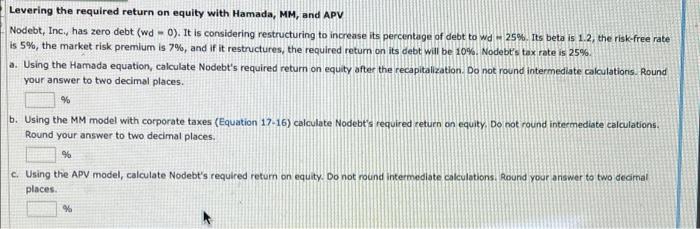

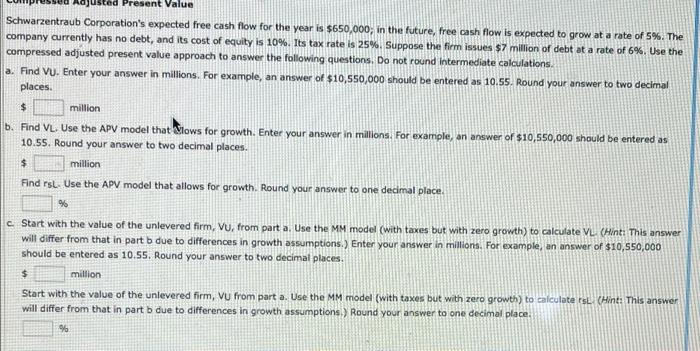

Levering the required return on equity with Hamada, MM, and APV Nodebt, Inc., has zero debt (wd - 0). It is considering restructuring to increase its percentage of debt to wd -25%. Its beta is 1.2, the risk-free rate is 5%, the market risk premium is 7%, and if it restructures, the required return on its debt will be 10%. Nodebt's tax rate is 25% a. Using the Hamada equation, calculate Nodebt's required return on equity after the recapitalization. Do not round intermediate calculations. Round your answer to two decimal places. % b. Using the MM model with corporate taxes (Equation 17-16) calculate Nodebt's required return on equity. Do not round intermediate calculations. Round your answer to two decimal places % c. Using the APV model, calculate Nodebt's required return on equity. Do not round intermediate calculations. Round your answer to two decimal places % Present Value Schwarzentraub Corporation's expected free cash flow for the year is $650,000; in the future, free cash flow is expected to grow at a rate of 5%. The company currently has no debt, and its cost of equity is 10%. Its tax rate is 25%. Suppose the firm issues $7 million of debt at a rate of 6%. Use the compressed adjusted present value approach to answer the following questions. Do not round Intermediate calculations a. Find VU. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million b. Find VL. Use the APV model that blows for growth. Enter your answer in milions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million Find rs. Use the APV model that allows for growth. Round your answer to one decimal place. % c. Start with the value of the unlevered firm, Vu, from part a. Use the MM model (with taxes but with zero growth) to calculate VL. (Hint: This answer will differ from that in part b due to differences in growth assumptions.) Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to two decimal places. $ million Start with the value of the unlevered firm, Vu from part a. Use the MM model (with taxes but with zero growth) to calculate ist. (Hint: This answer will differ from that in part b due to differences in growth assumptions.) Round your answer to one decimal place. %