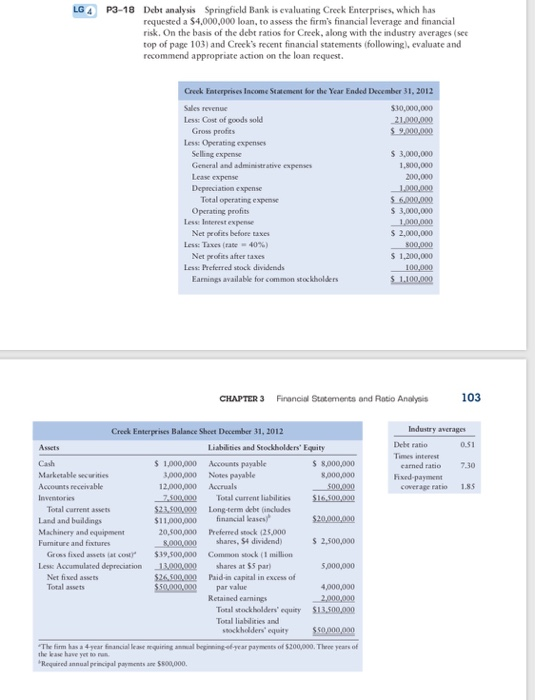

LG 4 P3-18 Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry averages (see top of page 103) and Creek's recent financial statements following), evaluate and recommend appropriate action on the loan request. Creck Enterprises Income Statement for the Year Ended December 31, 2012 $30,000,000 21.000.000 $19.000.000 $ 3.000.000 1.800.000 200,000 Sales reven Less Cost of goods sold Gross profits Les Operating expenses Selling expense General and administrative expenses Leave expense Depreciation expense Total operating expense Operating profits Less Interest expense Net profits before axes Less Taxes Crate 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders $ 6,000,000 $ 3.000.000 1,000,000 $ 2,000,000 300,000 $ 1.200.000 100,000 $ 1.100.000 CHAPTER 3 Financial Statements and Ratio Analysis 103 Industry averages 0:51 Debe ratio Times interest canned ratio Fixed payment Coverage ratio 7.30 1.85 Creek Enterprises Balance Sheet December 31, 2012 Assets Liabilities and Stockholders' Equity Cash $ 1,000,000 Accounts payable $ 8,000,000 Marketable securities 3,000,000 Notes payable 8,000,000 Accounts receivable 12,000,000 Accruals 500,000 Inventories 7.500.000 Total current lubilities $16.500.000 Total current assets $23.500.000 Long-term debe includes Land and buildings $11,000,000 financial leases $20,000,000 Machinery and equipment 20,500,000 Preferred stack 25,000 Furniture and fixtures 8,000,000 shares, S4 dividend) $ 2.500.000 Grens fixed a s a co $39.500,000 Common sok 1 million Les Accumulated depreciation 13.000.000 shares at $5 par 5,000,000 Net fixed assets $26.500.000 Paid in capital in excess of Total assets $50.000.000 par value 4,000,000 Retained earnings 2.000.000 Total stockholders' equity $13.500.000 Total liabilities and stockholders' equity $50.000.000 "The firm has year financial ingyear past of $200,000. Three years of the have You "Required annual principal payments S00,000