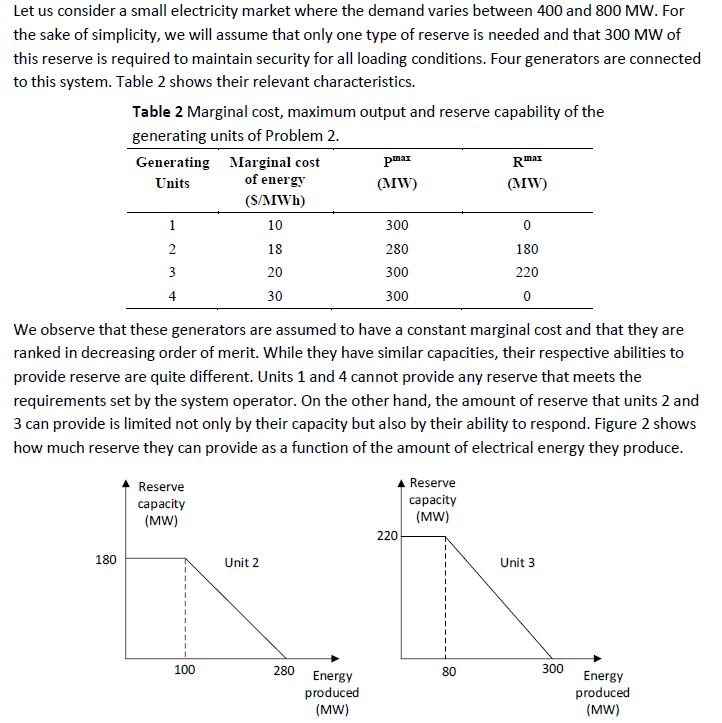

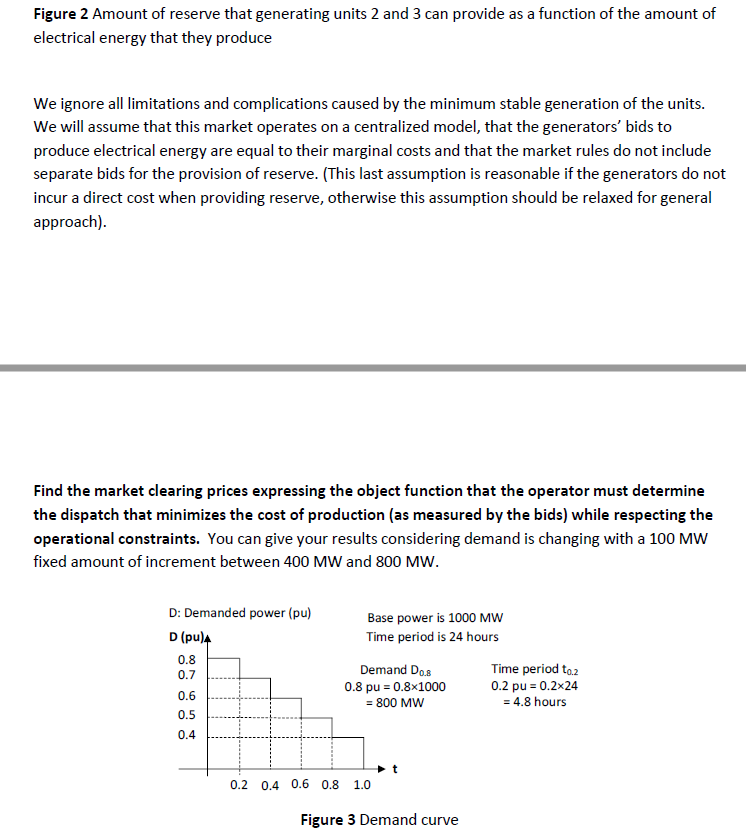

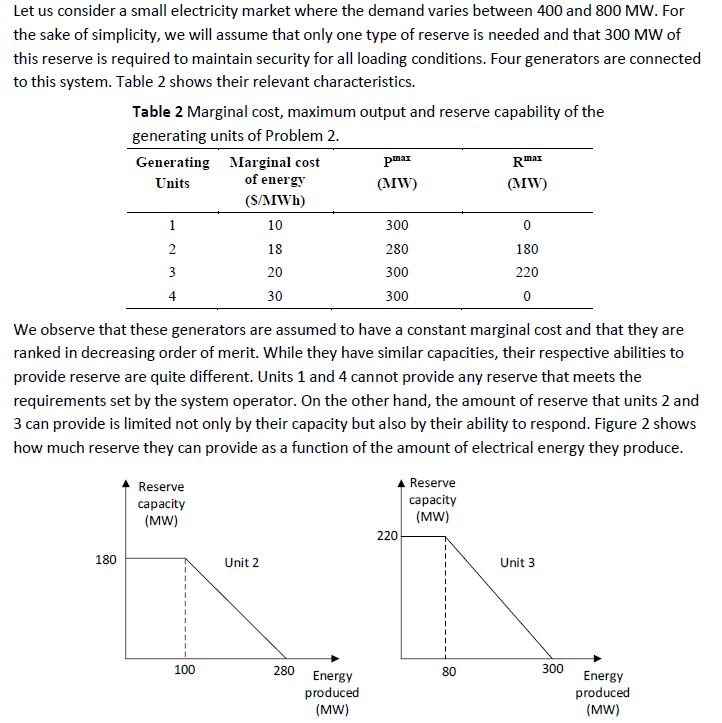

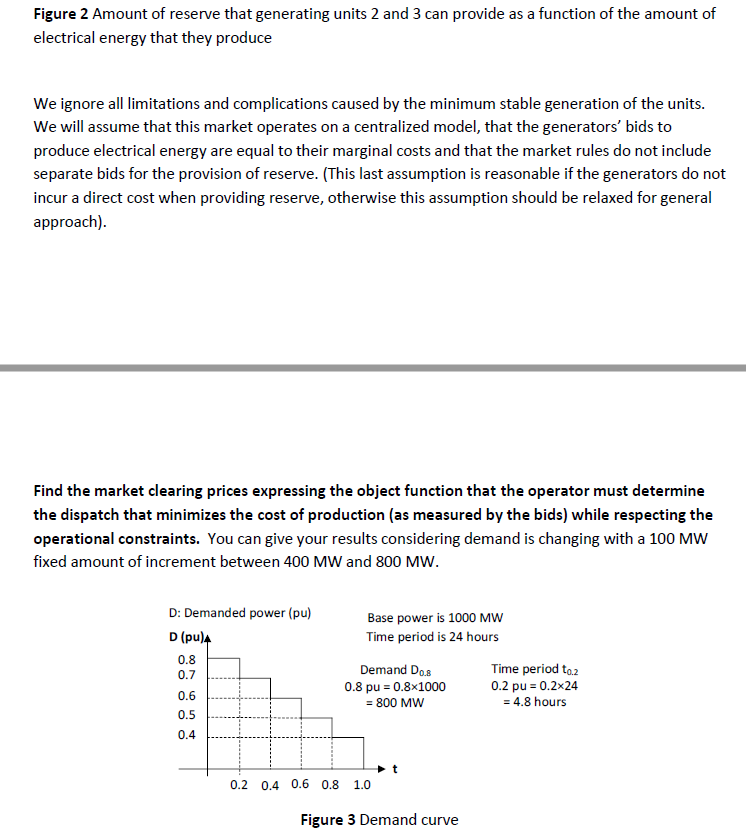

Let us consider a small electricity market where the demand varies between 400 and 800 MW. For the sake of simplicity, we will assume that only one type of reserve is needed and that 300 MW of this reserve is required to maintain security for all loading conditions. Four generators are connected to this system. Table 2 shows their relevant characteristics. Table 2 Marginal cost, maximum output and reserve capability of the generating units of Problem 2. Generating Marginal cost pinax Rmax Units of energy (MW) (MW) (S/MWh) 1 10 300 0 2 18 280 180 3 20 300 220 4 30 300 0 We observe that these generators are assumed to have a constant marginal cost and that they are ranked in decreasing order of merit. While they have similar capacities, their respective abilities to provide reserve are quite different. Units 1 and 4 cannot provide any reserve that meets the requirements set by the system operator. On the other hand, the amount of reserve that units 2 and 3 can provide is limited not only by their capacity but also by their ability to respond. Figure 2 shows how much reserve they can provide as a function of the amount of electrical energy they produce. Reserve capacity (MW) Reserve capacity (MW) Unit 2 Unit 3 180 100 280 Energy produced (MW) 220 80 300 Energy produced (MW) Figure 2 Amount of reserve that generating units 2 and 3 can provide as a function of the amount of electrical energy that they produce We ignore all limitations and complications caused by the minimum stable generation of the units. We will assume that this market