Question

Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table

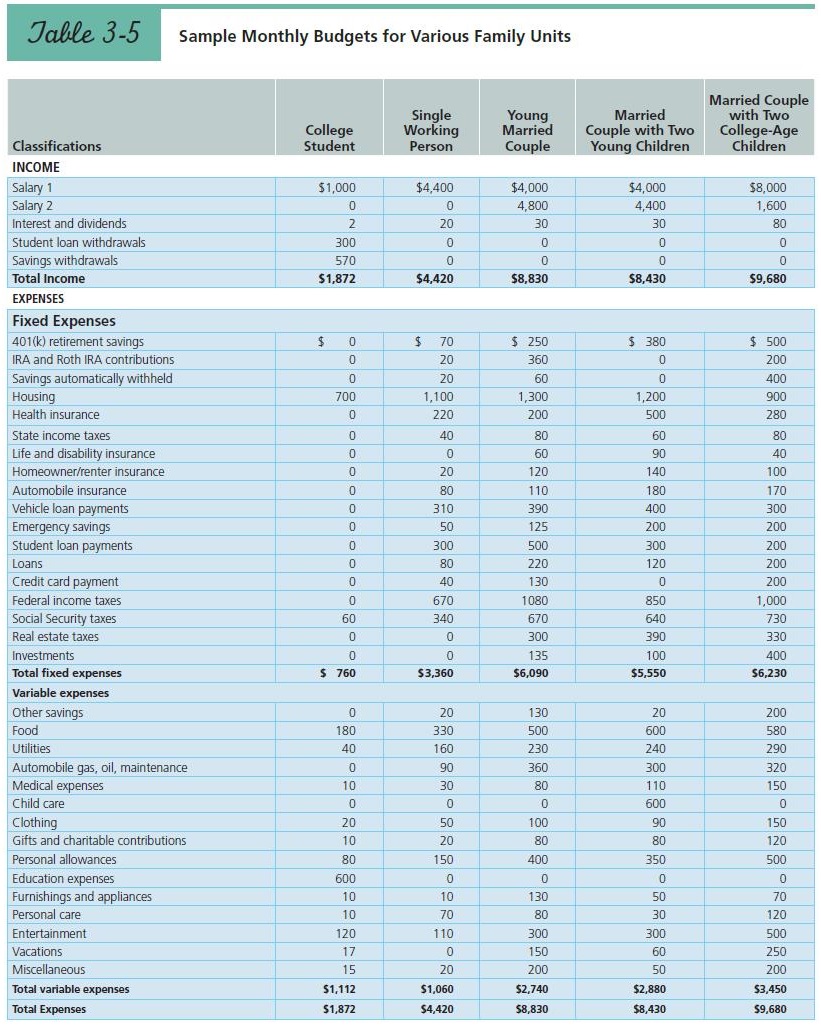

Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the "young married couple"). Leyia thinks that she can go on half-salary ($2,400 instead of $4,800 per month) in her job as a college textbook sales representative for about 18 months after the baby's birth; she will then return to full-time work.

Looking at the Hartley's current monthly budget, identify categories and amounts in their budget where they realistically might cut back $2,400. (Hint: Federal and state taxes should drop about $600 a month ($7,200 annually) as their income drops.)

Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give them for handling (i) their fixed expenses and (ii) their variable expenses to prepare financially for an anticipated $2,400 loss of income for 18 months as well as the expenses for the new baby?

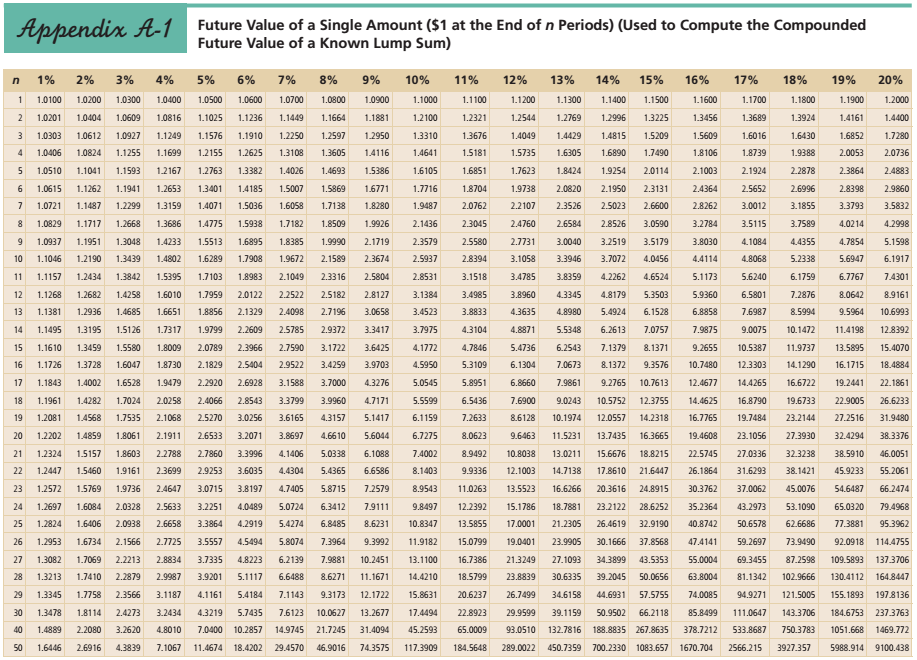

If the Hartley's gross income of $8,830 rises 4 percent per year in the future, what will their income be after five years? Round Future value of a Single Amount in intermediate calculations to four decimal places. (Hint: Use Appendix A-1 or the Garman/Forgue companion website.) Round your answer to the nearest dollar. $

