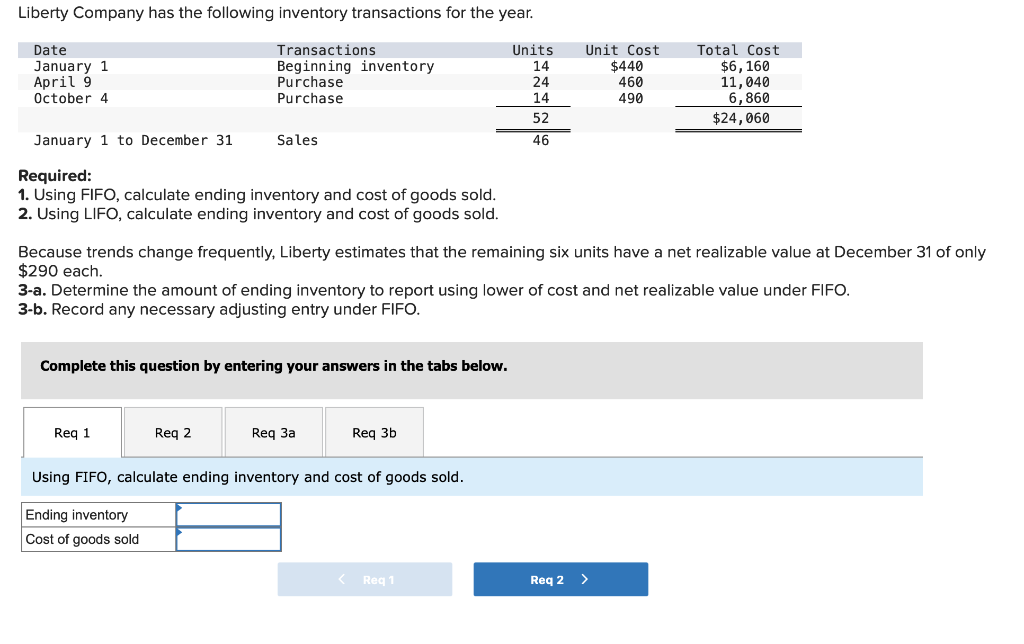

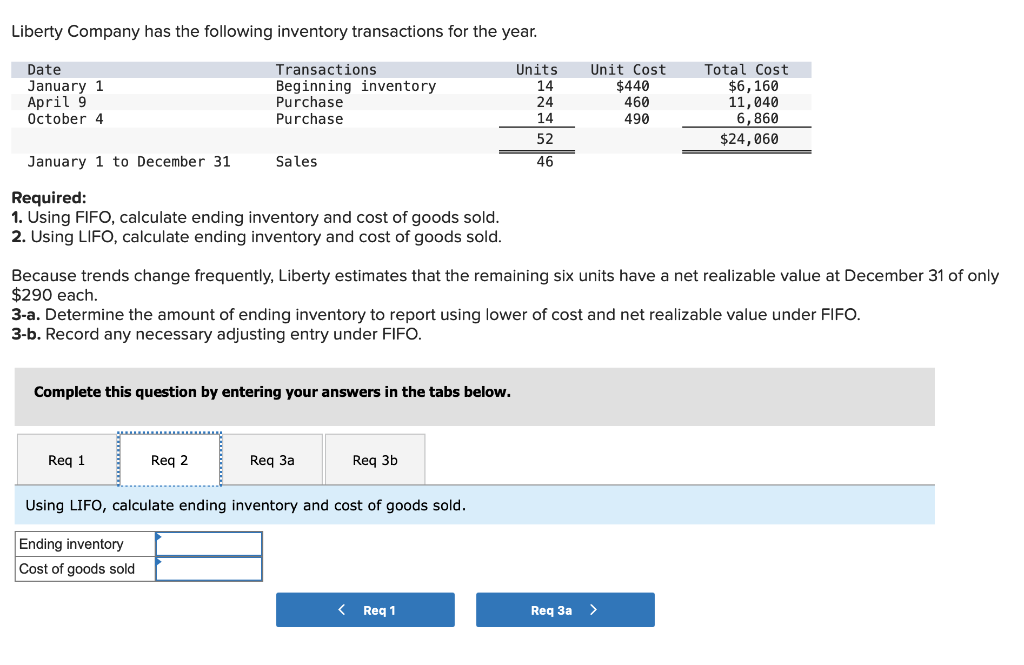

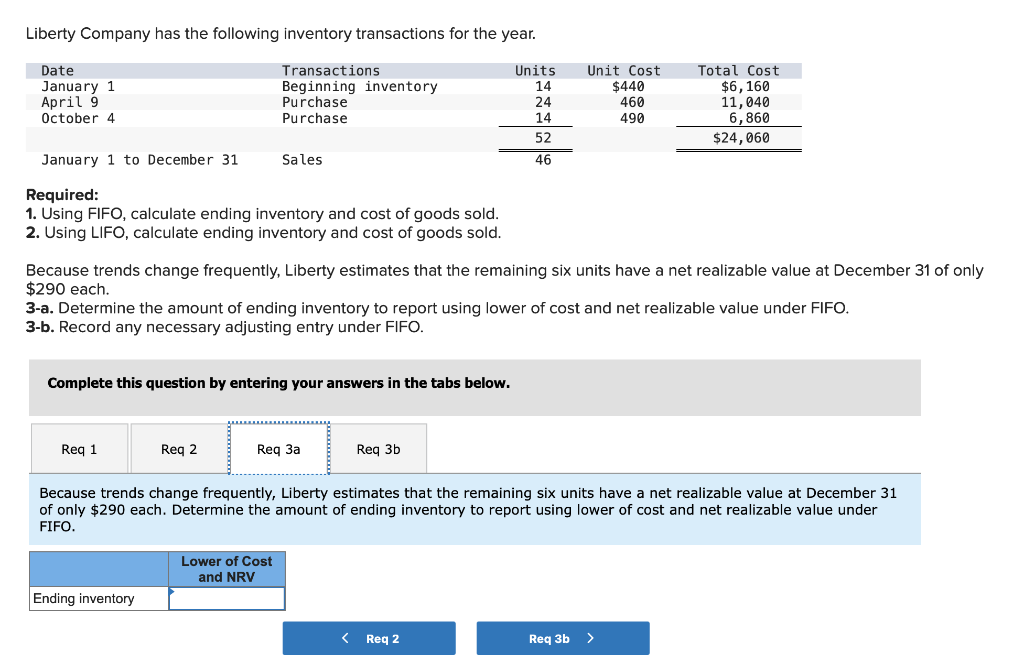

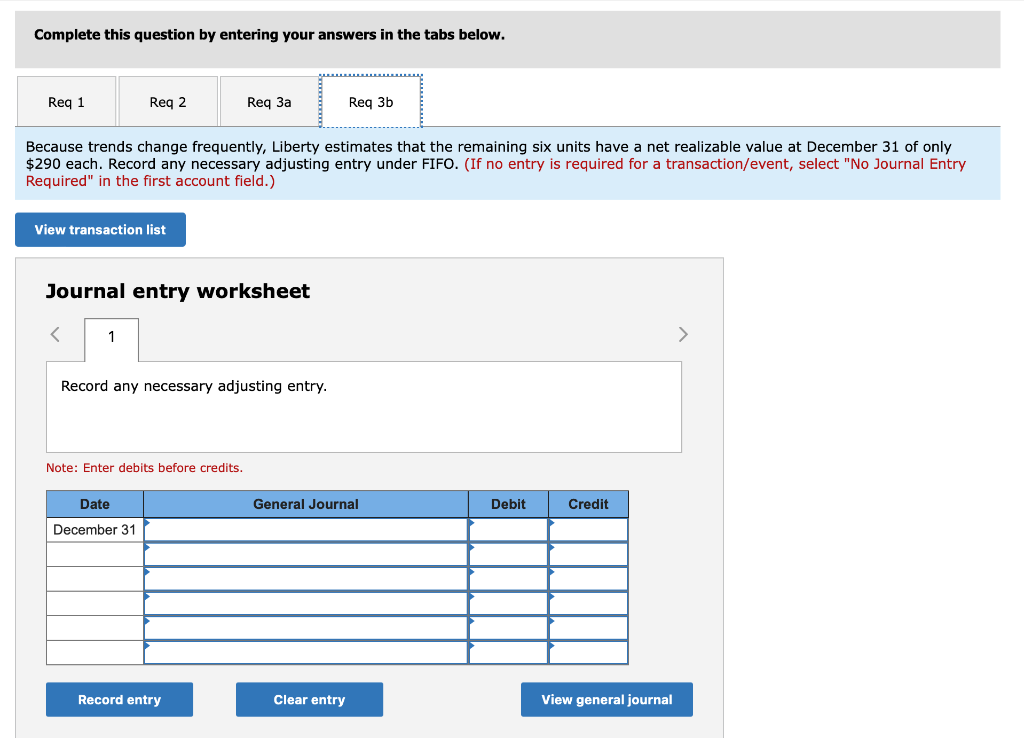

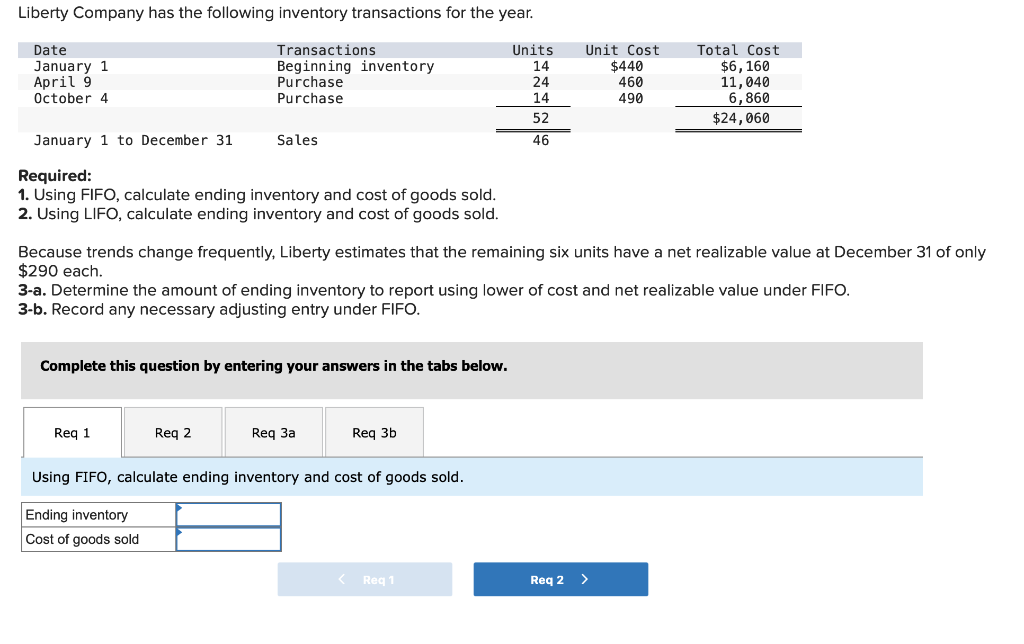

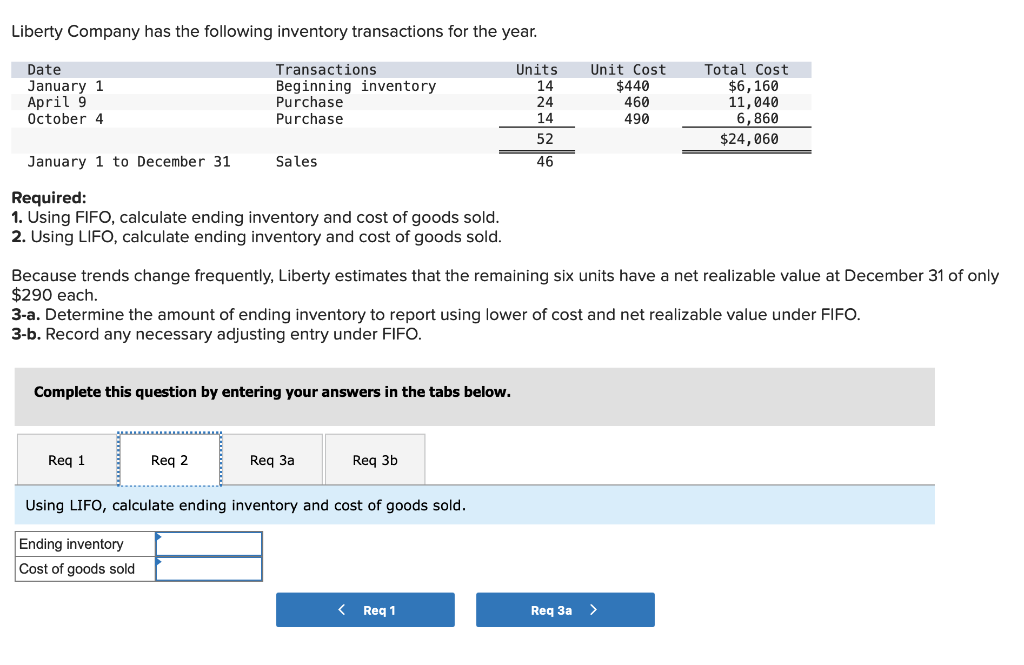

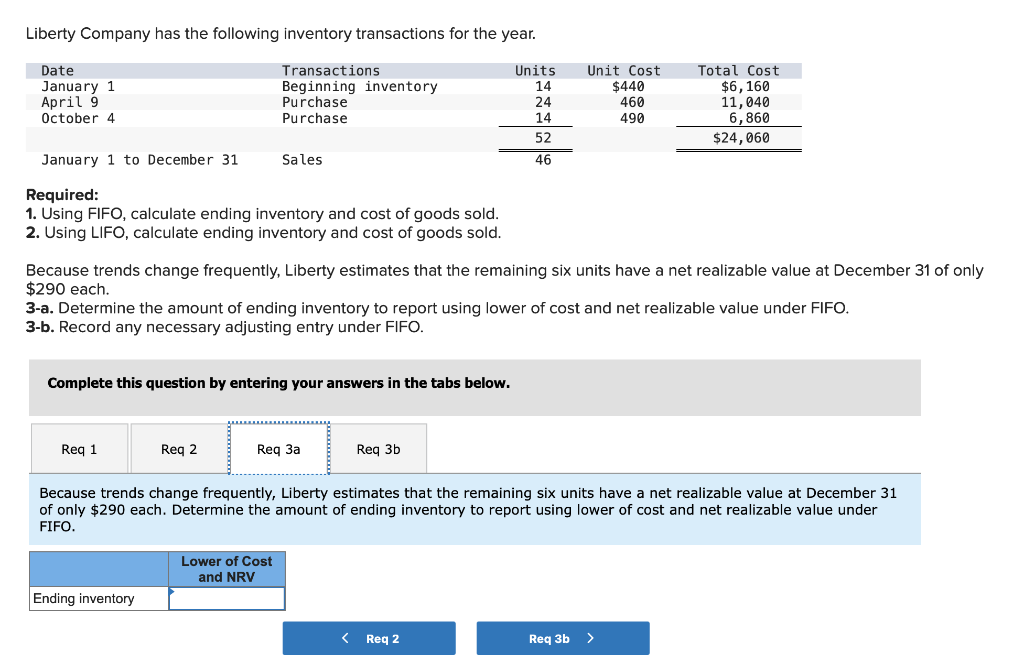

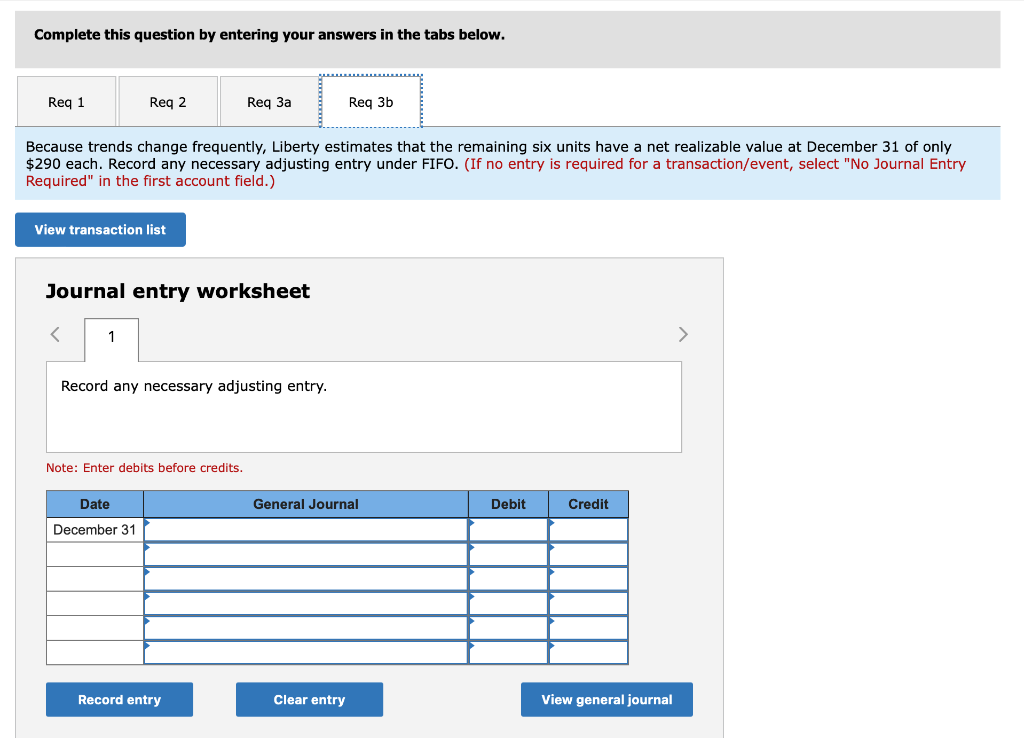

Liberty Company has the following inventory transactions for the year. Required: 1. Using FIFO, calculate ending inventory and cost of goods sold. 2. Using LIFO, calculate ending inventory and cost of goods sold. Because trends change