Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lexington is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Asa comes to Lexington on April

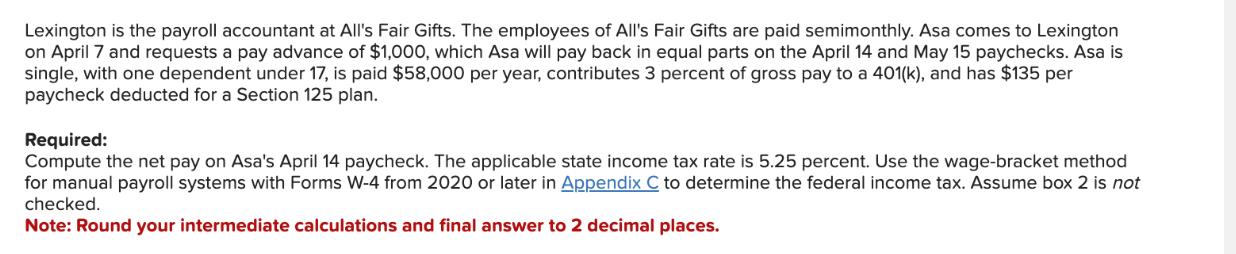

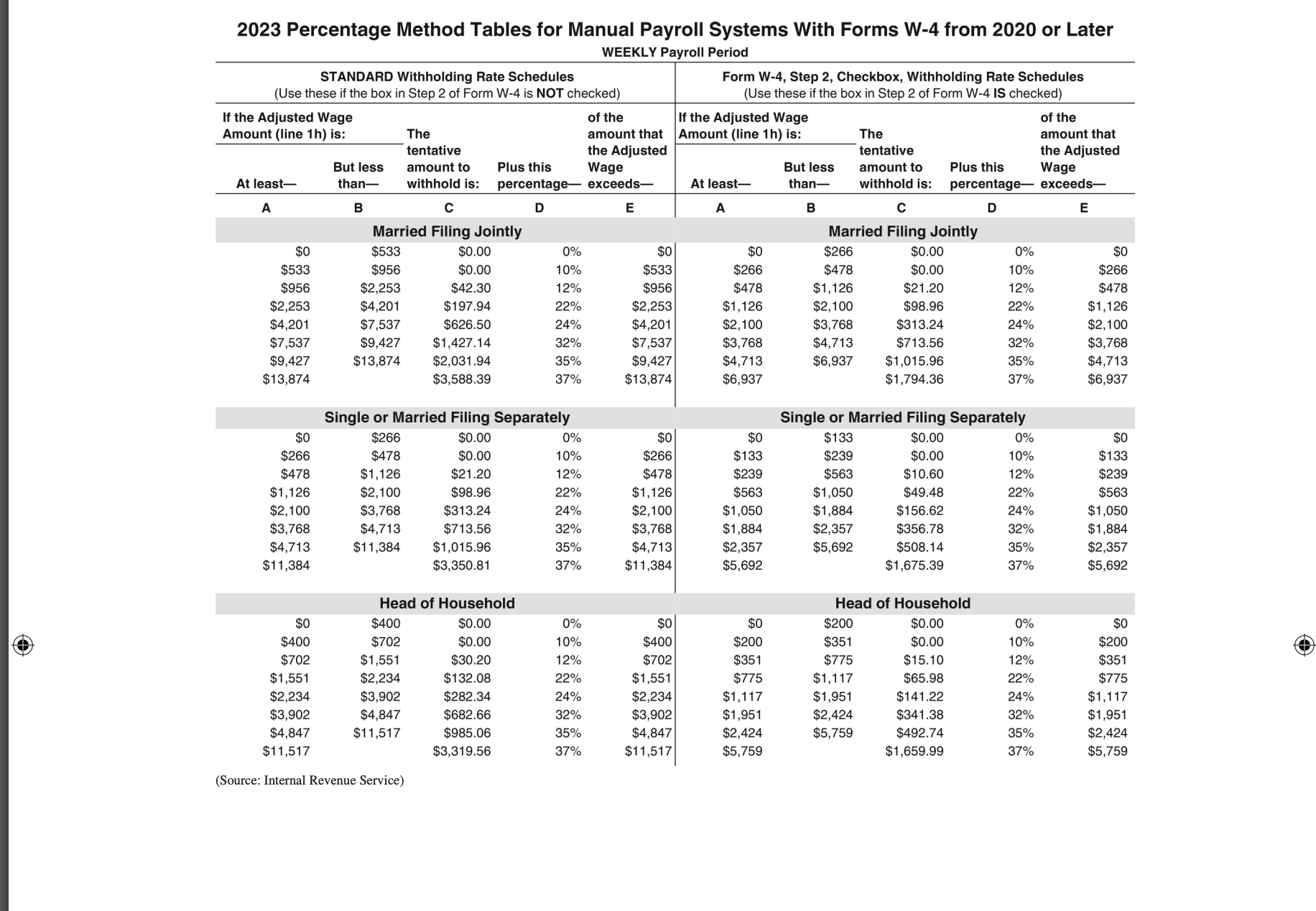

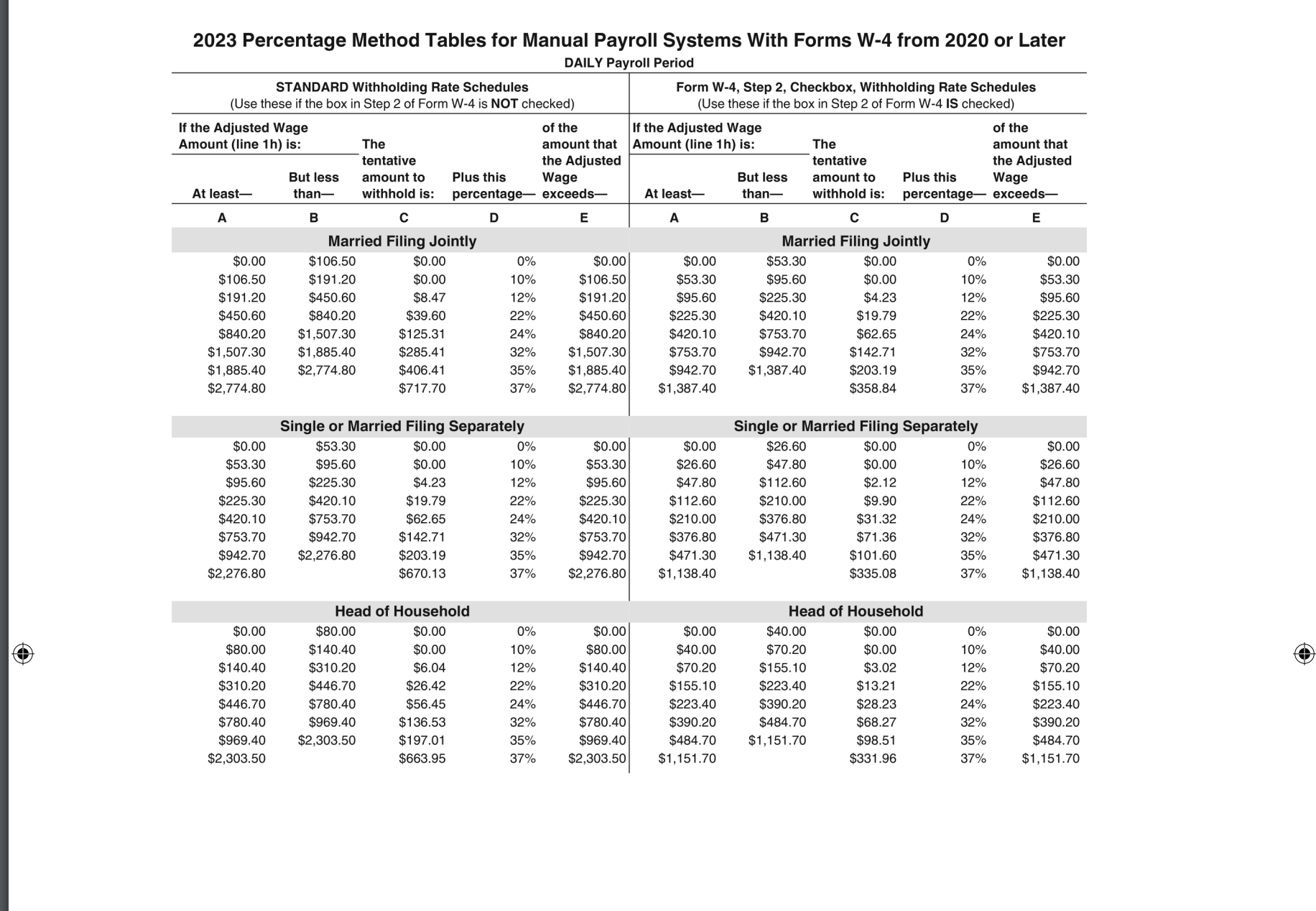

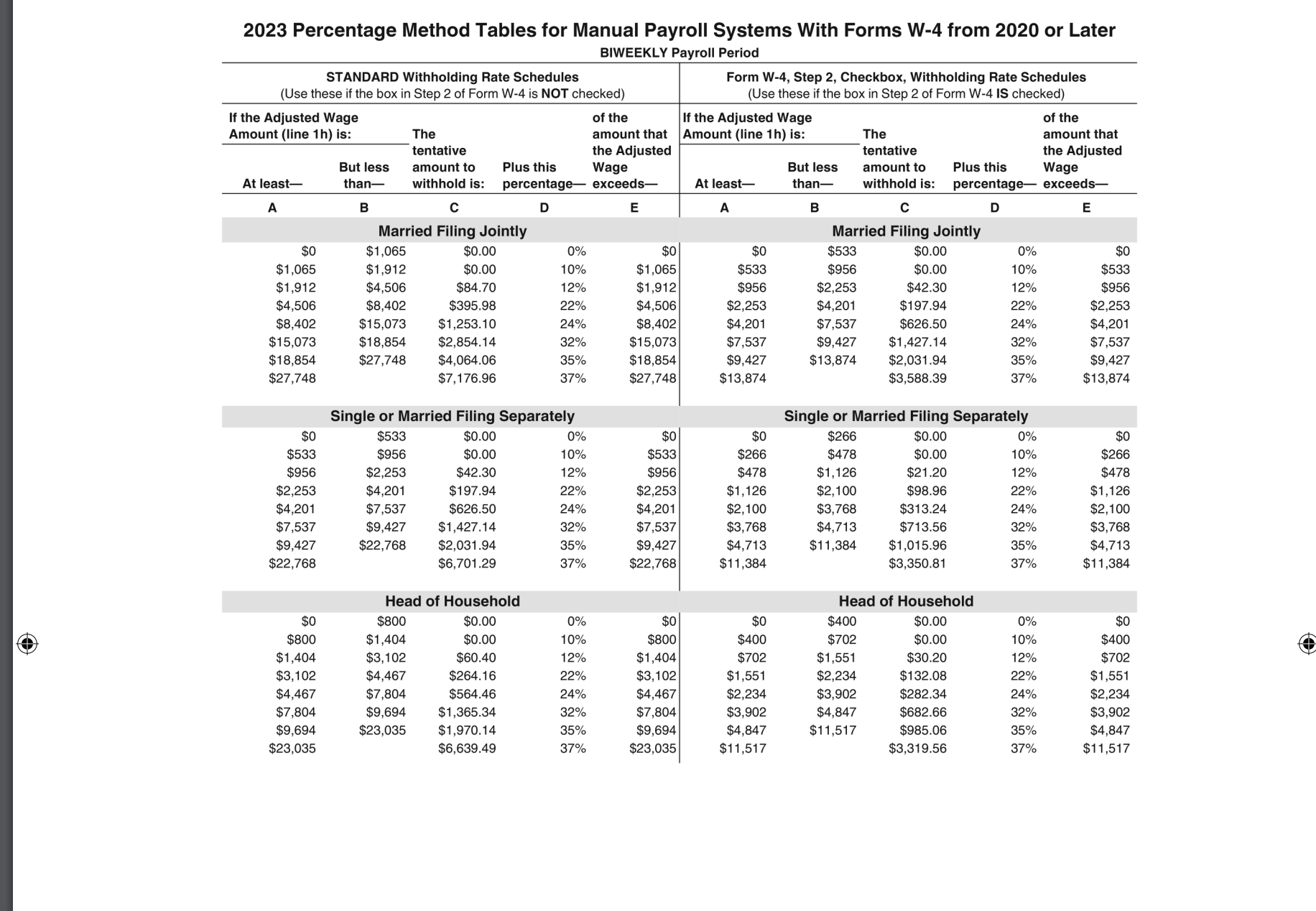

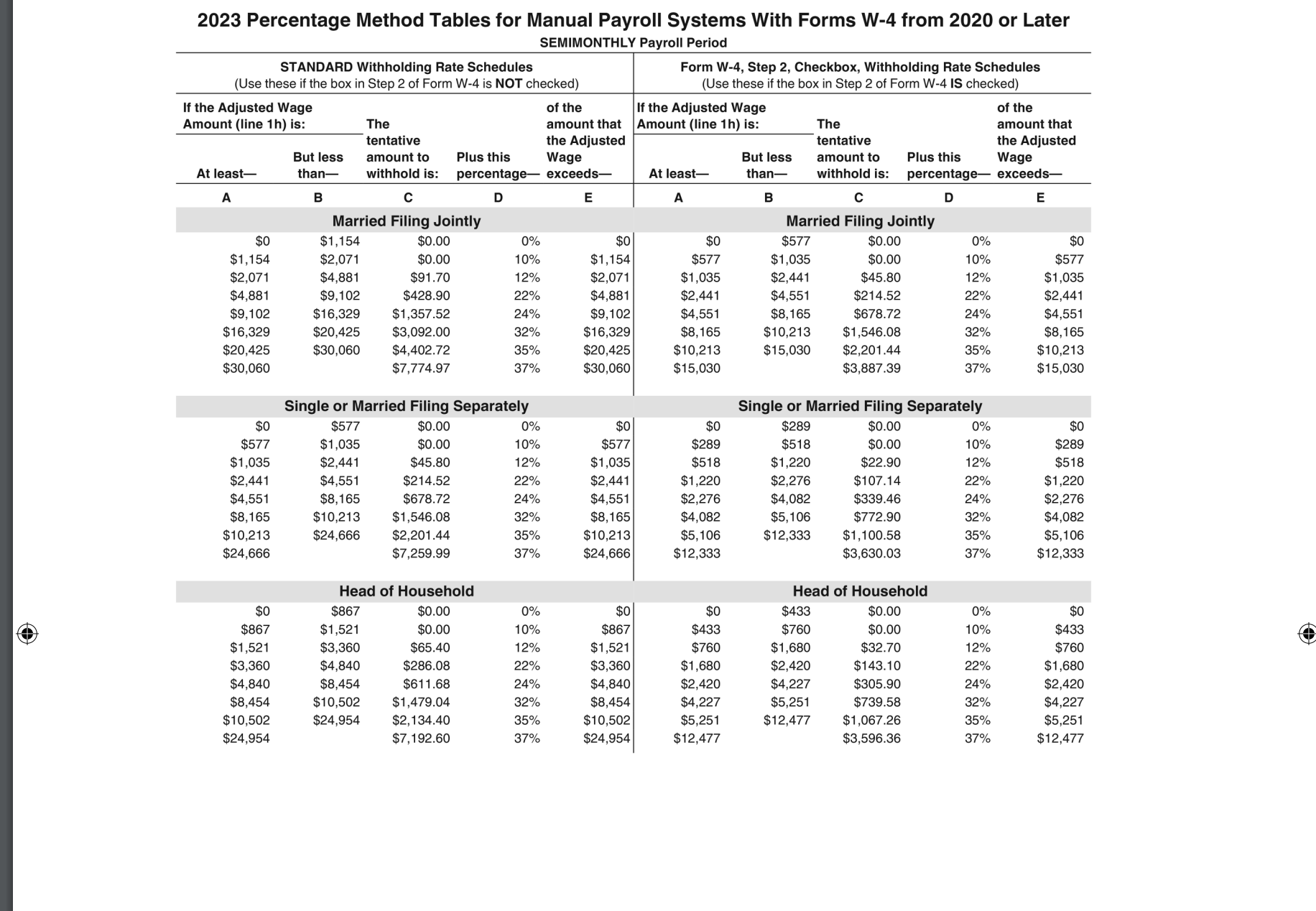

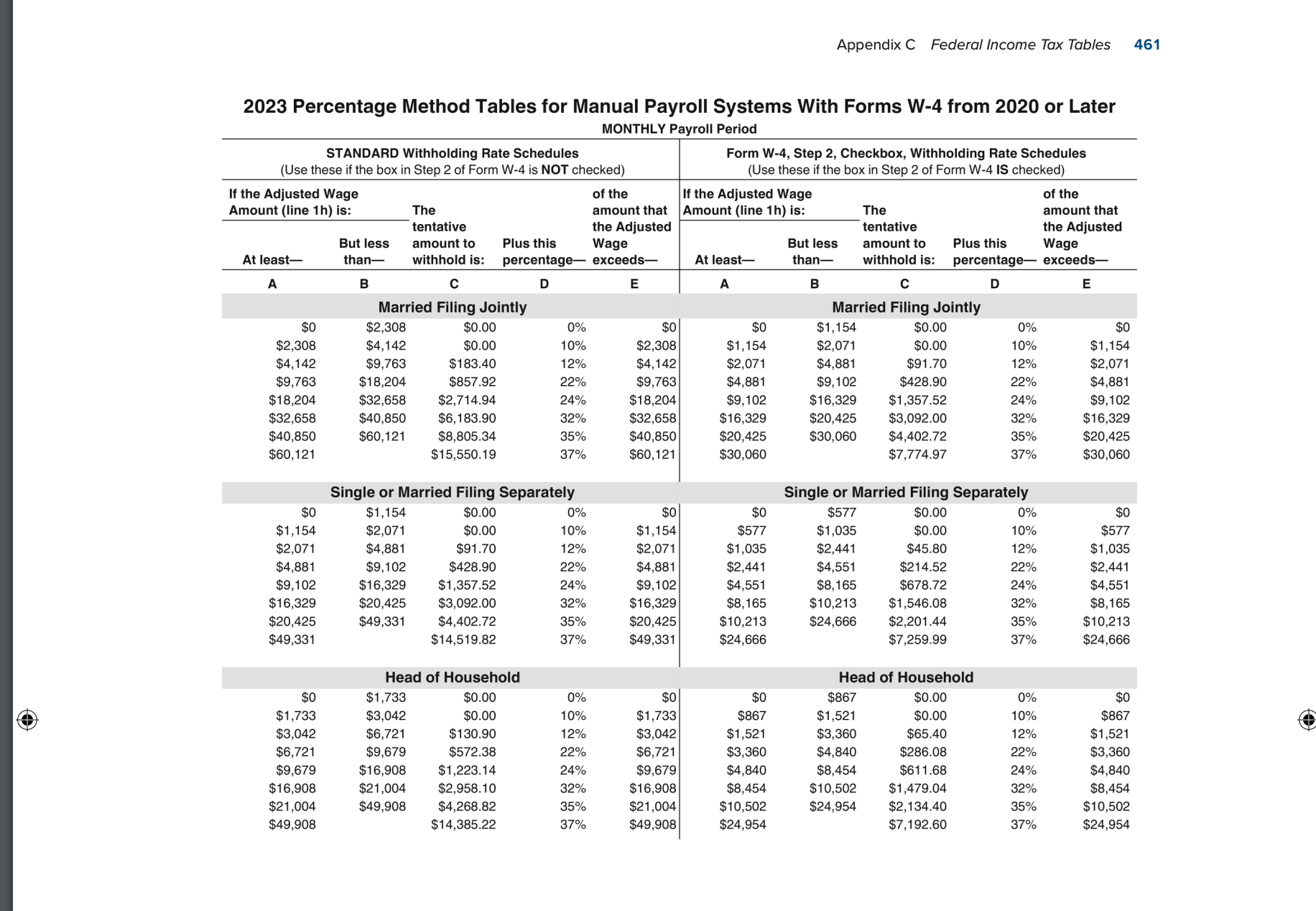

Lexington is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Asa comes to Lexington on April 7 and requests a pay advance of $1,000, which Asa will pay back in equal parts on the April 14 and May 15 paychecks. Asa is single, with one dependent under 17, is paid $58,000 per year, contributes 3 percent of gross pay to a 401(k), and has $135 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Asa's April 14 paycheck. The applicable state income tax rate is 5.25 percent. Use the wage-bracket method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine the federal income tax. Assume box 2 is not checked. Note: Round your intermediate calculations and final answer to 2 decimal places. 2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later STANDARD Withholding Rate Schedules WEEKLY Payroll Period (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: At least- But less than- The tentative amount to withhold is: of the amount that the Adjusted If the Adjusted Wage Amount (line 1h) is: of the Plus this A B C percentage D Wage exceeds At least- But less than- The tentative