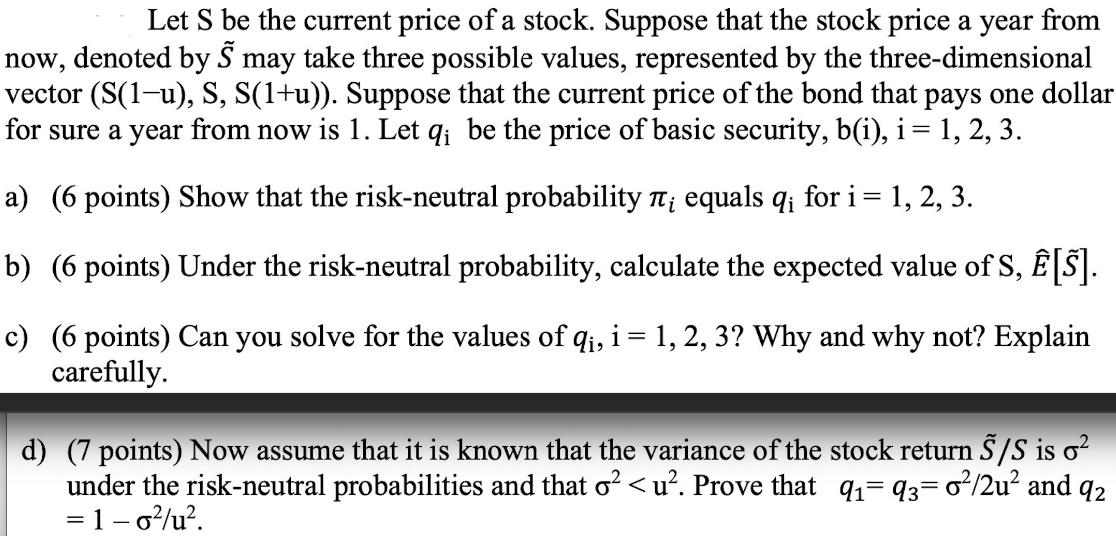

Let S be the current price of a stock. Suppose that the stock price a year from now, denoted by S may take three possible values, represented by the three-dimensional vector (S(1-u), S, S(1+u)). Suppose that the current price of the bond that pays one dollar for sure a year from now is 1. Let qi be the price of basic security, b(i), i = 1, 2, 3. a) (6 points) Show that the risk-neutral probability 7 equals q for i = 1, 2, 3. b) (6 points) Under the risk-neutral probability, calculate the expected value of S, [S]. c) (6 points) Can you solve for the values of qi, i = 1, 2, 3? Why and why not? Explain carefully. d) (7 points) Now assume that it is known that the variance of the stock return S/S is o under the risk-neutral probabilities and that o < u. Prove that qq3= 0/2u and 92 = 1 - 0/u.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a 6 points The basic securities are b1 S1u b2 S b3 S1u The riskneutral probabilities i equal the pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started