frequently, Liberty estimates that the remaining six units have a net realizable value at December 31 of only $290 each. 3-a. Determine the amount of ending inventory to report using lower of cost and net realizable value under FIFO. 3-b. Record any necessary adjusting entry under FIFO. Complete this question by entering your answers in the tabs below. Using FIFO, calculate ending inventory and cost of goods sold. Liberty Company has the following inventory transactions for the year. Required: 1. Using FIFO, calculate ending inventory and cost of goods sold. 2. Using LIFO, calculate ending inventory and cost of goods sold. Because trends change frequently, Liberty estimates that the remaining six units have a net realizable value at December 31 of only $290 each. 3-a. Determine the amount of ending inventory to report using lower of cost and net realizable value under FIFO. 3-b. Record any necessary adjusting entry under FIFO. Complete this question by entering your answers in the tabs below. Using LIFO, calculate ending inventory and cost of goods sold. Liberty Company has the following inventory transactions for the year. Required: 1. Using FIFO, calculate ending inventory and cost of goods sold. 2. Using LIFO, calculate ending inventory and cost of goods sold. Because trends change frequently, Liberty estimates that the remaining six units have a net realizable value at December 31 of only $290 each. 3-a. Determine the amount of ending inventory to report using lower of cost and net realizable value under FIFO. 3-b. Record any necessary adjusting entry under FIFO. Complete this question by entering your answers in the tabs below. Because trends change frequently, Liberty estimates that the remaining six units have a net realizable value at December 31 of only $290 each. Determine the amount of ending inventory to report using lower of cost and net realizable value under FIFO. Complete this question by entering your answers in the tabs below. Because trends change frequently, Liberty estimates that the remaining six units have a net realizable value at December 31 of only $290 each. Record any necessary adjusting entry under FIFO. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record any necessary adjusting entry. Note: Enter debits before credits