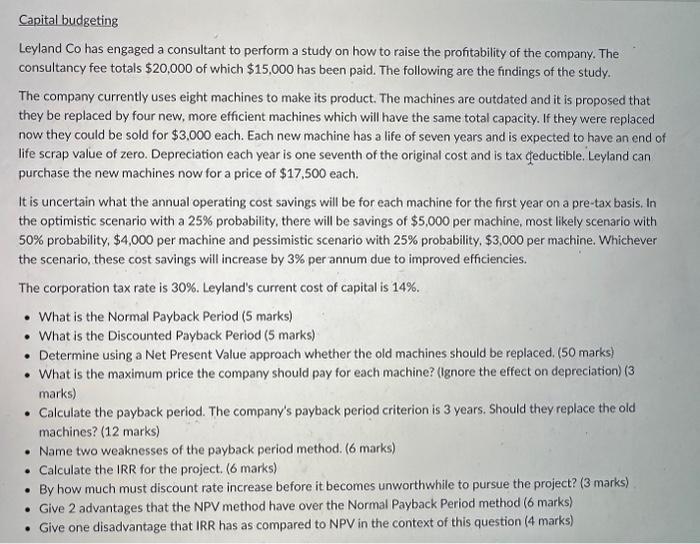

Leyland Co has engaged a consultant to perform a study on how to raise the profitability of the company. The consultancy fee totals $20,000 of which $15,000 has been paid. The following are the findings of the study. The company currently uses eight machines to make its product. The machines are outdated and it is proposed that they be replaced by four new, more efficient machines which will have the same total capacity. If they were replaced now they could be sold for $3,000 each. Each new machine has a life of seven years and is expected to have an end of life scrap value of zero. Depreciation each year is one seventh of the original cost and is tax cheductible. Leyland can purchase the new machines now for a price of $17,500 each. It is uncertain what the annual operating cost savings will be for each machine for the first year on a pre-tax basis. In the optimistic scenario with a 25% probability, there will be savings of $5,000 per machine, most likely scenario with 50% probability, $4,000 per machine and pessimistic scenario with 25% probability, $3,000 per machine. Whichever the scenario, these cost savings will increase by 3% per annum due to improved efficiencies. The corporation tax rate is 30%. Leyland's current cost of capital is 14%. - What is the Normal Payback Period (5 marks) - What is the Discounted Payback Period (5 marks) - Determine using a Net Present Value approach whether the old machines should be replaced, (50 marks) - What is the maximum price the company should pay for each machine? (Ignore the effect on depreciation) (3 marks) - Calculate the payback period. The company's payback period criterion is 3 years. Should they replace the old machines? (12 marks) - Name two weaknesses of the payback period method. (6 marks) - Calculate the IRR for the project. (6 marks) - By how much must discount rate increase before it becomes unworthwhile to pursue the project? (3 marks) - Give 2 advantages that the NPV method have over the Normal Payback Period method (6 marks) - Give one disadvantage that IRR has as compared to NPV in the context of this question (4 marks)