amount to withhold is: amount that Plus this percentage the Adjusted Wage exceeds- E A C D E Married Filing Jointly Married Filing Jointly $0 $533 $533 $0.00 0% $0 $0 $266 $0.00 0% $0 $956 $0.00 10% $533 $266 $478 $0.00 10% $266 $956 $2,253 $42.30 12% $956 $478 $1,126 $21.20 12% $478 $2,253 $4,201 $197.94 22% $2,253 $1,126 $2,100 $98.96 22% $1,126 $4,201 $7,537 $626.50 24% $4,201 $2,100 $3,768 $313.24 24% $2,100 $7,537 $9,427 $1,427.14 32% $7,537 $3,768 $4,713 $713.56 32% $3,768 $9,427 $13,874 $2,031.94 35% $9,427 $4,713 $6,937 $1,015.96 35% $4,713 $13,874 $3,588.39 37% $13,874 $6,937 $1,794.36 37% $6,937 Single or Married Filing Separately Single or Married Filing Separately $0 $266 $0.00 0% $0 $0 $133 $0.00 0% $0 $266 $478 $0.00 10% $266 $133 $239 $0.00 10% $133 $478 $1,126 $21.20 12% $478 $239 $563 $10.60 12% $239 $1,126 $2,100 $98.96 22% $1,126 $563 $1,050 $49.48 22% $563 $2,100 $3,768 $313.24 24% $2,100 $1,050 $1,884 $156.62 24% $1,050 $3,768 $4,713 $713.56 32% $3,768 $1,884 $2,357 $356.78 32% $1,884 $4,713 $11,384 $11,384 $1,015.96 $3,350.81 35% $4,713 $2,357 $5,692 $508.14 35% $2,357 37% $11,384 $5,692 $1,675.39 37% $5,692 Head of Household Head of Household $0 $400 $0.00 0% $0 $0 $200 $0.00 0% $0 $400 $702 $0.00 10% $400 $200 $351 $0.00 10% $200 $702 $1,551 $30.20 12% $702 $351 $775 $15.10 12% $351 $1,551 $2,234 $132.08 22% $1,551 $775 $1,117 $65.98 22% $775 $2,234 $3,902 $282.34 24% $2,234 $1,117 $1,951 $141.22 24% $1,117 $3,902 $4,847 $682.66 32% $3,902 $1,951 $2,424 $341.38 32% $1,951 $4,847 $11,517 $985.06 35% $4,847 $2,424 $5,759 $492.74 35% $2,424 $11,517 $3,319.56 37% $11,517 $5,759 $1,659.99 37% $5,759 (Source: Internal Revenue Service) 2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later STANDARD Withholding Rate Schedules DAILY Payroll Period (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: The tentative At least- But less than- amount to withhold is: Plus this A B percentage D of the amount that the Adjusted Wage exceeds- If the Adjusted Wage Amount (line 1h) is: of the At least- But less than- The tentative amount to withhold is: amount that the Adjusted Plus this percentage Wage exceeds- E A B C D E Married Filing Jointly Married Filing Jointly $0.00 $106.50 $0.00 0% $0.00 $0.00 $53.30 $0.00 0% $0.00 $106.50 $191.20 $0.00 10% $106.50 $53.30 $95.60 $0.00 10% $53.30 $191.20 $450.60 $8.47 12% $191.20 $95.60 $225.30 $4.23 12% $95.60 $450.60 $840.20 $39.60 22% $450.60 $225.30 $420.10 $19.79 22% $225.30 $840.20 $1,507.30 $125.31 24% $840.20 $420.10 $753.70 $62.65 24% $420.10 $1,507.30 $1,885.40 $285.41 32% $1,507.30 $753.70 $942.70 $142.71 32% $753.70 $1,885.40 $2,774.80 $406.41 35% $1,885.40 $942.70 $1,387.40 $203.19 35% $942.70 $2,774.80 $717.70 37% $2,774.80 $1,387.40 $358.84 37% $1,387.40 Single or Married Filing Separately Single or Married Filing Separately $0.00 $53.30 $0.00 0% $0.00 $53.30 $95.60 $0.00 10% $53.30 $0.00 $26.60 $26.60 $0.00 0% $0.00 $47.80 $0.00 10% $26.60 $95.60 $225.30 $4.23 12% $95.60 $47.80 $112.60 $2.12 12% $47.80 $225.30 $420.10 $19.79 22% $225.30 $112.60 $210.00 $9.90 22% $112.60 $420.10 $753.70 $62.65 24% $420.10 $210.00 $376.80 $31.32 24% $210.00 $753.70 $942.70 $142.71 32% $753.70 $376.80 $471.30 $71.36 32% $376.80 $942.70 $2,276.80 $203.19 35% $942.70 $471.30 $1,138.40 $101.60 35% $471.30 $2,276.80 $670.13 37% $2,276.80 $1,138.40 $335.08 37% $1,138.40 Head of Household Head of Household $0.00 $80.00 $0.00 0% $0.00 $0.00 $40.00 $0.00 0% $0.00 $80.00 $140.40 $0.00 10% $80.00 $40.00 $70.20 $0.00 10% $40.00 $140.40 $310.20 $6.04 12% $140.40 $70.20 $155.10 $3.02 12% $70.20 $310.20 $446.70 $26.42 22% $310.20 $155.10 $223.40 $13.21 22% $155.10 $446.70 $780.40 $56.45 24% $446.70 $223.40 $390.20 $28.23 24% $223.40 $780.40 $969.40 $136.53 32% $780.40 $390.20 $484.70 $68.27 32% $390.20 $969.40 $2,303.50 $197.01 35% $969.40 $484.70 $1,151.70 $98.51 35% $484.70 $2,303.50 $663.95 37% $2,303.50 $1,151.70 $331.96 37% $1,151.70 O 2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later STANDARD Withholding Rate Schedules BIWEEKLY Payroll Period (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: The tentative of the amount that the Adjusted If the Adjusted Wage of the Amount (line 1h) is: At least- But less than- amount to withhold is: Plus this A B percentage D Wage exceeds- E At least- But less than- The tentative amount to withhold is: Plus this percentage amount that the Adjusted Wage exceeds- A B E Married Filing Jointly Married Filing Jointly $0 $1,065 $0.00 0% $0 $0 $533 $0.00 0% $0 $1,065 $1,912 $0.00 10% $1,065 $533 $956 $0.00 10% $533 $1,912 $4,506 $84.70 12% $1,912 $956 $2,253 $42.30 12% $956 $4,506 $8,402 $395.98 22% $4,506 $2,253 $4,201 $197.94 22% $2,253 $8,402 $15,073 $1,253.10 24% $8,402 $4,201 $7,537 $626.50 24% $4,201 $15,073 $18,854 $2,854.14 32% $15,073 $7,537 $9,427 $1,427.14 32% $7,537 $18,854 $27,748 $4,064.06 35% $18,854 $9,427 $13,874 $2,031.94 35% $9,427 $27,748 $7,176.96 37% $27,748 $13,874 $3,588.39 37% $13,874 Single or Married Filing Separately Single or Married Filing Separately $0 $533 $0.00 0% $0 $0 $266 $0.00 0% $0 $533 $956 $0.00 10% $533 $266 $478 $0.00 10% $266 $956 $2,253 $42.30 12% $956 $478 $1,126 $21.20 12% $478 $2,253 $4,201 $197.94 22% $2,253 $1,126 $2,100 $98.96 22% $1,126 $4,201 $7,537 $626.50 24% $4,201 $2,100 $3,768 $313.24 24% $2,100 $7,537 $9,427 $1,427.14 32% $7,537 $3,768 $4,713 $713.56 32% $3,768 $9,427 $22,768 $2,031.94 35% $9,427 $4,713 $11,384 $1,015.96 35% $4,713 $22,768 $6,701.29 37% $22,768 $11,384 $3,350.81 37% $11,384 Head of Household Head of Household $0 $800 $0.00 0% $0 $0 $400 $0.00 0% $0 $800 $1,404 $0.00 10% $800 $400 $702 $0.00 10% $400 $1,404 $3,102 $60.40 12% $1,404 $702 $1,551 $30.20 12% $702 $3,102 $4,467 $264.16 22% $3,102 $1,551 $2,234 $132.08 22% $1,551 $4,467 $7,804 $564.46 24% $4,467 $2,234 $3,902 $282.34 24% $2,234 $7,804 $9,694 $1,365.34 32% $7,804 $3,902 $4,847 $682.66 32% $3,902 $9,694 $23,035 $1,970.14 35% $9,694 $4,847 $11,517 $985.06 35% $4,847 $23,035 $6,639.49 37% $23,035 $11,517 $3,319.56 37% $11,517 2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later STANDARD Withholding Rate Schedules SEMIMONTHLY Payroll Period (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: The of the amount that If the Adjusted Wage Amount (line 1h) is: of the tentative At least- But less than- amount to withhold is: Plus this A B C percentage D the Adjusted Wage exceeds- The tentative amount that the Adjusted At least- But less than- amount to withhold is: Plus this E A B C percentage D Wage exceeds- E Married Filing Jointly Married Filing Jointly $0 $1,154 $0.00 0% $0 $0 $577 $0.00 0% $0 $1,154 $2,071 $0.00 10% $1,154 $577 $1,035 $0.00 10% $577 $2,071 $4,881 $91.70 12% $2,071 $1,035 $2,441 $45.80 12% $1,035 $4,881 $9,102 $428.90 22% $4,881 $2,441 $4,551 $214.52 22% $2,441 $9,102 $16,329 $1,357.52 24% $9,102 $4,551 $8,165 $678.72 24% $4,551 $16,329 $20,425 $3,092.00 32% $16,329 $8,165 $10,213 $1,546.08 32% $8,165 $20,425 $30,060 $4,402.72 35% $20,425 $10,213 $15,030 $2,201.44 35% $10,213 $30,060 $7,774.97 37% $30,060 $15,030 $3,887.39 37% $15,030 Single or Married Filing Separately Single or Married Filing Separately $0 $577 $0.00 0% $0 $0 $289 $0.00 0% $0 $577 $1,035 $0.00 10% $577 $289 $518 $0.00 10% $289 $1,035 $2,441 $45.80 12% $1,035 $518 $1,220 $22.90 12% $518 $2,441 $4,551 $214.52 22% $2,441 $1,220 $2,276 $107.14 22% $1,220 $4,551 $8,165 $678.72 24% $4,551 $2,276 $4,082 $339.46 24% $2,276 $8,165 $10,213 $1,546.08 