Question

Lexon Inc. is a large manufacturer of affordable DVD players. Management recently became aware of rising expenses resulting from returns of malfunctioning products. As a

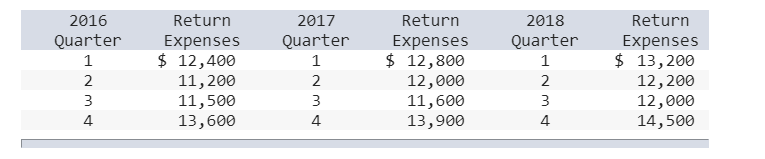

Lexon Inc. is a large manufacturer of affordable DVD players. Management recently became aware of rising expenses resulting from returns of malfunctioning products. As a starting point for further analysis, Paige Jennings, the controller, wants to test different forecasting methods and then use the best one to forecast quarterly expenses for 2019. The relevant quarterly data for the previous three years follow:

The result of a simple regression analysis using all 12 data points yielded an intercept of $11,754.55 and a coefficient for the independent variable of $126.22. (R-squared = 0.19, SE = $974.89.)

Required:

1. Plot the data in the order of the dates. (To earn full credit for this graph you must plot all required points for each curve. While plotting the points a tool icon will pop up. You can use this to enter exact co-ordinates for your points as needed.)

2016 Quarter 1 2 3 Return Expenses $ 12,400 11,200 11,500 13,600 2017 Quarter 1 2. 3 4. Return Expenses $ 12,800 12,000 11,600 13,900 2018 Quarter 1 2 3 4 Return Expenses $ 13,200 12,200 12,000 14,500 Return Expense 17,000 Tools 16,000 15,000 curve 1 14,000 13,000 12,000 11,000 10,000 9,000 8,000 7,000 Q 6,000 0 2. 4 6 8 10 12 14 Quarter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started