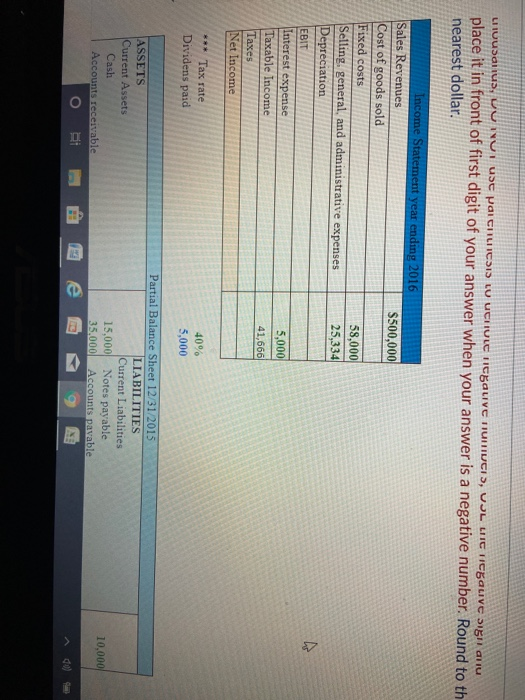

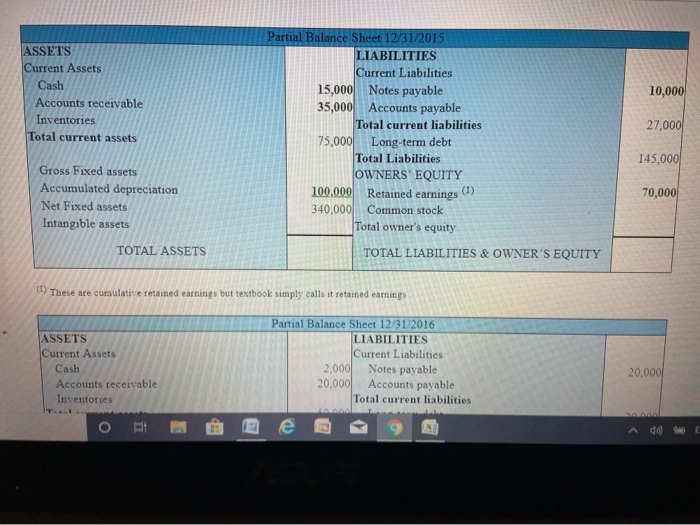

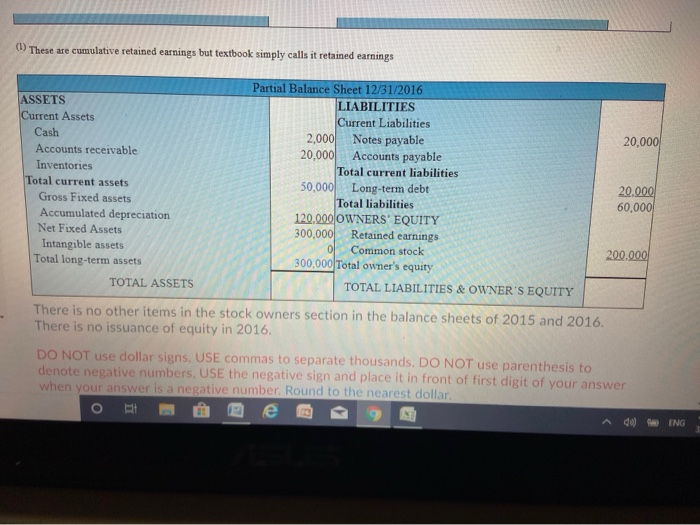

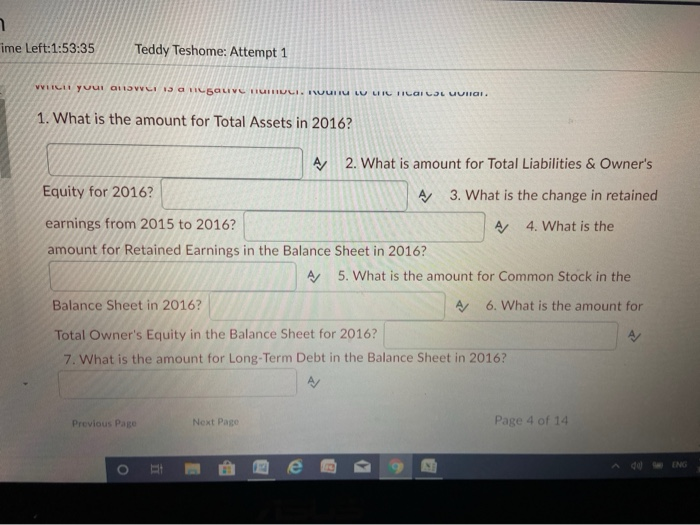

Li Iousanus, VUIUI use paiCHTLICSILU UCHULE HICEALIVE TUTUCIS, JL LIIC HCGalve Digii aliu place it in front of first digit of your answer when your answer is a negative number. Round to th nearest dollar. $500,000 58,000 25,334 Income Statement year ending 2016 Sales Revenues Cost of goods sold Fixed costs Selling, general, and administrative expenses Depreciation EBIT/ Interest expense Taxable Income Taxes Net Income 5,000 41,666 *** Tax rate Dividens paid 40% 5,000 ASSETS Current Assets Cash Accounts receivable Partial Balance Sheet 12/31/2015 LIABILITIES Current Liabilities 15,000 Notes payable 35,000 Accounts pavable 10,000 10,000 ASSETS Current Assets Cash Accounts receivable Inventories Total current assets 27,000 Partial Balance Sheet 12/31/2015 LIABILITIES Current Liabilities 15,000 Notes payable 35,000 Accounts payable Total current liabilities 75,000 Long-term debt Total Liabilities OWNERS' EQUITY 100,000 Retained earnings (1) 340,000 Common stock Total owner's equity TOTAL LIABILITIES & OWNER'S EQUITY 145,000 70,000 Gross Fixed assets Accumulated depreciation Net Fixed assets Intangible assets TOTAL ASSETS (1) These are cumulative retained earnings but textbook simply calls it retained earnings ASSETS Current Assets Cash Accounts receivable Inventories Partial Balance Sheet 12/31/2016 LIABILITIES Current Liabilities 2,000 Notes payable 20,000 Accounts payable Total current liabilities 20,000) (1) These are cumulative