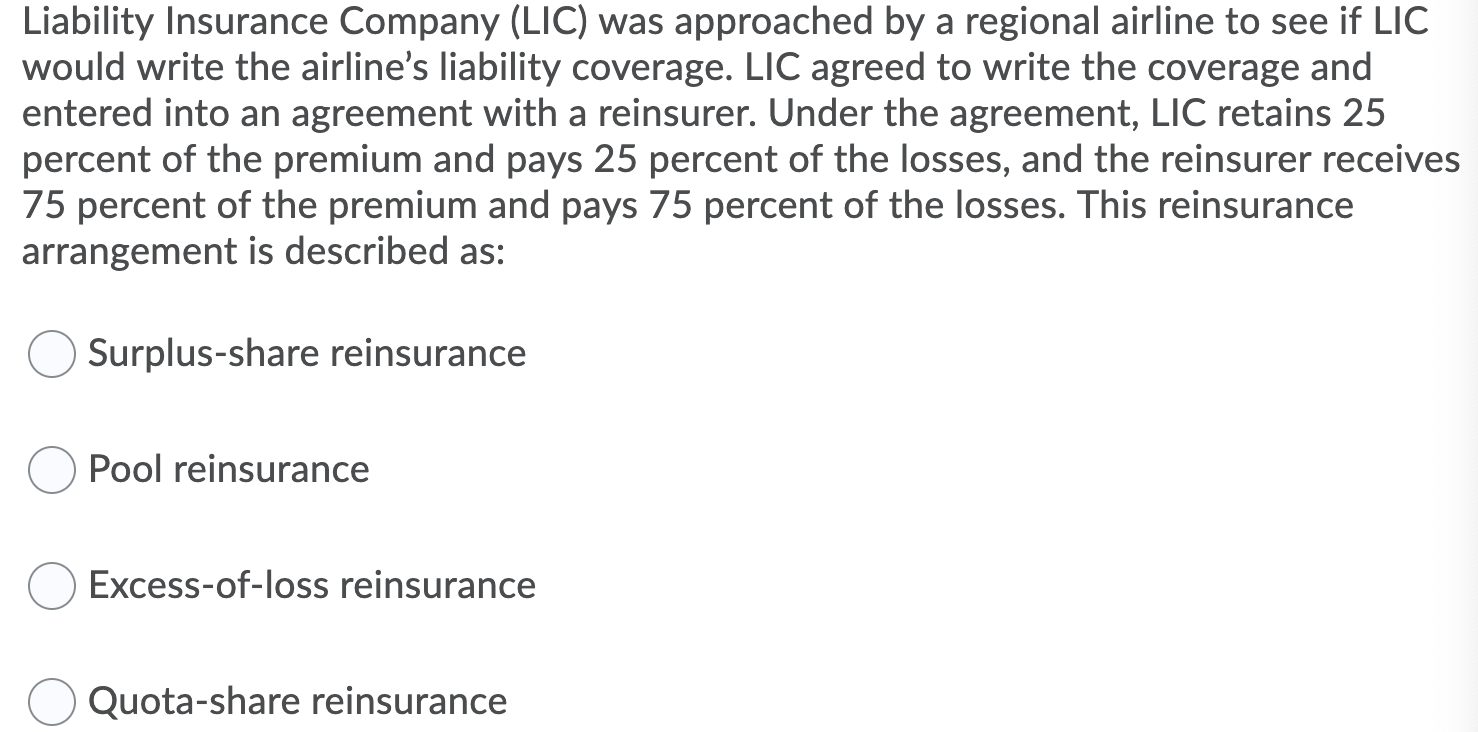

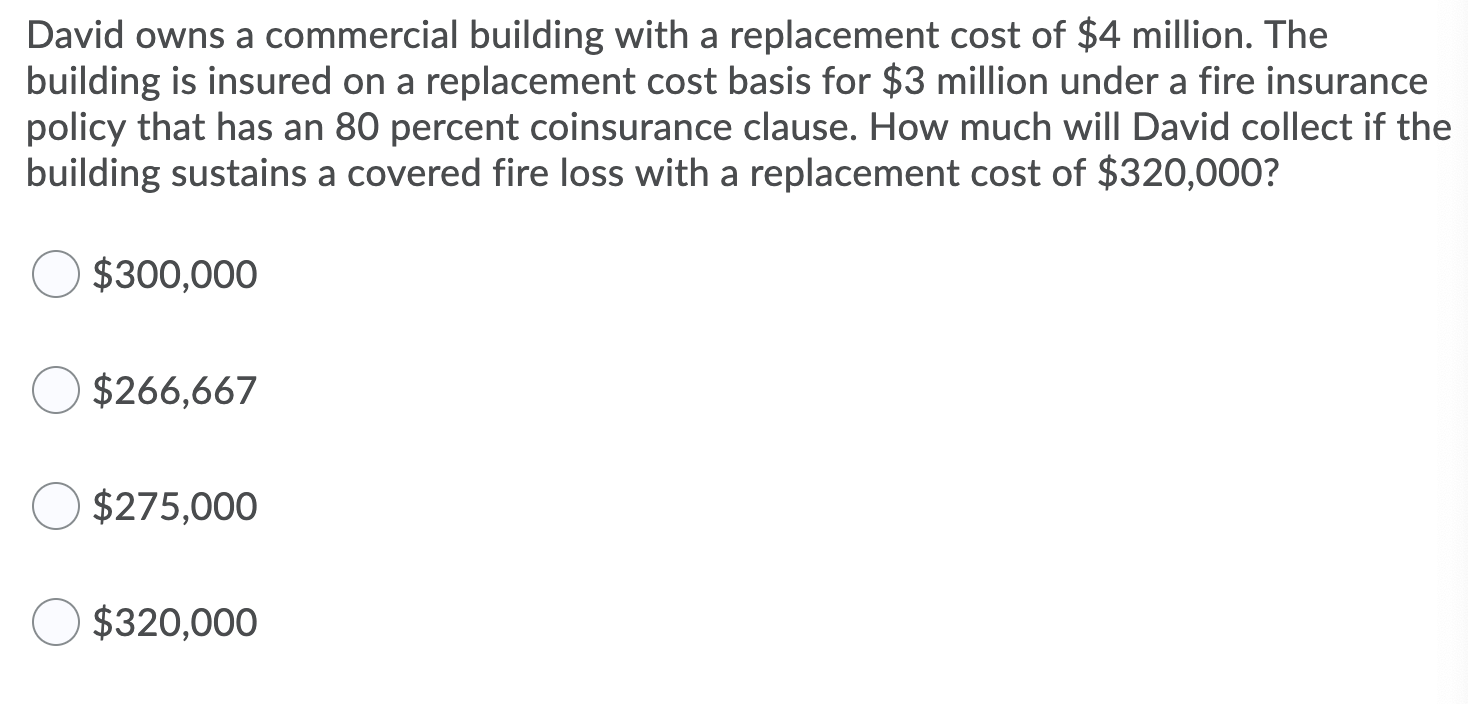

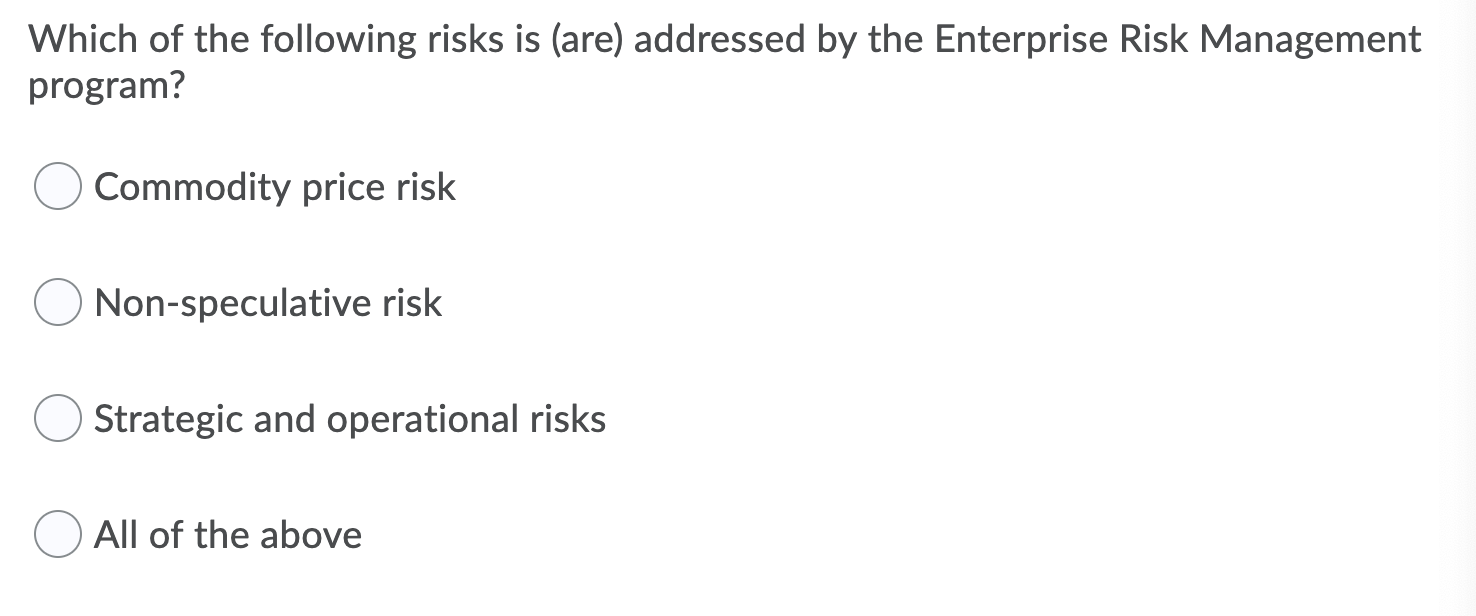

Liability Insurance Company (LIC) was approached by a regional airline to see if LIC would write the airline's liability coverage. LIC agreed to write the coverage and entered into an agreement with a reinsurer. Under the agreement, LIC retains 25 percent of the premium and pays 25 percent of the losses, and the reinsurer receives 75 percent of the premium and pays 75 percent of the losses. This reinsurance arrangement is described as: O Surplus-share reinsurance OPool reinsurance O Excess-of-loss reinsurance O Quota-share reinsurance David owns a commercial building with a replacement cost of $4 million. The building is insured on a