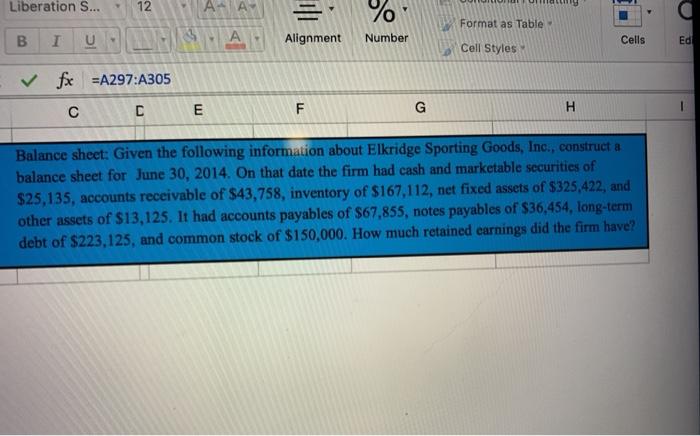

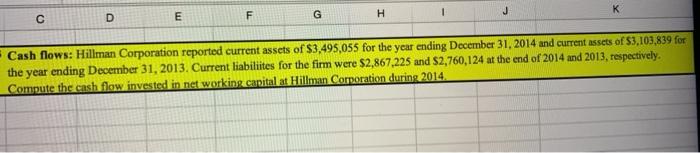

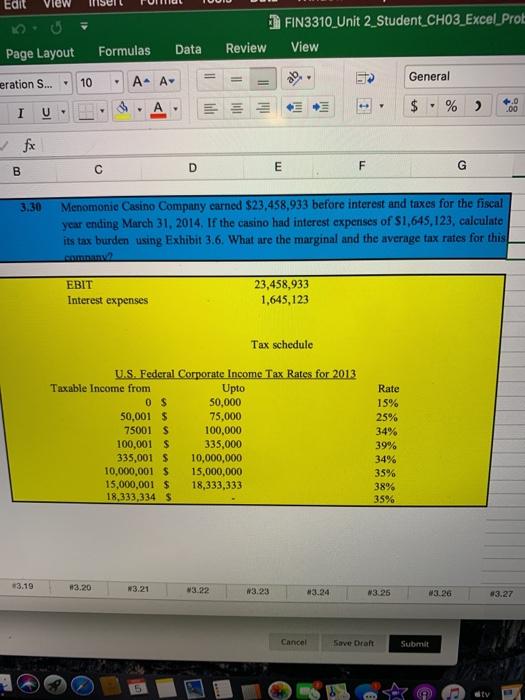

Liberation S... 12 % Format as Table B u Alignment Number Cells Ed Cell Styles fx =A297:A305 D E F H G Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125. It had accounts payables of $67,855, notes payables of $36,454, long-term debt of $223,125, and common stock of $150,000. How much retained earnings did the firm have? J K D H E F G - Cash flows: Hillman Corporation reported current assets of $3,495,055 for the year ending December 31, 2014 and current assets of 53,103,839 for the year ending December 31, 2013. Current liabiliites for the firm were $2,867,225 and $2,760,124 at the end of 2014 and 2013, respectively. Compute the cash flow invested in net working capital at Hillman Comparation during 2014, Cell Styles Lens 4 x fx =A297:A305 D mi F G H 24 Income statement: For its most recent fiscal year, Carmichael Hobby Shop recorded EBITDA of $512,725 20, EBIT of S362,450 zero interest expense, and cash flow to investors from operating activitiy of $348,461. 25. Assuming there are no non-cash revues recorded on the income statement what is the firm's net income after taxes2 Data Review View Formulas ert Page Layout 12 . % Liberation S... A Alignment Number B I U x fx =A297:A305 E D B 3.26 Cash flows: Refer to the information given in problem 3.21. What is the cash flow for Nimitz Rental? #3.26'! E18 eration S... 12 Format as Table 3 A Alignment Number I U Cell Styles fx =A297:A305 1 J E H D F G 3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retaine earnings of $323,325. During the year ended March 31, 2014, the company produced net income after taxes of $713,445 and paid out 45 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained carnings 9'!! Edit FIN3310_Unit 2_Student_CHO3_Excel Prot View Page Layout Formulas Data Review 10 eration S... General A- A+ A , $ % ) 200 B D F m G 3.30 Menomonie Casino Company carned $23,458,933 before interest and taxes for the fiscal year ending March 31, 2014. If the casino had interest expenses of S1,645,123, calculate its tax burden using Exhibit 3.6. What are the marginal and the average tax rates for this! EBIT Interest expenses 23,458,933 1,645,123 Tax schedule U.S. Federal Corporate Income Tax Rates for 2013 Taxable Income from Upto OS 50,000 50,001 $ 75,000 75001 $ 100,000 100,001 $ 335,000 335,001 S 10,000,000 10,000,001 S 15,000,000 15,000,001 $ 18,333,333 18,333,334 5 Rate 15% 25% 34% 39% 34% 35% 38% 35% 3.19 13.20 W3.21 W3.22 3.23 #3.24 3.25 w3.26 3.27 Cancel ve Draht Submit 5 V