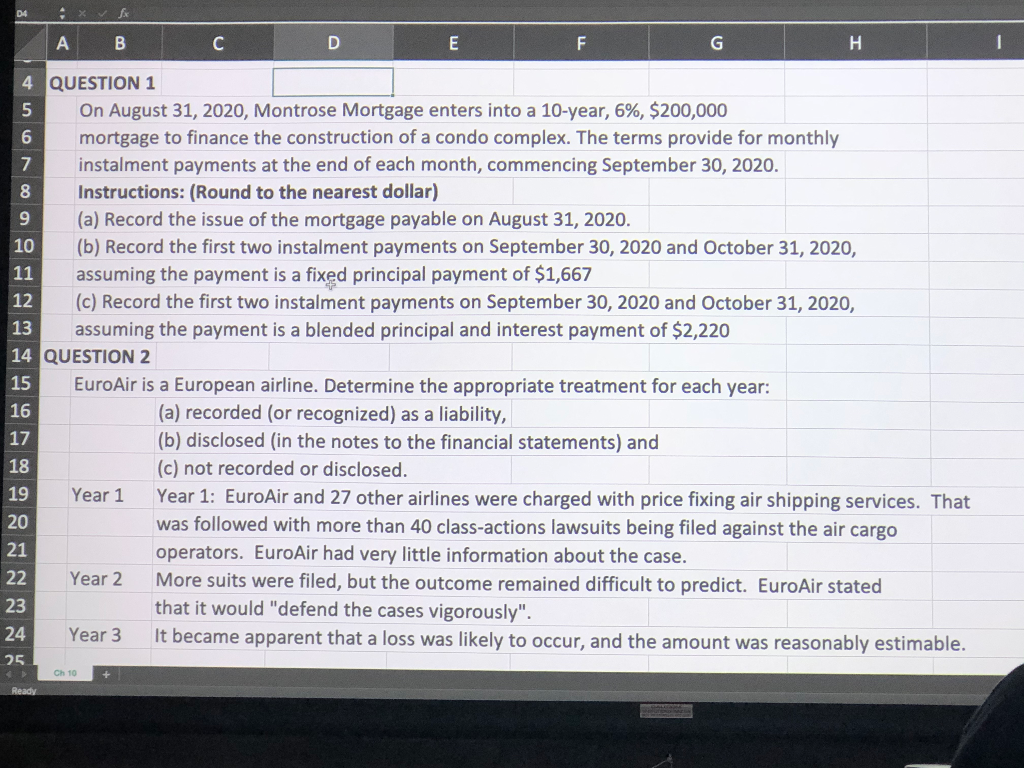

LG H I 1 13 QUESTION 1 On August 31, 2020, Montrose Mortgage enters into a 10-year, 6%, $200,000 mortgage to finance the construction of a condo complex. The terms provide for monthly instalment payments at the end of each month, commencing September 30, 2020. Instructions: (Round to the nearest dollar) (a) Record the issue of the mortgage payable on August 31, 2020. (b) Record the first two instalment payments on September 30, 2020 and October 31, 2020, assuming the payment is a fixed principal payment of $1,667 (c) Record the first two instalment payments on September 30, 2020 and October 31, 2020, assuming the payment is a blended principal and interest payment of $2,220 14 QUESTION 2 EuroAir is a European airline. Determine the appropriate treatment for each year: (a) recorded (or recognized) as a liability, (b) disclosed (in the notes to the financial statements) and (c) not recorded or disclosed. Year 1 Year 1: EuroAir and 27 other airlines were charged with price fixing air shipping services. That was followed with more than 40 class-actions lawsuits being filed against the air cargo operators. EuroAir had very little information about the case. Year 2 More suits were filed, but the outcome remained difficult to predict. EuroAir stated that it would "defend the cases vigorously". Year 3 It became apparent that a loss was likely to occur, and the amount was reasonably estimable. 25 Ch 10 Ready LG H I 1 13 QUESTION 1 On August 31, 2020, Montrose Mortgage enters into a 10-year, 6%, $200,000 mortgage to finance the construction of a condo complex. The terms provide for monthly instalment payments at the end of each month, commencing September 30, 2020. Instructions: (Round to the nearest dollar) (a) Record the issue of the mortgage payable on August 31, 2020. (b) Record the first two instalment payments on September 30, 2020 and October 31, 2020, assuming the payment is a fixed principal payment of $1,667 (c) Record the first two instalment payments on September 30, 2020 and October 31, 2020, assuming the payment is a blended principal and interest payment of $2,220 14 QUESTION 2 EuroAir is a European airline. Determine the appropriate treatment for each year: (a) recorded (or recognized) as a liability, (b) disclosed (in the notes to the financial statements) and (c) not recorded or disclosed. Year 1 Year 1: EuroAir and 27 other airlines were charged with price fixing air shipping services. That was followed with more than 40 class-actions lawsuits being filed against the air cargo operators. EuroAir had very little information about the case. Year 2 More suits were filed, but the outcome remained difficult to predict. EuroAir stated that it would "defend the cases vigorously". Year 3 It became apparent that a loss was likely to occur, and the amount was reasonably estimable. 25 Ch 10 Ready