No dividends declared by Theo AB during the year were paid. statements of Liam AB and Theo AB at December 31, 2014, are as

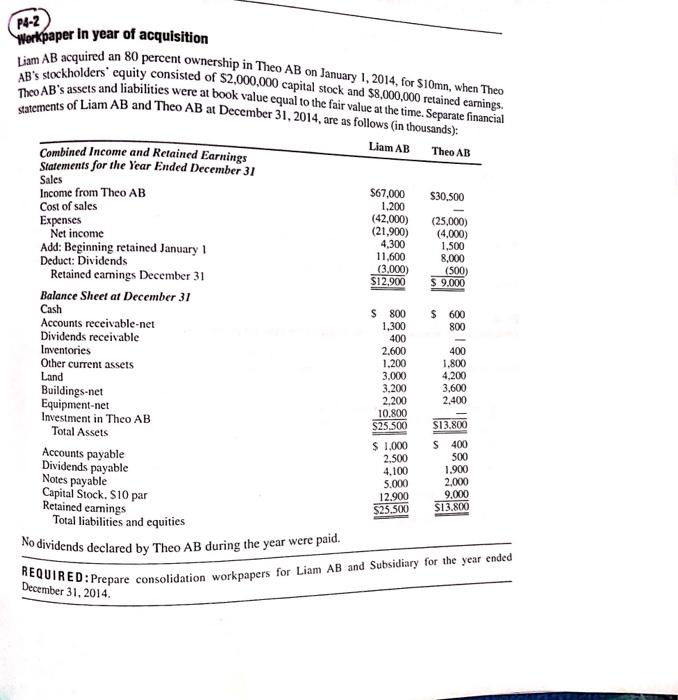

No dividends declared by Theo AB during the year were paid. statements of Liam AB and Theo AB at December 31, 2014, are as follows (in thousands): AB's stockholders' equity consisted of $2,000,000 capital stock and $8,000,000 retained earnings. Theo AB's assets and liabilities were at book value equal to the fair value at the time. Separate financial Liam AB acquired an 80 percent ownership in Theo AB on January 1, 2014, for S10mn, when Theo P4-2 Workpaper in year of acquisition on Liam AB Combined Income and Retained Earnings Statements for the Year Ended December 31 Theo AB Sales Income from Theo AB Cost of sales Expenses Net income Add: Beginning retained January 1 Deduct: Dividends Retained earmings December 31 $67,000 1,200 $30,500 (42,000) (21,900) 4,300 11,600 (3,000) S12.900 (25,000) (4,000) 1,500 8,000 (500) $ 9.000 Balance Sheet at December 31 Cash S 800 $ 600 Accounts receivable-net Dividends receivable Inventories 1,300 400 800 2.600 1,200 3,000 3,200 2,200 10.800 $25.500 Other current assets Land 400 1,800 4,200 3,600 Buildings-net Equipment-net Investment in Theo AB Total Assets 2,400 $13.800 Accounts payable Dividends payable Notes payable Capital Stock. S10 par Retained earnings Total liabilities and equities S 1,000 2.500 4,100 5.000 12.900 $25.500 S 400 500 1.900 2,000 9.000 $13.800 December 31, 2014.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Preliminary computations Purchase price for 80 interest acquired 10000000 Implied fair value of Theo ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started