operates on a centralized model, that the generators' bids to produce electrical energy are equal to their marginal costs and that the market rules do not include separate bids for the provision of reserve. (This last assumption is reasonable if the generators do not incur a direct cost when providing reserve, otherwise this assumption should be relaxed for general approach). Find the market clearing prices expressing the object function that the operator must determine the dispatch that minimizes the cost of production (as measured by the bids) while respecting the operational constraints. You can give your results considering demand is changing with a 100 MW fixed amount of increment between 400 MW and 800 MW. D: Demanded power (pu) Base power is 1000 MW Time period is 24 hours D (pu)A 0.8 0.7 Time period to.2 0.2 pu = 0.2x24 = 4.8 hours 0.6 0.5 0.4 Demand Do.8 0.8 pu = 0.81000 = 800 MW Figure 3 Demand curve 0.2 0.4 0.6 0.8 1.0 Let us consider a small electricity market where the demand varies between 400 and 800 MW. For the sake of simplicity, we will assume that only one type of reserve is needed and that 300 MW of this reserve is required to maintain security for all loading conditions. Four generators are connected to this system. Table 2 shows their relevant characteristics. Table 2 Marginal cost, maximum output and reserve capability of the generating units of Problem 2. Generating Marginal cost pinax Rmax Units of energy (MW) (MW) (S/MWh) 1 10 300 0 2 18 280 180 3 20 300 220 4 30 300 0 We observe that these generators are assumed to have a constant marginal cost and that they are ranked in decreasing order of merit. While they have similar capacities, their respective abilities to