32% $8,165 $4,082 $5,106 $772.90 32% $4,082 $10,213 $24,666 $2,201.44 35% $10,213 $5,106 $12,333 $1,100.58 35% $5,106 $24,666 $7,259.99 37% $24,666 $12,333 $3,630.03 37% $12,333 Head of Household Head of Household $0 $867 $0.00 0% $0 $867 $1,521 $0.00 10% $867 $0 $433 $433 $0.00 0% $0 $760 $0.00 10% $433 $1,521 $3,360 $65.40 12% $1,521 $760 $1,680 $32.70 12% $760 $3,360 $4,840 $286.08 22% $3,360 $1,680 $2,420 $143.10 22% $1,680 $4,840 $8,454 $611.68 24% $4,840 $2,420 $4,227 $305.90 24% $2,420 $8,454 $10,502 $1,479.04 32% $8,454 $4,227 $5,251 $739.58 32% $4,227 $10,502 $24,954 $2,134.40 35% $10,502 $5,251 $12,477 $1,067.26 35% $5,251 $24,954 $7,192.60 37% $24,954 $12,477 $3,596.36 37% $12,477 Appendix C Federal Income Tax Tables 461 2023 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later STANDARD Withholding Rate Schedules MONTHLY Payroll Period (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: The tentative At least- But less than- amount to withhold is: Plus this A B percentage D of the amount that the Adjusted Wage exceeds- If the Adjusted Wage of the Amount (line 1h) is: The tentative At least- But less than- amount to withhold is: Plus this percentage amount that the Adjusted Wage exceeds- E A B C D E Married Filing Jointly Married Filing Jointly $0 $2,308 $0.00 0% $0 $0 $1,154 $0.00 0% $0 $2,308 $4,142 $0.00 10% $2,308 $1,154 $2,071 $0.00 10% $1,154 $4,142 $9,763 $183.40 12% $4,142 $2,071 $4,881 $91.70 12% $2,071 $9,763 $18,204 $857.92 22% $9,763 $4,881 $9,102 $428.90 22% $4,881 $18,204 $32,658 $2,714.94 24% $18,204 $9,102 $16,329 $1,357.52 24% $9,102 $32,658 $40,850 $6,183.90 32% $32,658 $16,329 $20,425 $3,092.00 32% $16,329 $40,850 $60,121 $60,121 $8,805.34 $15,550.19 35% $40,850 $20,425 $30,060 $4,402.72 35% $20,425 37% $60,121 $30,060 $7,774.97 37% $30,060 Single or Married Filing Separately Single or Married Filing Separately $0 $1,154 $0.00 0% $0 $0 $577 $0.00 0% $0 $1,154 $2,071 $0.00 10% $1,154 $577 $1,035 $0.00 10% $577 $2,071 $4,881 $91.70 12% $2,071 $1,035 $2,441 $45.80 12% $1,035 $4,881 $9,102 $428.90 22% $4,881 $2,441 $4,551 $214.52 22% $2,441 $9,102 $16,329 $1,357.52 24% $9,102 $4,551 $8,165 $678.72 24% $4,551 $16,329 $20,425 $3,092.00 32% $16.329 $8,165 $10,213 $1,546.08 32% $8,165 $20,425 $49,331 $4,402.72 35% $20,425 $10,213 $24,666 $2,201.44 35% $10,213 $49,331 $14,519.82 37% $49,331 $24,666 $7,259.99 37% $24,666 Head of Household Head of Household $0 $1,733 $0.00 0% $0 $0 $867 $0.00 0% $0 $1,733 $3,042 $0.00 10% $1,733 $867 $1,521 $0.00 10% $867 $3,042 $6,721 $130.90 12% $3,042 $1,521 $3,360 $65.40 12% $1,521 $6,721 $9,679 $572.38 22% $6,721 $3,360 $4,840 $286.08 22% $3,360 $9,679 $16,908 $1,223.14 24% $9,679 $4,840 $8,454 $611.68 24% $4,840 $16,908 $21,004 $2,958.10 32% $16,908 $8,454 $10,502 $1,479.04 32% $8,454 $21,004 $49,908 $4,268.82 35% $21,004 $10,502 $24,954 $2,134.40 35% $10,502 $49,908 $14,385.22 37% $49,908 $24,954 $7,192.60 37% $24,954 +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started