Answered step by step

Verified Expert Solution

Question

1 Approved Answer

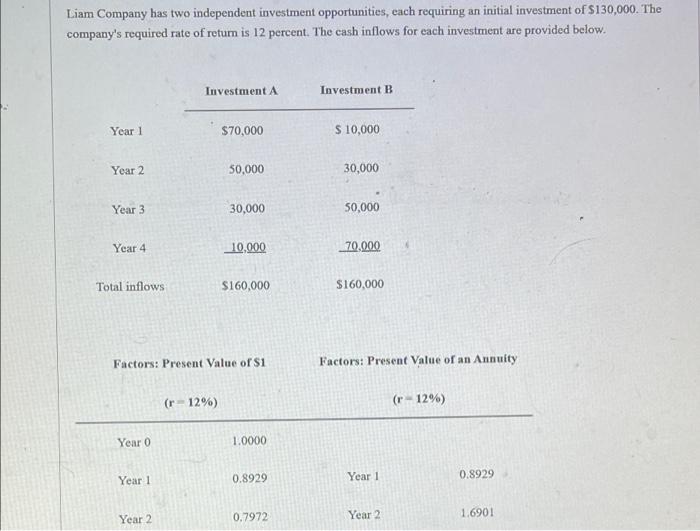

Liam Company has two independent investment opportunities, each requiring an initial investment of $130,000. The company's required rate of returm is 12 percent. The

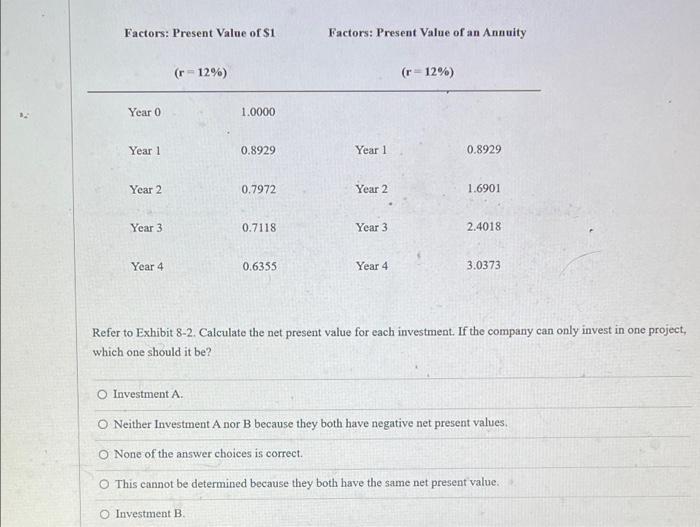

Liam Company has two independent investment opportunities, each requiring an initial investment of $130,000. The company's required rate of returm is 12 percent. The cash inflows for each investment are provided below. Investment A Investment B Year 1 $70,000 S 10,000 Year 2 50,000 30,000 Year 3 30,000 50,000 Year 4 10,000 70,000 Total inflows $160,000 $160,000 Factors: Present Value of S1 Factors: Present Value of an Annuity (r- 12%) (r- 12%) Year 0 1.0000 0.8929 Year 1 0.8929 Year 1 0.7972 Year 2 1.6901 Year 2 Factors: Present Value of $1 Factors: Present Value of an Annuity (r= 12%) (r= 12%) Year 0 1.0000 Year 1 0.8929 Year 1 0.8929 Year 2 0.7972 Year 2 1.6901 Year 3 0.7118 Year 3 2.4018 Year 4 0.6355 Year 4 3.0373 Refer to Exhibit 8-2. Calculate the net present value for each investment. If the company can only invest in one project, which one should it be? O Investment A. O Neither Investment A nor B because they both have negative net present values. O None of the answer choices is correct. O This cannot be determined because they both have the same net present value. O Investment B.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Investment A Year Cash inflows PV factor of 1 Pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started