Question

Ligaya is engaged in business both subject to VAT and non-VAT and has the following transactions during the month: a. Cash purchase of goods

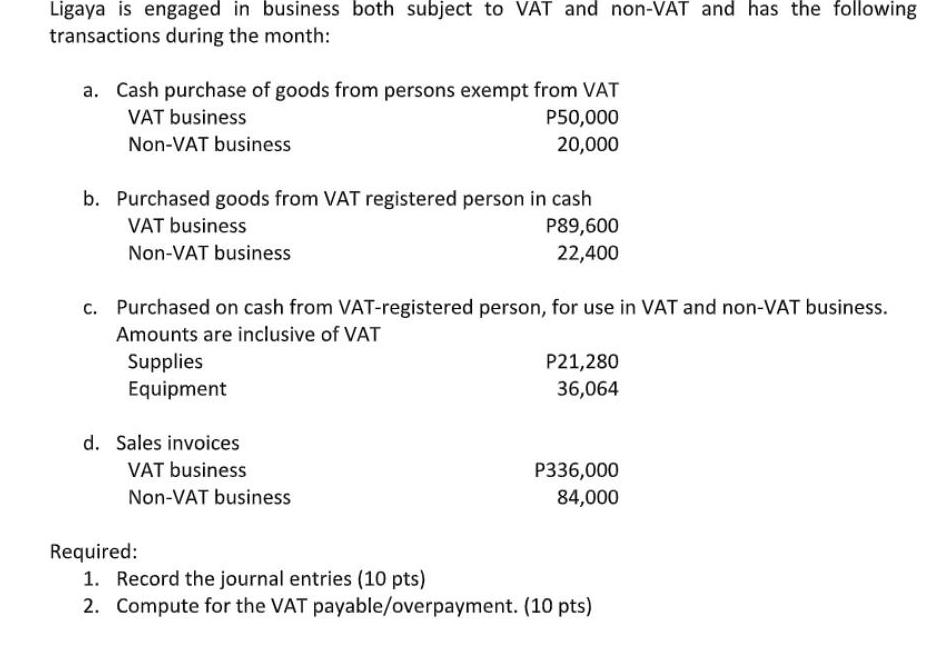

Ligaya is engaged in business both subject to VAT and non-VAT and has the following transactions during the month: a. Cash purchase of goods from persons exempt from VAT VAT business Non-VAT business b. Purchased goods from VAT registered person in cash VAT business P89,600 22,400 Non-VAT business P50,000 20,000 c. Purchased on cash from VAT-registered person, for use in VAT and non-VAT business. Amounts are inclusive of VAT Supplies Equipment d. Sales invoices VAT business Non-VAT business P21,280 36,064 P336,000 84,000 Required: 1. Record the journal entries (10 pts) 2. Compute for the VAT payable/overpayment. (10 pts)

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 VAT rate is considered to be 12 a Purchase ac Dr P70...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App