replacement cost basis for $3 million under a fire insurance policy that has an 80 percent coinsurance clause. How much will David collect if the building sustains a covered fire loss with a replacement cost of $320,000? O $300,000 O $266,667 O $275,000 O $320,000 Which of the following risks is (are) addressed by the Enterprise Risk Management program? O Commodity price risk O Non-speculative risk O Strategic and operational risks O All of the above Liability Insurance Company (LIC) was approached by a regional airline to see if LIC would write the airline's liability coverage. LIC agreed to write the coverage and entered into an agreement with a reinsurer. Under the agreement, LIC retains 25 percent of the premium and pays 25 percent of the losses, and the reinsurer receives 75 percent of the premium and pays 75 percent of the losses. This reinsurance arrangement is described as: O Surplus-share reinsurance OPool reinsurance O Excess-of-loss reinsurance O Quota-share reinsurance David owns a commercial building with a replacement cost of $4 million. The building is insured on a replacement cost basis for $3 million under a fire insurance policy that has an 80 percent coinsurance clause. How much will David collect if the building sustains a covered fire loss with a replacement cost of $320,000? O $300,000 O $266,667 O $275,000 O $320,000 Which of the following risks is (are) addressed by the Enterprise Risk Management program? O Commodity price risk O Non-speculative risk O Strategic and operational risks O All of the above