Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Life Event: THREE DIFFERENT INVESTMENTS . . WHICH ONE IS RIGHT FOR YOU? Assume that one year ago, you purchased a certificate of deposit (

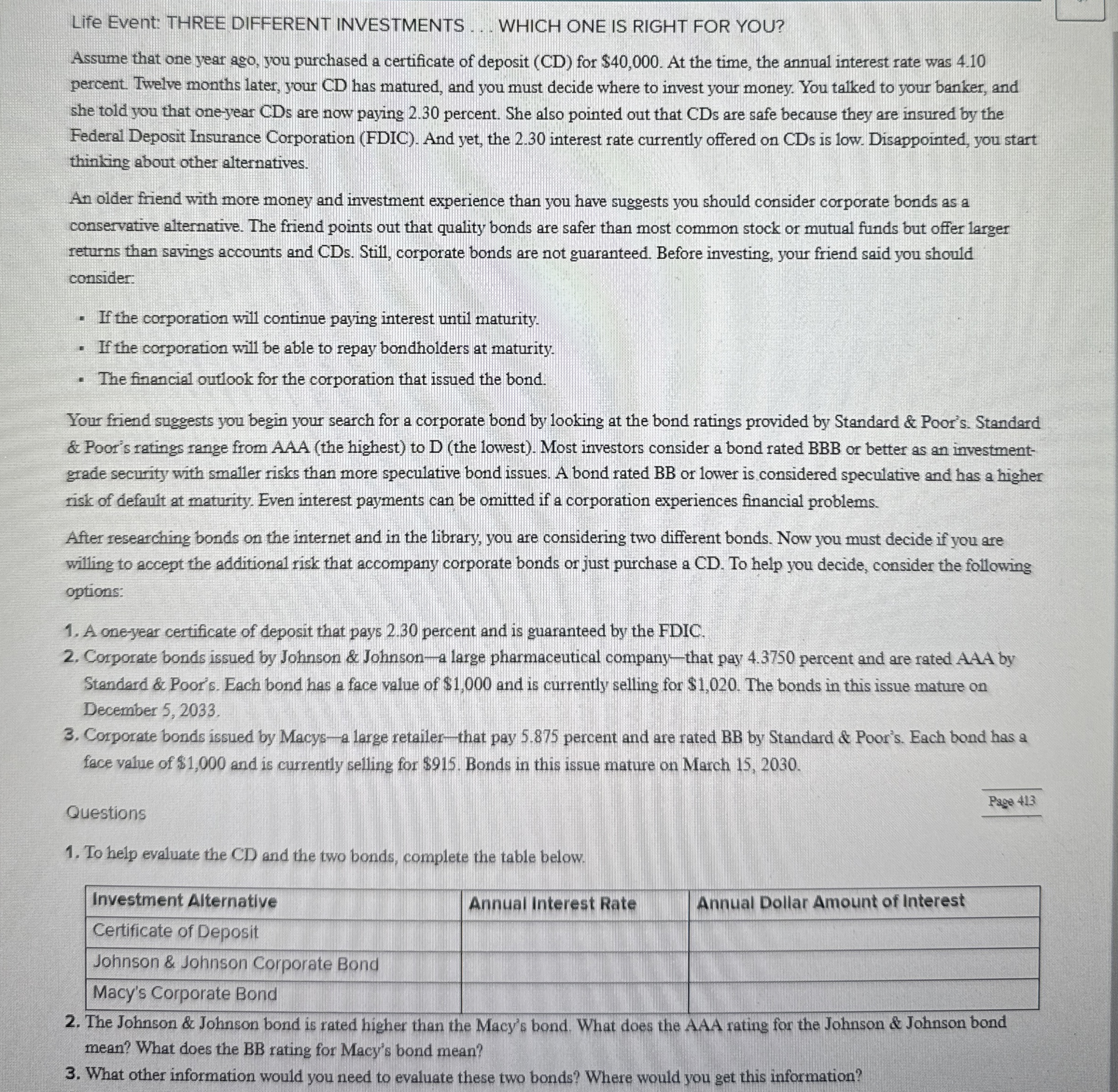

Life Event: THREE DIFFERENT INVESTMENTS WHICH ONE IS RIGHT FOR YOU?

Assume that one year ago, you purchased a certificate of deposit CD for $ At the time, the annual interest rate was percent. Twelve months later, your CD has matured, and you must decide where to invest your money. You talked to your banker, and she told you that oneyear CDs are now paying percent. She also pointed out that CDs are safe because they are insured by the Federal Deposit Insurance Corporation FDIC And yet, the interest rate currently offered on CDs is low. Disappointed, you start thinking about other alternatives.

An older friend with more money and investment experience than you have suggests you should consider corporate bonds as a conservative alternative. The friend points out that quality bonds are safer than most common stock or mutual funds but offer larger returns than savings accounts and CDs Still, corporate bonds are not guaranteed. Before investing, your friend said you should consider:

If the corporation will continue paying interest until maturity.

If the corporation will be able to repay bondholders at maturity.

The financial outlook for the corporation that issued the bond.

Your friend suggests you begin your search for a corporate bond by looking at the bond ratings provided by Standard & Poor's. Standard & Poor's ratings range from AAA the highest to D the lowest Most investors consider a bond rated BBB or better as an investmentgrade security with smaller risks than more speculative bond issues. A bond rated BB or lower is considered speculative and has a higher risk of default at maturity. Even interest payments can be omitted if a corporation experiences financial problems.

After researching bonds on the internet and in the library, you are considering two different bonds. Now you must decide if you are willing to accept the additional risk that accompany corporate bonds or just purchase a CD To help you decide, consider the following options:

A oneyear certificate of deposit that pays percent and is guaranteed by the FDIC.

Corporate bonds issued by Johnson & Johnsona large pharmaceutical companythat pay percent and are rated AAA by Standard & Poor's. Each bond has a face value of $ and is currently selling for $ The bonds in this issue mature on December

Corporate bonds issued by Macysa large retailerthat pay percent and are rated BB by Standard & Poor's. Each bond has a face value of $ and is currently selling for $ Bonds in this issue mature on March

Questions

Preg

To help evaluate the CD and the two bonds, complete the table below.

tableInvestment Alternative,Annual Interest Rate,Annual Dollar Amount of InterestCertificate of Deposit,,Johnson & Johnson Corporate Bond,,Macys Corporate Bond,,

The Johnson & Johnson bond is rated higher than the Macy's bond. What does the AAA rating for the Johnson & Johnson bond mean? What does the BB rating for Macy's bond mean?

What other information would you need to evaluate these two bonds? Where would you get this information?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started