provide reserve are quite different. Units 1 and 4 cannot provide any reserve that meets the requirements set by the system operator. On the other hand, the amount of reserve that units 2 and 3 can provide is limited not only by their capacity but also by their ability to respond. Figure 2 shows how much reserve they can provide as a function of the amount of electrical energy they produce. Reserve capacity (MW) Reserve capacity (MW) Unit 2 Unit 3 180 100 280 Energy produced (MW) 220 80 300 Energy produced (MW) Figure 2 Amount of reserve that generating units 2 and 3 can provide as a function of the amount of electrical energy that they produce We ignore all limitations and complications caused by the minimum stable generation of the units. We will assume that this market operates on a centralized model, that the generators' bids to produce electrical energy are equal to their marginal costs and that the market rules do not include separate bids for the provision of reserve. (This last assumption is reasonable if the generators do not incur a direct cost when providing reserve, otherwise this assumption should be relaxed for general approach). Find the market clearing prices expressing the object function that the operator must determine the dispatch that minimizes the cost of production (as measured by the bids) while respecting the operational constraints. You can give your results considering demand is changing with a 100 MW fixed amount of increment between 400 MW and 800 MW. D: Demanded power (pu) Base power is 1000 MW Time period is 24 hours D (pu)A 0.8 0.7 Time period to.2 0.2 pu = 0.2x24 = 4.8 hours 0.6 0.5 0.4 Demand Do.8 0.8 pu = 0.81000 = 800 MW Figure 3 Demand curve 0.2 0.4 0.6 0.8 1.0