Answered step by step

Verified Expert Solution

Question

1 Approved Answer

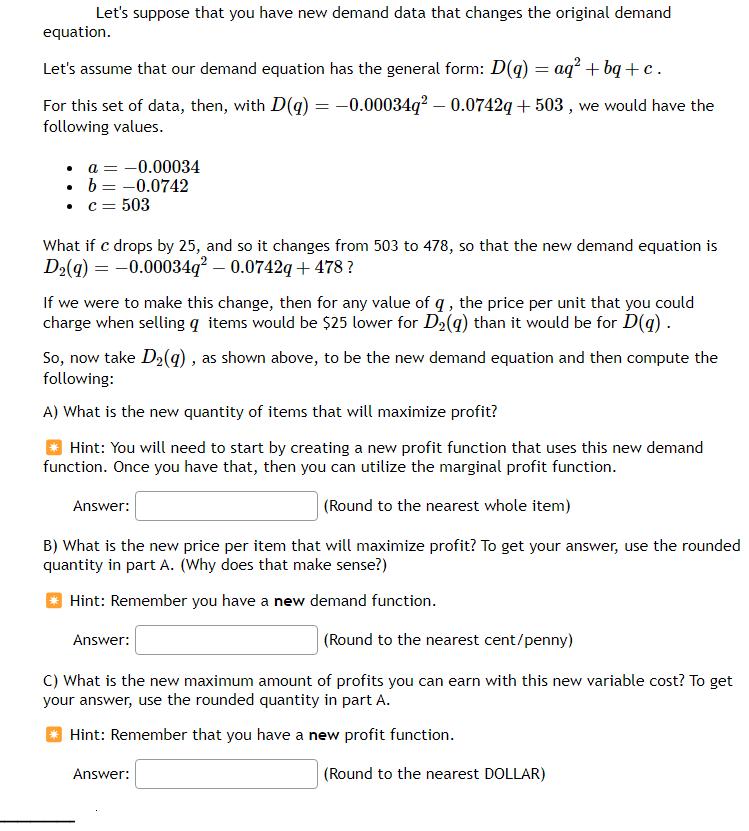

Let's suppose that you have new demand data that changes the original demand equation. Let's assume that our demand equation has the general form:

Let's suppose that you have new demand data that changes the original demand equation. Let's assume that our demand equation has the general form: D(q) = aq + bq+c. For this set of data, then, with D(q) = -0.00034q-0.0742q +503, we would have the following values. . a = -0.00034 b= -0.0742 c = 503 What if c drops by 25, and so it changes from 503 to 478, so that the new demand equation is D2(q) = -0.00034q - 0.0742q + 478? If we were to make this change, then for any value of q, the price per unit that you could charge when selling q items would be $25 lower for D(g) than it would be for D(q). So, now take D(q), as shown above, to be the new demand equation and then compute the following: A) What is the new quantity of items that will maximize profit? Hint: You will need to start by creating a new profit function that uses this new demand function. Once you have that, then you can utilize the marginal profit function. (Round to the nearest whole item) B) What is the new price per item that will maximize profit? To get your answer, use the rounded quantity in part A. (Why does that make sense?) Hint: Remember you have a new demand function. Answer: Answer: (Round to the nearest cent/penny) C) What is the new maximum amount of profits you can earn with this new variable cost? To get your answer, use the rounded quantity in part A. Hint: Remember that you have a new profit function. Answer: (Round to the nearest DOLLAR)

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To find the new quantity of items that will maximize profit we need to create a new prof...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started