Answered step by step

Verified Expert Solution

Question

1 Approved Answer

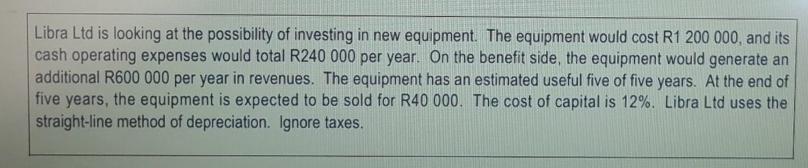

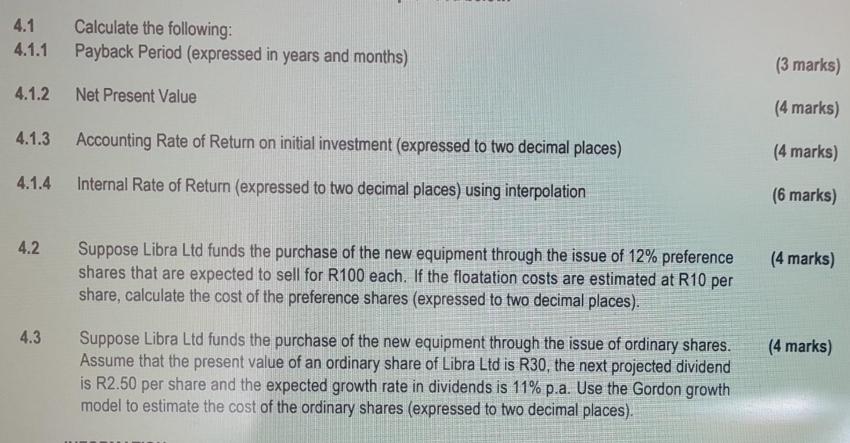

Libra Ltd is looking at the possibility of investing in new equipment. The equipment would cost R1 200 000, and its cash operating expenses

Libra Ltd is looking at the possibility of investing in new equipment. The equipment would cost R1 200 000, and its cash operating expenses would total R240 000 per year. On the benefit side, the equipment would generate an additional R600 000 per year in revenues. The equipment has an estimated useful five of five years. At the end of five years, the equipment is expected to be sold for R40 000. The cost of capital is 12%. Libra Ltd uses the straight-line method of depreciation. Ignore taxes. 4.1 Calculate the following: 4.1.2 Net Present Value 4.1.3 4.1.4 4.2 Payback Period (expressed in years and months) 4.3 Accounting Rate of Return on initial investment (expressed to two decimal places) Internal Rate of Return (expressed to two decimal places) using interpolation Suppose Libra Ltd funds the purchase of the new equipment through the issue of 12% preference shares that are expected to sell for R100 each. If the floatation costs are estimated at R10 per share, calculate the cost of the preference shares (expressed to two decimal places). Suppose Libra Ltd funds the purchase of the new equipment through the issue of ordinary shares. Assume that the present value of an ordinary share of Libra Ltd is R30, the next projected dividend is R2.50 per share and the expected growth rate in dividends is 11% p.a. Use the Gordon growth model to estimate the cost of the ordinary shares (expressed to two decimal places). (3 marks) (4 marks) (4 marks) (6 marks) (4 marks) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started