Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Life Contingencies 3. [14 marks] Sam, age 30, has just started working at their first full-time job, with a starting salary of $50,000. The company

Life Contingencies

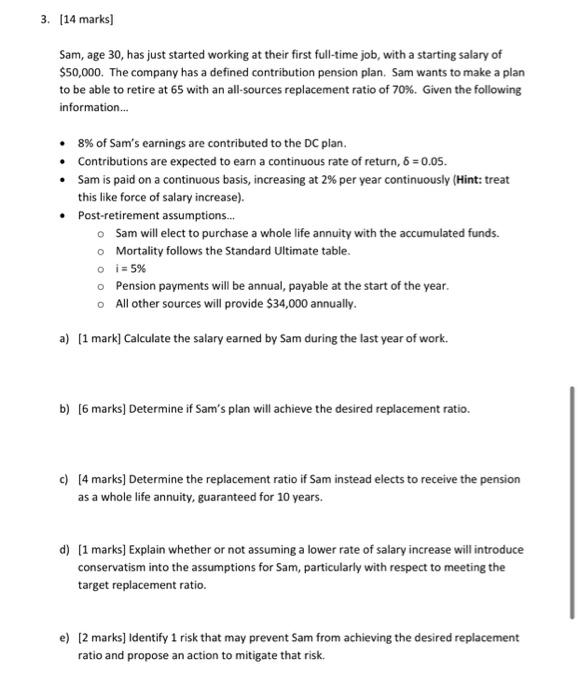

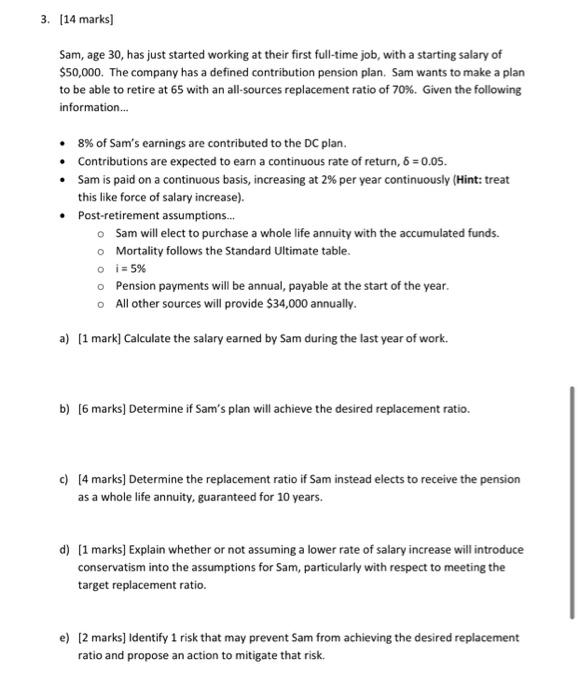

3. [14 marks] Sam, age 30, has just started working at their first full-time job, with a starting salary of $50,000. The company has a defined contribution pension plan. Sam wants to make a plan to be able to retire at 65 with an all-sources replacement ratio of 70%. Given the following information... .8% of Sam's earnings are contributed to the DC plan. Contributions are expected to earn a continuous rate of return, 6 = 0.05. Sam is paid on a continuous basis, increasing at 2% per year continuously (Hint: treat this like force of salary increase). Post-retirement assumptions... Sam will elect to purchase a whole life annuity with the accumulated funds. Mortality follows the Standard Ultimate table. O 1 = 5% Pension payments will be annual, payable at the start of the year. All other sources will provide $34,000 annually. a) (1 mark] Calculate the salary earned by Sam during the last year of work. b) [6 marks] Determine if Sam's plan will achieve the desired replacement ratio. c) [4 marks] Determine the replacement ratio if Sam instead elects to receive the pension as a whole life annuity, guaranteed for 10 years. d) (1 marks] Explain whether or not assuming a lower rate of salary increase will introduce conservatism into the assumptions for Sam, particularly with respect to meeting the target replacement ratio. e) (2 marks] Identify 1 risk that may prevent Sam from achieving the desired replacement ratio and propose an action to mitigate that risk. 3. [14 marks] Sam, age 30, has just started working at their first full-time job, with a starting salary of $50,000. The company has a defined contribution pension plan. Sam wants to make a plan to be able to retire at 65 with an all-sources replacement ratio of 70%. Given the following information... .8% of Sam's earnings are contributed to the DC plan. Contributions are expected to earn a continuous rate of return, 6 = 0.05. Sam is paid on a continuous basis, increasing at 2% per year continuously (Hint: treat this like force of salary increase). Post-retirement assumptions... Sam will elect to purchase a whole life annuity with the accumulated funds. Mortality follows the Standard Ultimate table. O 1 = 5% Pension payments will be annual, payable at the start of the year. All other sources will provide $34,000 annually. a) (1 mark] Calculate the salary earned by Sam during the last year of work. b) [6 marks] Determine if Sam's plan will achieve the desired replacement ratio. c) [4 marks] Determine the replacement ratio if Sam instead elects to receive the pension as a whole life annuity, guaranteed for 10 years. d) (1 marks] Explain whether or not assuming a lower rate of salary increase will introduce conservatism into the assumptions for Sam, particularly with respect to meeting the target replacement ratio. e) (2 marks] Identify 1 risk that may prevent Sam from achieving the desired replacement ratio and propose an action to mitigate that risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started