Answered step by step

Verified Expert Solution

Question

1 Approved Answer

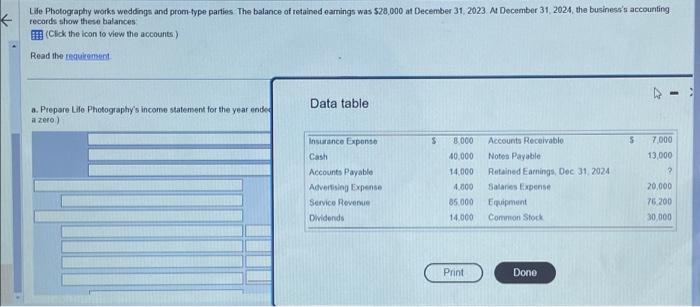

-- Life Photography works weddings and prom-type parties. The balance of retained earnings was $28,000 at December 31, 2023. At December 31, 2024, the business's

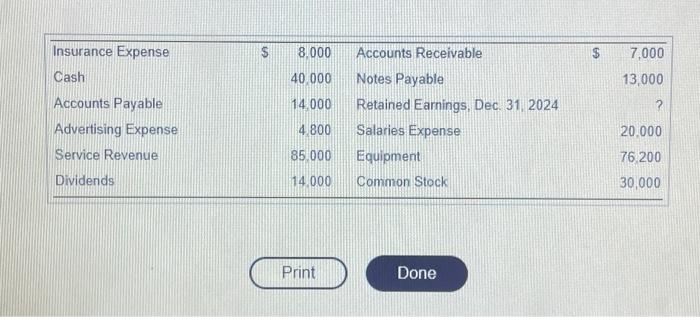

-- Life Photography works weddings and prom-type parties. The balance of retained earnings was $28,000 at December 31, 2023. At December 31, 2024, the business's accounting records show these balances: (Click the icon to view the accounts.) Read the requirement. a. Prepare Life Photography's income statement for the year ended a zero.) BE Data table Insurance Expense Cash Accounts Payable Advertising Expense Service Revenue Dividends $ 8.000 40,000 14.000 4,800 85,000 14,000 Print Accounts Receivable Notes Payable Retained Earnings, Dec. 31, 2024 Salaries Expense Equipment Common Stock Done $ 2 I 7,000 13,000 ? 20,000 76,200 30,000

I have posted all that was provided to me.

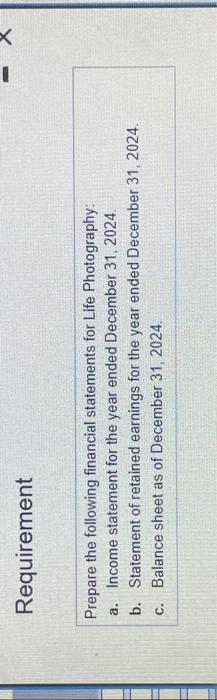

Lde Photography works weddings and promitype parties. The balance of retained oamings was $28.000 at December 31,2023 . At December 31 , 2024, the business's accounting records show these balances Ift (Clck the icon to view the accounts) Read the isquiciment a. Prepare Life Photography's incorme statement for the year endec Data table a zero) Read the requirement Life Photography works weddings and prom-type parties. The balance of retained earnings was $28,000 at December 31 , 2023 Al December 31 , 2024 , the business's accounting records show these balances (Clek the icon to view the accounts.) Read the requiremunt. a. Prepare Life Photography's income statement for the year ended December 31,2024 af a box is not used in the table leave the box emply, do not select a label or enter a zero) Print Done Net Income Requirement Prepare the following financial statements for Life Photography: a. Income statement for the year ended December 31, 2024. b. Statement of retained earnings for the year ended December 31, 2024 . c. Balance sheet as of December 31, 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started