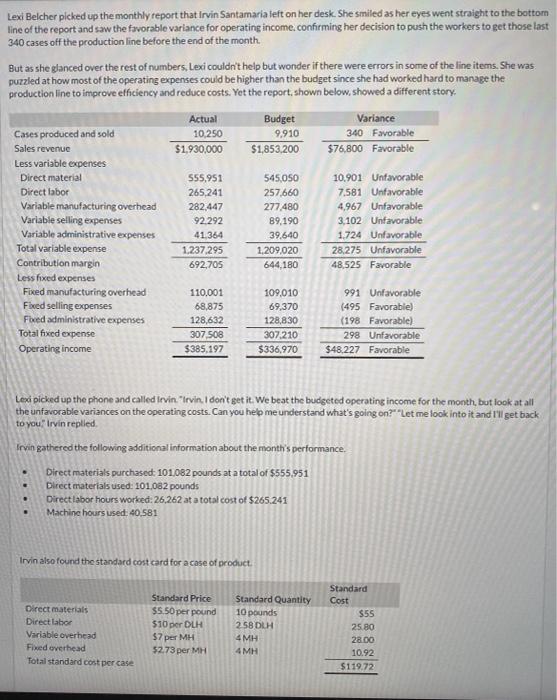

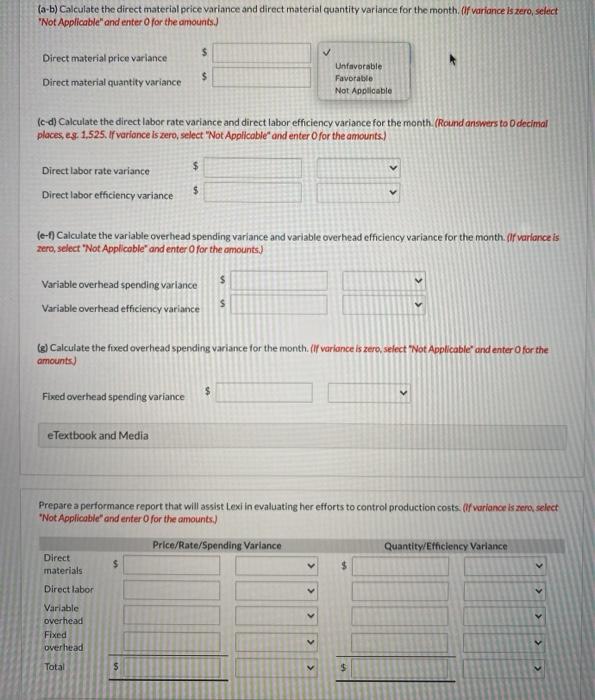

Lexi Belcher picked up the monthly report that Irvin Santamaria left on her desk. She smiled as her eyes went straight to the bottom line of the report and saw the favorable variance for operating income confirming her decision to push the workers to get those last 340 cases off the production line before the end of the month. But as she glanced over the rest of numbers, Lexi couldn't help but wonder if there were errors in some of the line items. She was puzzled at how most of the operating expenses could be higher than the budget since she had worked hard to manage the production line to improve efficiency and reduce costs. Yet the report shown below, showed a different story, Actual 10.250 $1.930,000 Budget 9.910 $1,853.200 Variance 340 Favorable $76,800 Favorable Cases produced and sold Sales revenue Less variable expenses Direct material Direct labor Variable manufacturing overhead Variable selling expenses Variable administrative expenses Total variable expense Contribution margin Less fixed expenses Fixed manufacturing overhead Fixed selling expenses Feed administrative expenses Total fixed expense Operating income 555.951 265,241 282,447 92.292 41.364 1.237.295 692,705 545,050 257,660 277.480 89,190 39.640 1,209,020 644,180 10.901 Unfavorable 7.581 Unfavorable 4,967 Unfavorable 3.102 Unfavorable 1.724 Unfavorable 28,275 Unfavorable 48,525 Favorable 110.001 68,875 128,632 307 508 $385,197 109,010 69,370 128,830 307.210 $336,970 991 Unfavorable (495 Favorable) (198 Favorable) 298 Unfavorable $48.227 Favorable Lexi picked up the phone and called tevin. "Irvin. I don't get it. We beat the budgeted operating income for the month, but look at all the unfavorable variances on the operating costs. Can you help me understand what's going on?""Let me look into it and I'll get back to you Irvin replied Irwin gathered the following additional information about the month's performance. Direct materials purchased: 101,082 pounds at a total of $555.951 Direct materials used: 101,082 pounds Direct labor hours worked: 26,262 at a total cost of $265.241 Machine hours used: 40.581 . Irvin also found the standard cost card for a case of product. Direct materials Direct labor Variable overhead Fixed overhead Total standard cost per case Standard Price $5.50 per pound $10 per DLH $7 per MH $2.73 per MH Standard Quantity 10 pounds 258DLH 4 MH 4 MH Standard Cost $55 25.80 28.00 10.92 $11972 (a-b) Calculate the direct material price variance and direct material quantity variance for the month of variance is zero, select "Not Applicable" and enter for the amounts) $ Direct material price variance Direct material quantity variance $ Unfavorable Favorable Not Applicable (c-d) Calculate the direct labor rate variance and direct labor efficiency variance for the month. (Round answers to decimal places , es 1,525. If variance is zero, select "Not Applicable and enter for the amounts) $ Direct labor rate variance Direct labor efficiency variance $ le-1) Calculate the variable overhead spending variance and variable overhead efficiency variance for the month. (f variance is zero, select "Not Applicable and enter for the amounts.) $ Variable overhead spending variance Variable overhead efficiency variance