Answered step by step

Verified Expert Solution

Question

1 Approved Answer

LIFO was designed to protect cash flow in industries where prices increase rapidly. It has been used for both tax and financial statement reporting

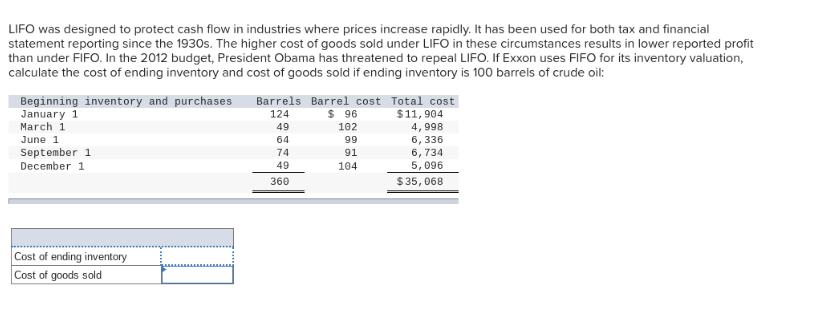

LIFO was designed to protect cash flow in industries where prices increase rapidly. It has been used for both tax and financial statement reporting since the 1930s. The higher cost of goods sold under LIFO in these circumstances results in lower reported profit than under FIFO. In the 2012 budget, President Obama has threatened to repeal LIFO. If Exxon uses FIFO for its inventory valuation, calculate the cost of ending inventory and cost of goods sold if ending inventory is 100 barrels of crude oil: Beginning inventory and purchases Barrels Barrel cost Total cost January 1 124 $ 96 49 102 March 1 June 1 64 99 74 91 September 1 December 1 49 104 360 Cost of ending inventory Cost of goods sold $11,904 4,998 6, 336 6,734 5,096 $35,068

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the cost of ending inventory and cost of goods sold using the FIFO FirstIn FirstOut met...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started