Jable 3-5 Sample Monthly Budgets for Various Family Units \begin{tabular}{|c|c|c|c|c|c|} \hline Classifications & \begin{tabular}{l} College \\ Student \end{tabular} & \begin{tabular}{c} Single \\ Working \\ Person \end{tabular} & \begin{tabular}{l} Young \\ Married \\ Couple \end{tabular} & \begin{tabular}{c} Married \\ Couple with Two \\ Young Children \end{tabular} & \begin{tabular}{l} Married Couple \\ with Two \\ College-Age \\ Children \end{tabular} \\ \hline \multicolumn{6}{|l|}{ INCOME } \\ \hline Salary 1 & $1,000 & $4,400 & $4,000 & $4,000 & $8,000 \\ \hline Salary 2 & 0 & 0 & 4,800 & 4,400 & 1,600 \\ \hline Interest and dividends & 2 & 20 & 30 & 30 & 80 \\ \hline Student loan withdrawals & 300 & 0 & 0 & 0 & 0 \\ \hline Savings withdrawals & 570 & 0 & 0 & 0 & 0 \\ \hline Total Income & $1,872 & $4,420 & $8,830 & $8,430 & $9,680 \\ \hline \end{tabular} EXPENSES \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Fixed Expenses } \\ \hline 401(k) retirement savings & $ & $70 & $250 & $380 & $500 \\ \hline IRA and Roth IRA contributions & 0 & 20 & 360 & 0 & 200 \\ \hline Savings automatically withheld & 0 & 20 & 60 & 0 & 400 \\ \hline Housing & 700 & 1,100 & 1,300 & 1,200 & 900 \\ \hline Health insurance & 0 & 220 & 200 & 500 & 280 \\ \hline State income taxes & 0 & 40 & 80 & 60 & 80 \\ \hline Life and disability insurance & 0 & 0 & 60 & 90 & 40 \\ \hline Homeowner/renter insurance & 0 & 20 & 120 & 140 & 100 \\ \hline Automobile insurance & 0 & 80 & 110 & 180 & 170 \\ \hline Vehicle loan payments & 0 & 310 & 390 & 400 & 300 \\ \hline Emergency savings & 0 & 50 & 125 & 200 & 200 \\ \hline Student loan payments & 0 & 300 & 500 & 300 & 200 \\ \hline Loans & 0 & 80 & 220 & 120 & 200 \\ \hline Credit card payment & 0 & 40 & 130 & 0 & 200 \\ \hline Federal income taxes & 0 & 670 & 1080 & 850 & 1,000 \\ \hline Social Security taxes & 60 & 340 & 670 & 640 & 730 \\ \hline Real estate taxes & 0 & 0 & 300 & 390 & 330 \\ \hline Investments & 0 & 0 & 135 & 100 & 400 \\ \hline Total fixed expenses & S 760 & $3,360 & $6,090 & $5,550 & $6,230 \\ \hline \multicolumn{6}{|l|}{ Variable expenses } \\ \hline Other savings & 0 & 20 & 130 & 20 & 200 \\ \hline Food & 180 & 330 & 500 & 600 & 580 \\ \hline Utilities & 40 & 160 & 230 & 240 & 290 \\ \hline Automobile gas, oil, maintenance & 0 & 90 & 360 & 300 & 320 \\ \hline Medical expenses & 10 & 30 & 80 & 110 & 150 \\ \hline Child care & 0 & 0 & 0 & 600 & 0 \\ \hline Clothing & 20 & 50 & 100 & 90 & 150 \\ \hline Gifts and charitable contributions & 10 & 20 & 80 & 80 & 120 \\ \hline Personal allowances & 80 & 150 & 400 & 350 & 500 \\ \hline Education expenses & 600 & 0 & 0 & 0 & 0 \\ \hline Furnishings and appliances & 10 & 10 & 130 & 50 & 70 \\ \hline Personal care & 10 & 70 & 80 & 30 & 120 \\ \hline Entertainment & 120 & 110 & 300 & 300 & 500 \\ \hline Vacations & 17 & 0 & 150 & 60 & 250 \\ \hline Miscellaneous & 15 & 20 & 200 & 50 & 200 \\ \hline Total variable expenses & $1,112 & $1,060 & $2,740 & $2,880 & $3,450 \\ \hline Total Expenses & $1,872 & $4,420 & $8,830 & $8,430 & $9,680 \\ \hline \end{tabular} Future Value of a Single Amount ( $1 at the End of n Periods) (Used to Compute the Compounded Fiture V/alue of a Knnuin I umn Cum)

