Answered step by step

Verified Expert Solution

Question

1 Approved Answer

lew Policies Current Attempt in Progress EcoFabrics has budgeted overhead costs of $963,900. It has allocated overhead on a plantwide basis to its two products

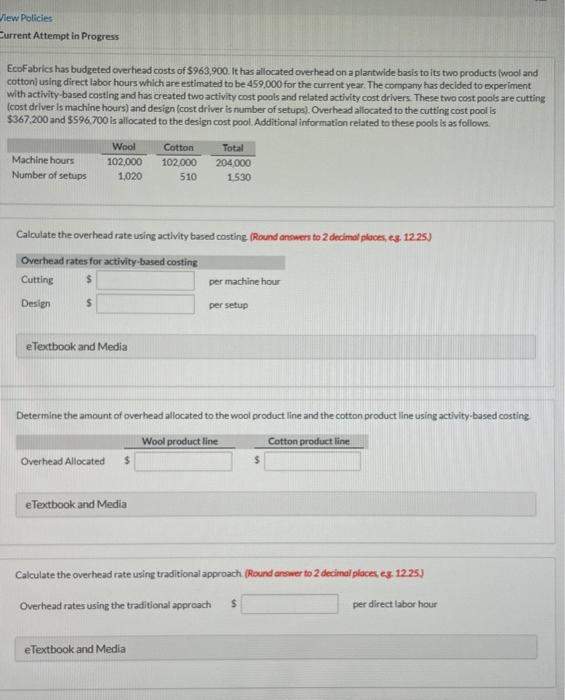

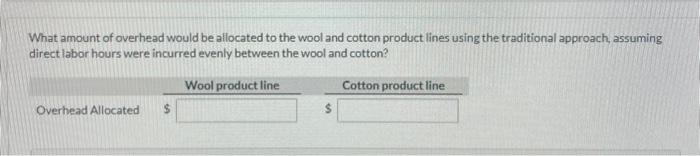

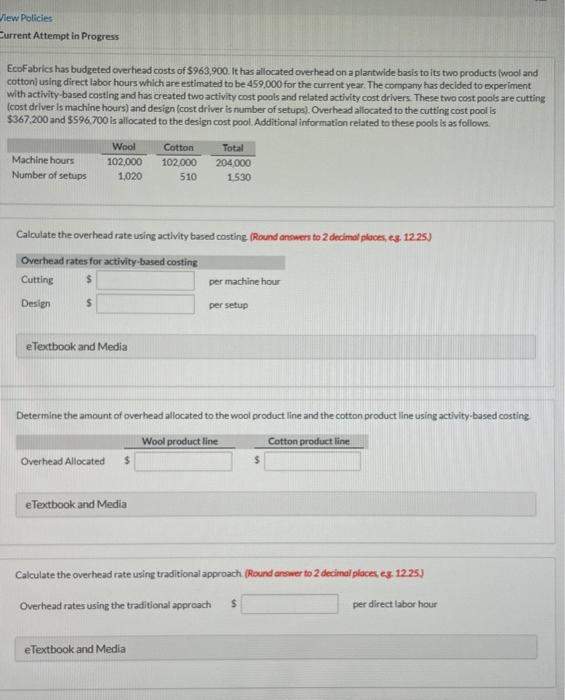

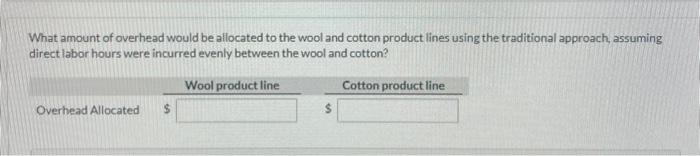

lew Policies Current Attempt in Progress EcoFabrics has budgeted overhead costs of $963,900. It has allocated overhead on a plantwide basis to its two products (wool and cotton) using direct labor hours which are estimated to be 459,000 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (cost driver is machine hours) and design (cost driver is number of setups). Overhead allocated to the cutting cost pool is $367.200 and $596.700 is allocated to the design cost pool. Additional information related to these pools is as follows. Machine hours Number of setups Wool 102,000 1,020 Cotton 102.000 510 Total 204 000 1.530 Calculate the overhead rate using activity based costing (Round answers to 2 decimal places, s. 1225) Overhead rates for activity-based costing Cutting per machine hour Design $ $ per setup eTextbook and Media Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing Wool product line Cotton product line Overhead Allocated eTextbook and Media Calculate the overhead rate using traditional approach (Round answer to 2 decimal places es. 1225) Overhead rates using the traditional approach $ per direct labor hour e Textbook and Media What amount of overhead would be allocated to the wool and cotton product lines using the traditional approach, assuming direct labor hours were incurred evenly between the wool and cotton? Wool product line Cotton product line Overhead Allocated $

lew Policies Current Attempt in Progress EcoFabrics has budgeted overhead costs of $963,900. It has allocated overhead on a plantwide basis to its two products (wool and cotton) using direct labor hours which are estimated to be 459,000 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (cost driver is machine hours) and design (cost driver is number of setups). Overhead allocated to the cutting cost pool is $367.200 and $596.700 is allocated to the design cost pool. Additional information related to these pools is as follows. Machine hours Number of setups Wool 102,000 1,020 Cotton 102.000 510 Total 204 000 1.530 Calculate the overhead rate using activity based costing (Round answers to 2 decimal places, s. 1225) Overhead rates for activity-based costing Cutting per machine hour Design $ $ per setup eTextbook and Media Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing Wool product line Cotton product line Overhead Allocated eTextbook and Media Calculate the overhead rate using traditional approach (Round answer to 2 decimal places es. 1225) Overhead rates using the traditional approach $ per direct labor hour e Textbook and Media What amount of overhead would be allocated to the wool and cotton product lines using the traditional approach, assuming direct labor hours were incurred evenly between the wool and cotton? Wool product line Cotton product line Overhead Allocated $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started