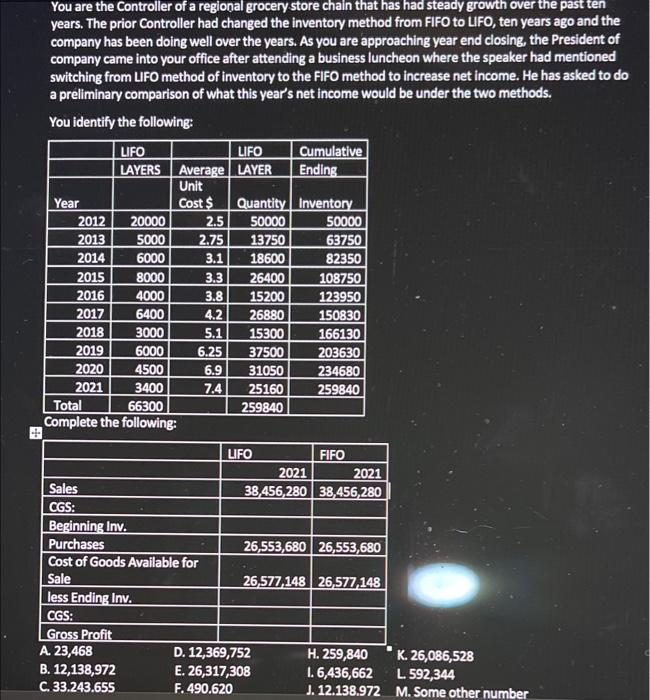

LIFO You are the Controller of a regional grocery store chain that has had steady growth over the past ten years. The prior Controller had changed the inventory method from FIFO to LIFO, ten years ago and the company has been doing well over the years. As you are approaching year end closing, the President of company came into your office after attending a business luncheon where the speaker had mentioned switching from LIFO method of inventory to the FIFO method to increase net income. He has asked to do a preliminary comparison of what this year's net income would be under the two methods. You identify the following: LIFO Cumulative LAYERS Average LAYER Ending Unit Year Cost $ Quantity Inventory 2012 20000 2.5 50000 50000 2013 5000 2.75 13750 63750 2014 6000 3.1 18600 82350 2015 8000 3.3 26400 108750 2016 4000 3.8 15200 123950 2017 6400 4.2 26880 150830 2018 3000 5.1 15300 166130 2019 6000 6.25 37500 203630 2020 4500 6.9 31050 234680 2021 3400 7.4 25160 259840 Total 66300 259840 Complete the following: LIFO FIFO 2021 2021 Sales 38,456,280 38,456,280 CGS: Beginning Inv. Purchases 26,553,680 26,553,680 Cost of Goods Available for Sale 26,577,148 26,577,148 less Ending Inv. CGS: Gross Profit A. 23,468 D. 12,369,752 H. 259,840 K. 26,086,528 B. 12,138,972 E. 26,317,308 1.6,436,662 L. 592,344 C. 33.243.655 F.490.620 J. 12.138.972 M. Some other number LIFO You are the Controller of a regional grocery store chain that has had steady growth over the past ten years. The prior Controller had changed the inventory method from FIFO to LIFO, ten years ago and the company has been doing well over the years. As you are approaching year end closing, the President of company came into your office after attending a business luncheon where the speaker had mentioned switching from LIFO method of inventory to the FIFO method to increase net income. He has asked to do a preliminary comparison of what this year's net income would be under the two methods. You identify the following: LIFO Cumulative LAYERS Average LAYER Ending Unit Year Cost $ Quantity Inventory 2012 20000 2.5 50000 50000 2013 5000 2.75 13750 63750 2014 6000 3.1 18600 82350 2015 8000 3.3 26400 108750 2016 4000 3.8 15200 123950 2017 6400 4.2 26880 150830 2018 3000 5.1 15300 166130 2019 6000 6.25 37500 203630 2020 4500 6.9 31050 234680 2021 3400 7.4 25160 259840 Total 66300 259840 Complete the following: LIFO FIFO 2021 2021 Sales 38,456,280 38,456,280 CGS: Beginning Inv. Purchases 26,553,680 26,553,680 Cost of Goods Available for Sale 26,577,148 26,577,148 less Ending Inv. CGS: Gross Profit A. 23,468 D. 12,369,752 H. 259,840 K. 26,086,528 B. 12,138,972 E. 26,317,308 1.6,436,662 L. 592,344 C. 33.243.655 F.490.620 J. 12.138.972 M. Some other number