A Ltd acquired a 60% shareholding interest in B Ltd in 20x4. B Ltd acquired a 30% shareholding interest in C Ltd in 20x5.

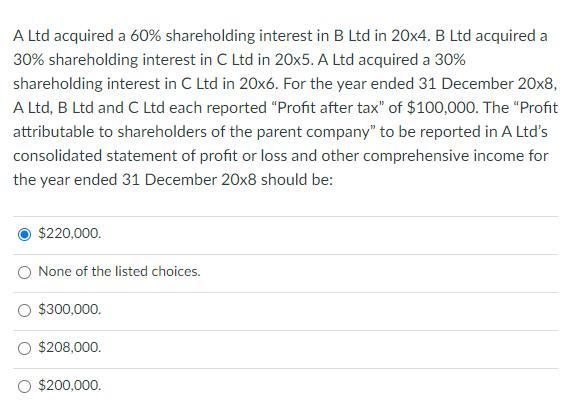

A Ltd acquired a 60% shareholding interest in B Ltd in 20x4. B Ltd acquired a 30% shareholding interest in C Ltd in 20x5. A Ltd acquired a 30% shareholding interest in C Ltd in 20x6. For the year ended 31 December 20x8, A Ltd, B Ltd and C Ltd each reported "Profit after tax" of $100,000. The "Profit attributable to shareholders of the parent company" to be reported in A Ltd's consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x8 should be: $220,000. None of the listed choices. $300,000. $208,000. $200,000.

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The Profit attributable to shareh...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started