Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Let's assume that the investors decide to set up a 20% reserve additional to the total costs (direct + indirect costs) for risk management. The

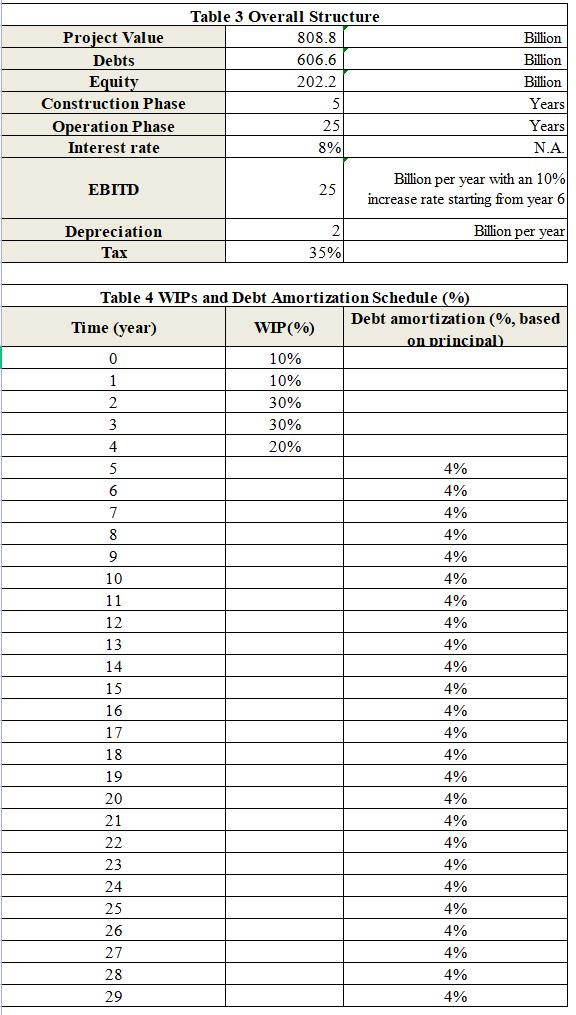

Let's assume that the investors decide to set up a 20% reserve additional to the total costs (direct + indirect costs) for risk management. The banks and the stakeholders will invest 80% and 20% of the reserve amount to this project at the beginning of the project (Year 0) respectively. What is the profitability of stakeholders? Please clearly explain the steps taken for calculation.

Table 3 Overall Structure Project Value 808.8 Billion Debts 606.6 Billion Equity 202.2 Billion Years Years Construction Phase 5 Operation Phase 25 Interest rate 8% N.A. Billion per year with an 10% increase rate starting from year 6 EBITD 25 Depreciation 2 Billion per year 35% Table 4 WIPS and Debt Amortization Schedule (%) Debt amortization (%, based Time (year) WIP(%) on principal 10% 1 10% 2 30% 3 30% 4 20% 5 4% 6 4% 7 4% 8 4% 9 4% 10 4% 11 4% 12 4% 13 4% 14 4% 15 4% 16 4% 17 4% 18 4% 19 4% 20 4% 21 4% 22 4% 23 4% 24 4% 25 4% 26 4% 27 4% 28 4% 29 4%

Step by Step Solution

★★★★★

3.24 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

The profitability of stakeholders can be calculated by taking the sum of the equity and debt amortiz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started