retained earnings but textbook simply calls it retained earnings Partial Balance Sheet 12/31/2016 ASSETS LIABILITIES Current Assets Current Liabilities Cash 2,000 Notes payable 20,000 Accounts receivable 20,000 Accounts payable Inventories Total current liabilities Total current assets 50,000 Long-term debt 20.000 Gross Fixed assets Total liabilities 60,000 Accumulated depreciation 120.000 OWNERS' EQUITY Net Fixed Assets 300,000 Retained earnings Intangible assets 0 Common stock 200.000 Total long-term assets 300,000 Total owner's equity TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY There is no other items in the stock owners section in the balance sheets of 2015 and 2016. There is no issuance of equity in 2016. DO NOT use dollar signs, USE commas to separate thousands. DO NOT use parenthesis to denote negative numbers, USE the negative sign and place it in front of first digit of your answer when your answer is a negative number. Round to the nearest dollar. 06 ENG 1 ime Left:1:53:35 /Teddy Teshome: Attempt 1 VILI yuuianSVCI 13 TILSALIVE TUINULI. INUUTTU LU LIL FILOILIL UUTIOI. 1. What is the amount for Total Assets in 2016? A 2. What is amount for Total Liabilities & Owner's Equity for 2016? A 3. What is the change in retained earnings from 2015 to 2016? A 4. What is the amount for Retained Earnings in the Balance Sheet in 2016? A 5. What is the amount for Common Stock in the Balance Sheet in 2016? A/ 6. What is the amount for Total Owner's Equity in the Balance Sheet for 2016? 7. What is the amount for Long-Term Debt in the Balance Sheet in 2016? Previous Page Next Page Page 4 of 14