Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lia plans to retire when she turns 70. Lia believes she needs $100,000 per year to live comfortably in her post-work life. She has

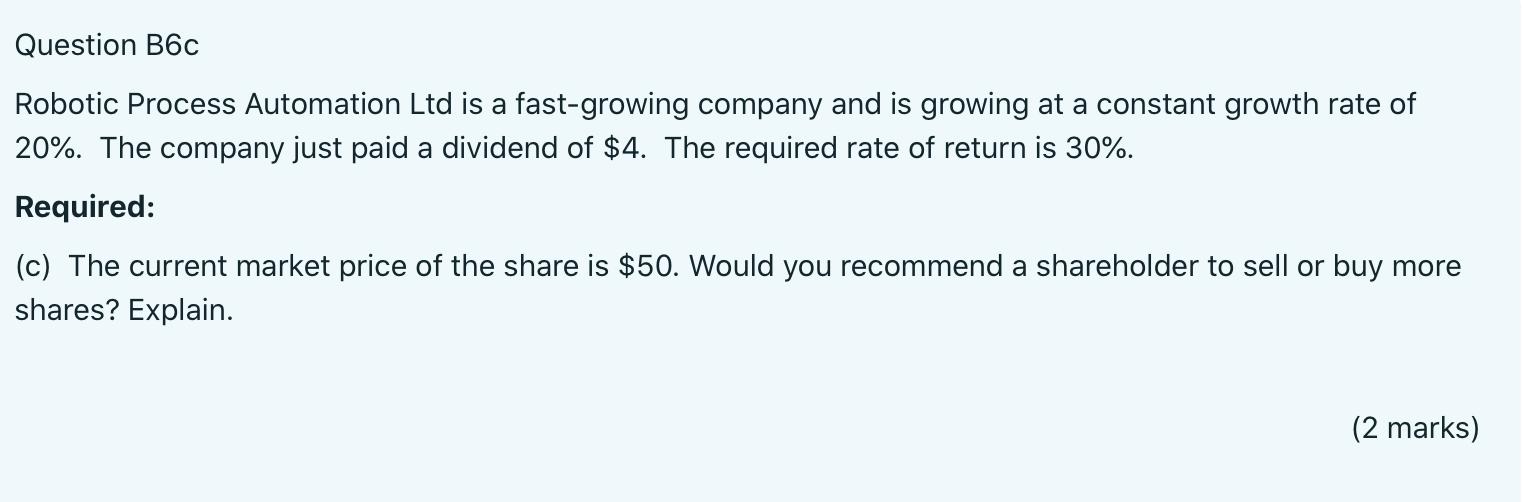

Lia plans to retire when she turns 70. Lia believes she needs $100,000 per year to live comfortably in her post-work life. She has two children and hope after she has passed away her children and heirs can receive the same amount forever. Required: (b) Lia is 30. She wants to use her superannuation funds to save for the retirement fund and payment for her heirs. The current superannuation balance is $50,000. What is the constant annual superannuation contribution Lia must make until retirement to satisfy the superannuation balance you have calculated in (a)? Use 8% as the rate of return on his superannuation fund. Question B6c Robotic Process Automation Ltd is a fast-growing company and is growing at a constant growth rate of 20%. The company just paid a dividend of $4. The required rate of return is 30%. Required: (c) The current market price of the share is $50. Would you recommend a shareholder to sell or buy more shares? Explain. (2 marks)

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

b To calculate the constant annual superannuation contribution Lia must make until retirement we need to determine the present value of the desired re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started