Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Liabilities & Stockholders' Equity Accounts payable Bank note payable Year 0007 $ 16,700 Year 0008 $ 12,500 4,900 3,600 Income tax payable 12,500 12,600

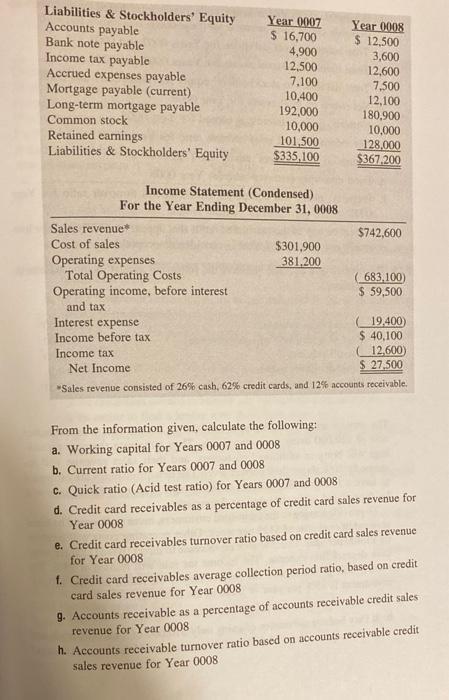

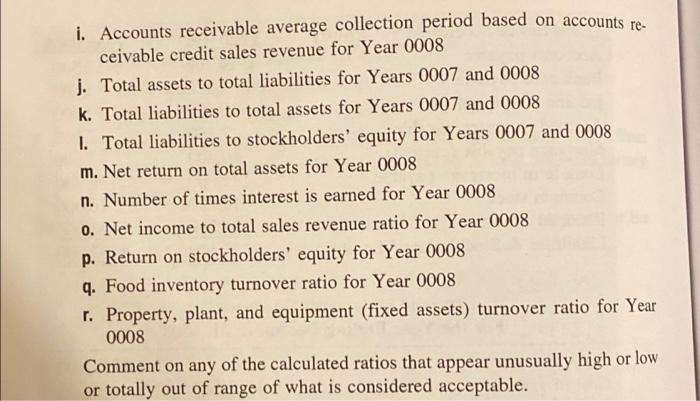

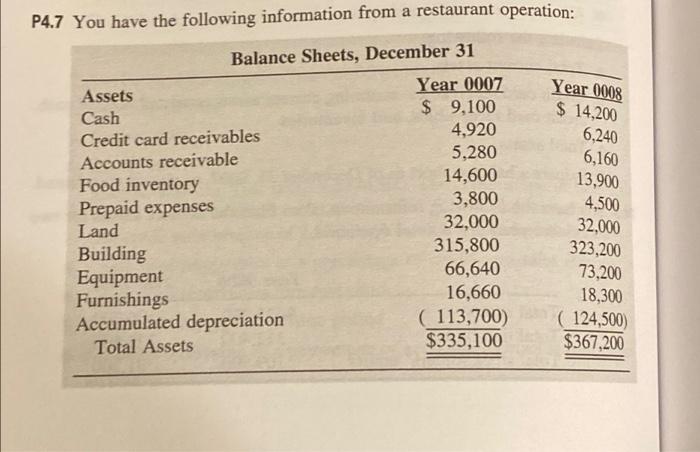

Liabilities & Stockholders' Equity Accounts payable Bank note payable Year 0007 $ 16,700 Year 0008 $ 12,500 4,900 3,600 Income tax payable 12,500 12,600 Accrued expenses payable 7.100 7,500 Mortgage payable (current) 10,400 12,100 Long-term mortgage payable 192,000 180,900 Common stock 10,000 10,000 Retained earnings 101,500 128,000 Liabilities & Stockholders' Equity $335,100 $367,200 Income Statement (Condensed) For the Year Ending December 31, 0008 Sales revenue* Cost of sales Operating expenses Total Operating Costs Operating income, before interest and tax Interest expense $742,600 $301,900 381,200 (683,100) $ 59,500 Income before tax Income tax Net Income 19.400) $ 40,100 (12,600) $ 27,500 "Sales revenue consisted of 26% cash, 62% credit cards, and 12% accounts receivable. From the information given, calculate the following: a. Working capital for Years 0007 and 0008 b. Current ratio for Years 0007 and 0008 c. Quick ratio (Acid test ratio) for Years 0007 and 0008 d. Credit card receivables as a percentage of credit card sales revenue for Year 0008 e. Credit card receivables turnover ratio based on credit card sales revenue for Year 0008 1. Credit card receivables average collection period ratio, based on credit card sales revenue for Year 0008 g. Accounts receivable as a percentage of accounts receivable credit sales revenue for Year 0008 h. Accounts receivable turnover ratio based on accounts receivable credit sales revenue for Year 0008

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started