Jable 3-5 Sample Monthly Budgets for Various Family Units \begin{tabular}{|c|c|c|c|c|c|} \hline Classifications & \begin{tabular}{l} College \\ Student \end{tabular} & \begin{tabular}{c} Single \\ Working \\ Person \end{tabular} & \begin{tabular}{l} Young \\ Married \\ Couple \end{tabular} & \begin{tabular}{c} Married \\ Couple with Two \\ Young Children \end{tabular} & \begin{tabular}{l} Married Couple \\ with Two \\ College-Age \\ Children \end{tabular} \\ \hline \multicolumn{6}{|l|}{ INCOME } \\ \hline Salary 1 & $1,000 & $4,400 & $4,000 & $4,000 & $8,000 \\ \hline Salary 2 & 0 & 0 & 4,800 & 4,400 & 1,600 \\ \hline Interest and dividends & 2 & 20 & 30 & 30 & 80 \\ \hline Student loan withdrawals & 300 & 0 & 0 & 0 & 0 \\ \hline Savings withdrawals & 570 & 0 & 0 & 0 & 0 \\ \hline Total Income & $1,872 & $4,420 & $8,830 & $8,430 & $9,680 \\ \hline \end{tabular} EXPENSES \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|l|}{ Fixed Expenses } \\ \hline 401(k) retirement savings & $ & $70 & $250 & $380 & $500 \\ \hline IRA and Roth IRA contributions & 0 & 20 & 360 & 0 & 200 \\ \hline Savings automatically withheld & 0 & 20 & 60 & 0 & 400 \\ \hline Housing & 700 & 1,100 & 1,300 & 1,200 & 900 \\ \hline Health insurance & 0 & 220 & 200 & 500 & 280 \\ \hline State income taxes & 0 & 40 & 80 & 60 & 80 \\ \hline Life and disability insurance & 0 & 0 & 60 & 90 & 40 \\ \hline Homeowner/renter insurance & 0 & 20 & 120 & 140 & 100 \\ \hline Automobile insurance & 0 & 80 & 110 & 180 & 170 \\ \hline Vehicle loan payments & 0 & 310 & 390 & 400 & 300 \\ \hline Emergency savings & 0 & 50 & 125 & 200 & 200 \\ \hline Student loan payments & 0 & 300 & 500 & 300 & 200 \\ \hline Loans & 0 & 80 & 220 & 120 & 200 \\ \hline Credit card payment & 0 & 40 & 130 & 0 & 200 \\ \hline Federal income taxes & 0 & 670 & 1080 & 850 & 1,000 \\ \hline Social Security taxes & 60 & 340 & 670 & 640 & 730 \\ \hline Real estate taxes & 0 & 0 & 300 & 390 & 330 \\ \hline Investments & 0 & 0 & 135 & 100 & 400 \\ \hline Total fixed expenses & S 760 & $3,360 & $6,090 & $5,550 & $6,230 \\ \hline \multicolumn{6}{|l|}{ Variable expenses } \\ \hline Other savings & 0 & 20 & 130 & 20 & 200 \\ \hline Food & 180 & 330 & 500 & 600 & 580 \\ \hline Utilities & 40 & 160 & 230 & 240 & 290 \\ \hline Automobile gas, oil, maintenance & 0 & 90 & 360 & 300 & 320 \\ \hline Medical expenses & 10 & 30 & 80 & 110 & 150 \\ \hline Child care & 0 & 0 & 0 & 600 & 0 \\ \hline Clothing & 20 & 50 & 100 & 90 & 150 \\ \hline Gifts and charitable contributions & 10 & 20 & 80 & 80 & 120 \\ \hline Personal allowances & 80 & 150 & 400 & 350 & 500 \\ \hline Education expenses & 600 & 0 & 0 & 0 & 0 \\ \hline Furnishings and appliances & 10 & 10 & 130 & 50 & 70 \\ \hline Personal care & 10 & 70 & 80 & 30 & 120 \\ \hline Entertainment & 120 & 110 & 300 & 300 & 500 \\ \hline Vacations & 17 & 0 & 150 & 60 & 250 \\ \hline Miscellaneous & 15 & 20 & 200 & 50 & 200 \\ \hline Total variable expenses & $1,112 & $1,060 & $2,740 & $2,880 & $3,450 \\ \hline Total Expenses & $1,872 & $4,420 & $8,830 & $8,430 & $9,680 \\ \hline \end{tabular} Future Value of a Single Amount ( $1 at the End of n Periods) (Used to Compute the Compounded Fiture V/alue of a Knnuin I umn Cum) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started