Answered step by step

Verified Expert Solution

Question

1 Approved Answer

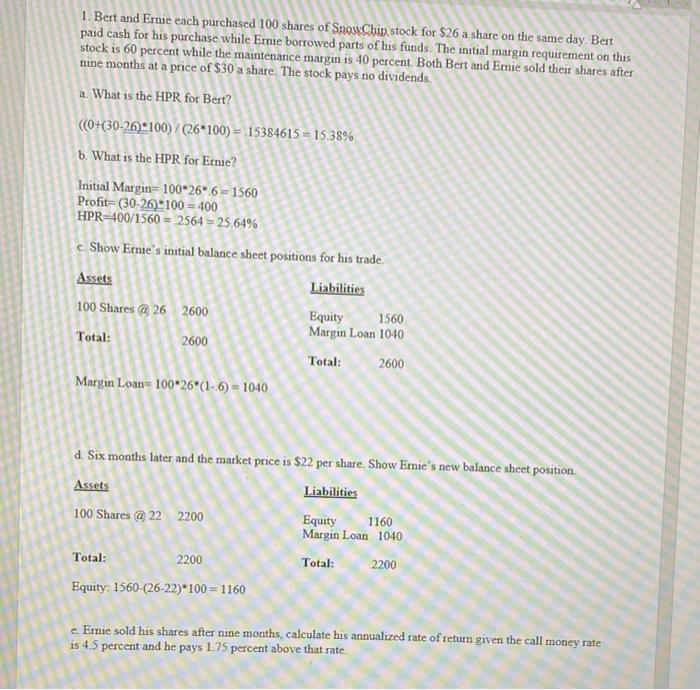

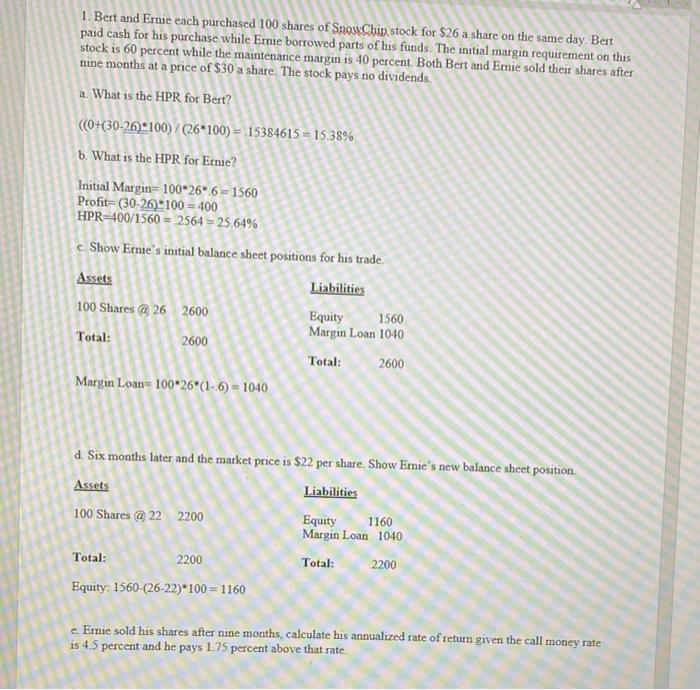

Letter e please 1. Bert and Emmie each purchased 100 shares of Spose Chip, stock for $26 a share on the same day. Bert paid

Letter e please

1. Bert and Emmie each purchased 100 shares of Spose Chip, stock for $26 a share on the same day. Bert paid cash for his purchase while Ernie borrowed parts of his funds. The initial margin requirement on this stock is 60 percent while the maintenance margin is 40 percent. Both Bert and Emnie sold their shares after nine months at a price of $30 a share. The stock pays no dividends a. What is the HPR for Bert? ((O+(30-26100)/(26*100) = 15384615 = 15.38% 6. What is the HPR for Ernie? Initial Margin= 100*26*6 = 1560 Profit-(30-26 100 = 400 HPR-400/1560 = 2564 = 25.64% c Show Ernie's initial balance sheet positions for his trade Assets Liabilities 100 Shares @ 26 2600 Equity 1560 Margin Lonn 1040 Total: 2600 Total: 2600 Margin Loan= 100*26*(1-6) = 1040 d. Six months later and the market price is $22 per share. Show Emie's new balance sheet position Assets Liabilities 100 Shares @22 2200 Equity Margin Loan 1040 Total: 2200 Total: 2200 Equity: 1560-(26-22)*100 = 1160 1160 e Ernie sold his shares after nine months, calculate his annualized rate of return given the call money rate is 4.5 percent and he pays 1.75 percent above that rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started