Question

Levin had some cash flow issues and asked Zasio for a $90,000 loan. On June 30, 20X1, Zasio agreed to provide a loan at five

Levin had some cash flow issues and asked Zasio for a $90,000 loan. On June 30, 20X1, Zasio agreed to provide a loan at five percent interest, but required the loan to be repaid by June 30, 20X2. At December 31, 20X1, Levin had not made any interest or principal payments.

- Levin sold inventory to Zasio for $810,000. Levin did not give Zasio any special deals or discounts. At December 31, 20X1, $202,500 of the goods were still in Zasio's inventory.

- Zasio sold $405,000 of goods to Levin at the same price that it sells the goods to its other customers. At December 31, 20X1, $81,000 of these goods were still in Levin's inventory.

- There were no disposals of capital assets.

Other information:

-At the acquisition date, Levin's building had an estimated remaining useful life of 10 years and the equipment had an estimated remaining useful life of five years.

-The testing for impairment of goodwill at December 31, 20X1 indicated that no impairment had occurred.

-For both Zasio and Levin, the amounts Due to Shareholder are interest-free and have no set terms of repayment.

-In 20X2, net and comprehensive incomes for Zasio and Levin are $159,840 and $263,250 respectively.

-During 20X2, Levin made sales of $324,000 to Zasio, at its usual gross margin. At the end of 20X2, half of these goods remain in Zasio's inventory.

-In December 20X2, Zasio made sales of $108,000 to Levin. For these sales, Zasio had a gross margin of 35 percent. All of the goods are still in Levin's inventory at the end of 20X2.

Required:

a. Calculate the goodwill at December 31, 20X1.

b. Calculate Zasio's 20X1 consolidated cost of sales.

c. Calculate the net income attributable to the NCI that should appear on Zasio's 20X1 consolidated statements of comprehensive income.

d. Calculate the NCI that would appear on Zasio's 20X1 consolidated statement of financial position.

e. Calculate the consolidated balances for the following accounts:

i. Building

ii. Accumulated depreciation—building

f. Calculate the net income attributable to the NCI that should appear on Zasio's 20X2 consolidated statement of comprehensive income.

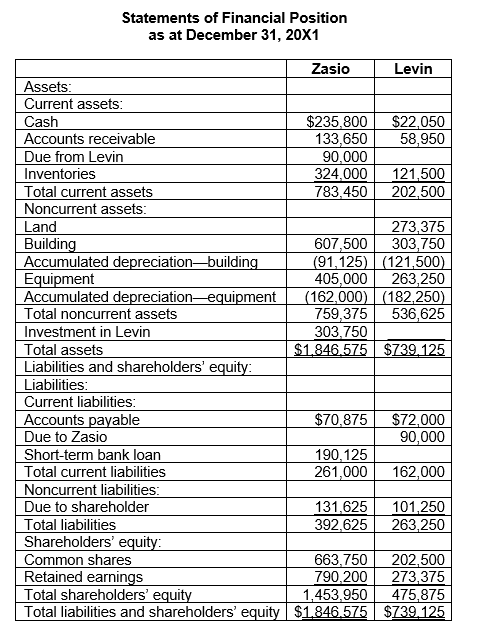

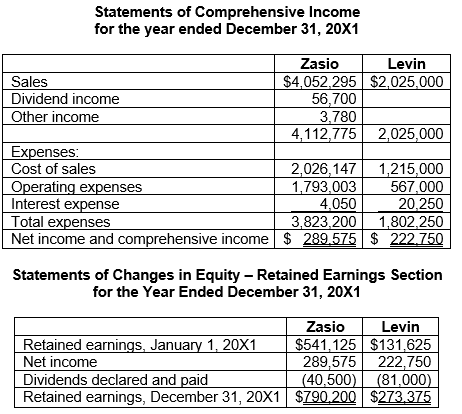

During 20X1,

- Levin had some cash flow issues and asked Zasio for a $90,000 loan. On June 30, 20X1, Zasio agreed to provide a loan at five percent interest, but required the loan to be repaid by June 30, 20X2. At December 31, 20X1, Levin had not made any interest or principal payments.

- Levin sold inventory to Zasio for $810,000. Levin did not give Zasio any special deals or discounts. At December 31, 20X1, $202,500 of the goods were still in Zasio's inventory.

- Zasio sold $405,000 of goods to Levin at the same price that it sells the goods to its other customers. At December 31, 20X1, $81,000 of these goods were still in Levin's inventory.

- There were no disposals of capital assets.

Other information:

-At the acquisition date, Levin's building had an estimated remaining useful life of 10 years and the equipment had an estimated remaining useful life of five years.

-The testing for impairment of goodwill at December 31, 20X1 indicated that no impairment had occurred.

-For both Zasio and Levin, the amounts Due to Shareholder are interest-free and have no set terms of repayment.

-In 20X2, net and comprehensive incomes for Zasio and Levin are $159,840 and $263,250 respectively.

-During 20X2, Levin made sales of $324,000 to Zasio, at its usual gross margin. At the end of 20X2, half of these goods remain in Zasio's inventory.

-In December 20X2, Zasio made sales of $108,000 to Levin. For these sales, Zasio had a gross margin of 35 percent. All of the goods are still in Levin's inventory at the end of 20X2.

Required:

a. Calculate the goodwill at December 31, 20X1.

b. Calculate Zasio's 20X1 consolidated cost of sales.

c. Calculate the net income attributable to the NCI that should appear on Zasio's 20X1 consolidated statements of comprehensive income.

d. Calculate the NCI that would appear on Zasio's 20X1 consolidated statement of financial position.

e. Calculate the consolidated balances for the following accounts:

i. Building

ii. Accumulated depreciation—building

f. Calculate the net income attributable to the NCI that should appear on Zasio's 20X2 consolidated statement of comprehensive income.

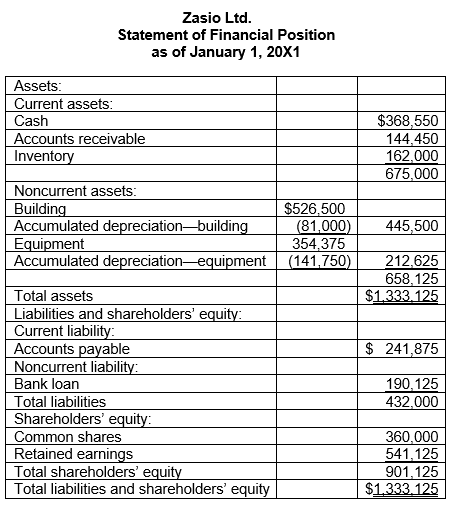

Zasio Ltd. Statement of Financial Position as of January 1, 20X1 Assets: Current assets: Cash $368,550 Accounts receivable 144,450 Inventory 162,000 675,000 Noncurrent assets: Building $526,500 Accumulated depreciation-building (81,000) 445,500 Equipment 354,375 Accumulated depreciation-equipment (141,750) 212,625 658,125 Total assets $1,333,125 Liabilities and shareholders' equity: Current liability: Accounts payable $ 241,875 Noncurrent liability: Total shareholders' equity Bank loan Total liabilities Shareholders' equity: Common shares Retained earnings Total liabilities and shareholders' equity 190,125 432,000 360,000 541.125 901,125 $1,333.125

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started