Answered step by step

Verified Expert Solution

Question

1 Approved Answer

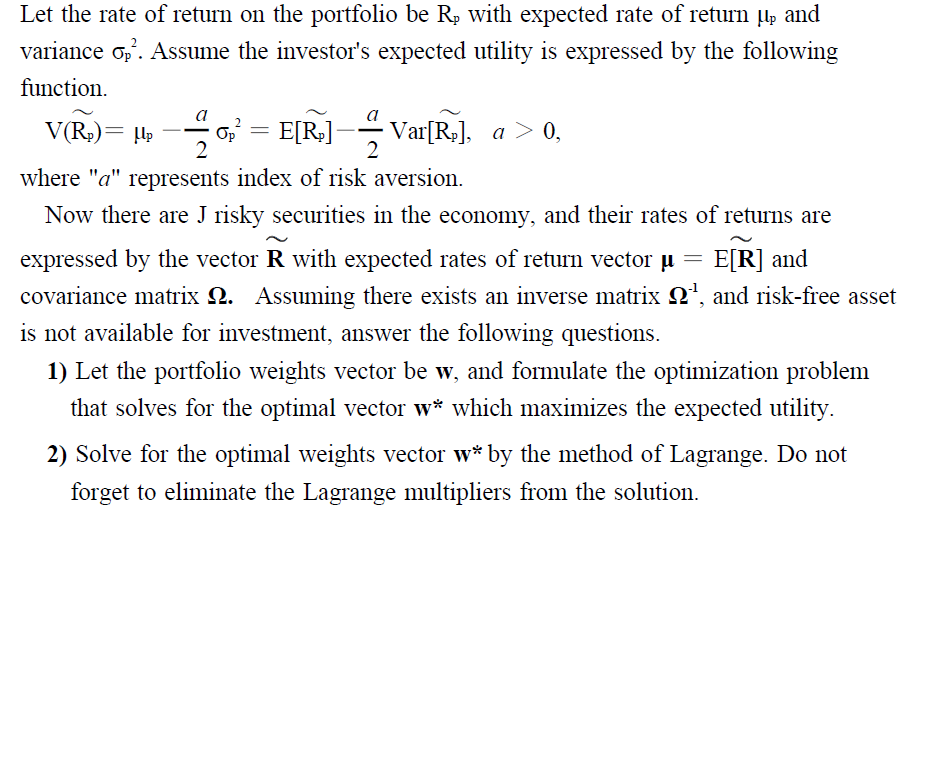

Let the rate of return on the portfolio be R with expected rate of return and variance Op. Assume the investor's expected utility is

Let the rate of return on the portfolio be R with expected rate of return and variance Op. Assume the investor's expected utility is expressed by the following function. V(R) = p 0, = E[R] Var[R], a > 0, Op 2 2 where "a" represents index of risk aversion. = Now there are J risky securities in the economy, and their rates of returns are expressed by the vector R with expected rates of return vector E[R] and covariance matrix 2. Assuming there exists an inverse matrix , and risk-free asset is not available for investment, answer the following questions. 1) Let the portfolio weights vector be w, and formulate the optimization problem that solves for the optimal vector w* which maximizes the expected utility. 2) Solve for the optimal weights vector w* by the method of Lagrange. Do not forget to eliminate the Lagrange multipliers from the solution.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To formulate the optimization problem for finding the optimal vector of portfolio weights we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started