Question

Lightpoint, Inc. is a computer software company that seeks debt financing in order to support its growth initiatives. As a relatively new firm, Lightpoint has

Lightpoint, Inc. is a computer software company that seeks debt financing in order to support its growth initiatives. As a relatively new firm, Lightpoint has generated scant profits, and produced meager cash flows from operations to date. Sharon Light, the firms founder and CEO, charged her Chief Financial Officer (CFO), Richard McManus, with securing debt financing that the firm can service with its income level and cash flows. Working with Lightpoints investment banker, McManus thought he found a potential solution to the problem. McManus agreed with the investment banker that the concept of floating zero-percent or deep-discount bonds deserved serious consideration.

Befitting its name, zero-percent (or deep-discount) bonds do not pay interest periodically, unlike conventional term bonds. Zero-percent bonds operate in the following manner:

The firm receives the amount of cash needed when it issues the bonds. Those cash receipts equal the present value of the amount it must repay upon maturity.

It does not pay interest periodically, such as every year, to the bondholders in such an arrangement.

The current market rate of interest determines the difference between the future value of money and its present value. (This difference is the amount of the bond discount, or the time value of money.)

Zero-percent and other deeply discounted bonds usually increase the borrowers cost of financing because all of the cash payments are loaded at the back-end of the bond contract. Consequently, investors demand a higher return on their investment for under- taking a greater degree of risk in such arrangements.

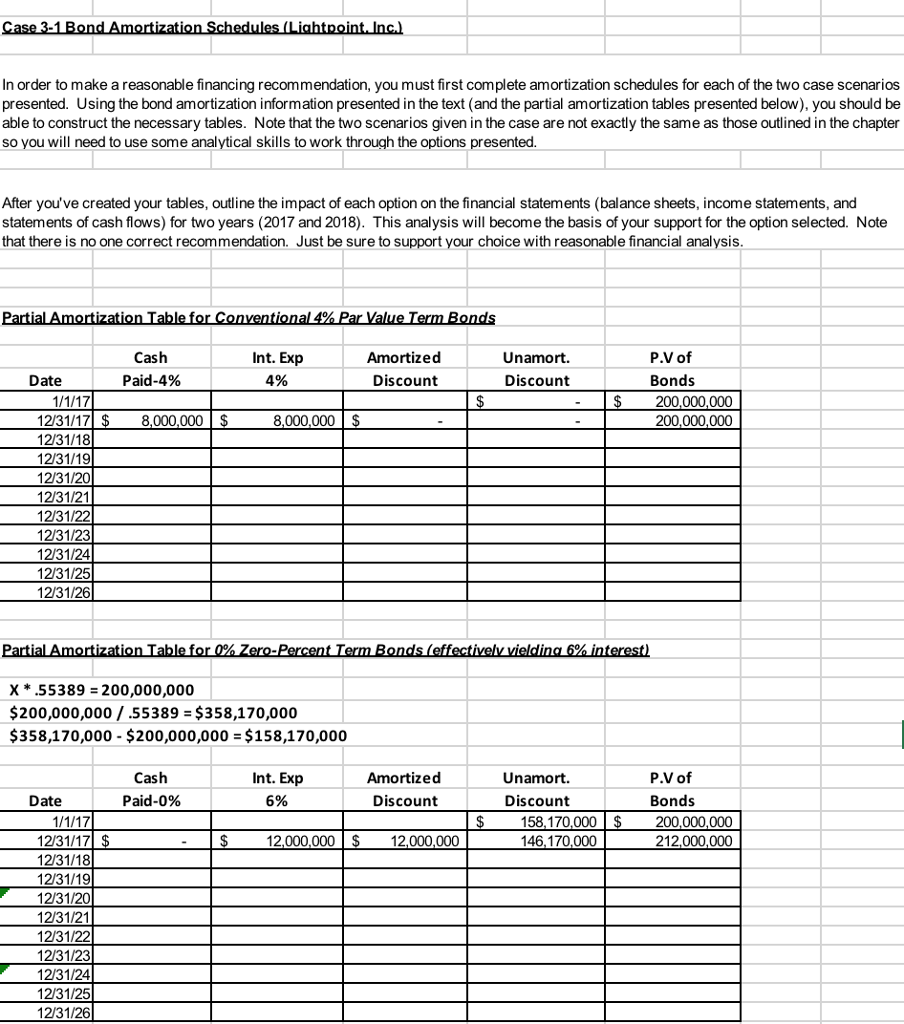

CFO McManus identified two financing avenues by which Lightpoint could raise the $200 million in capital it needs on January 1, 2017. The firm could float ten-year bonds that mature on December 31, 2026 in one of two ways:

1. Conventional 4% term bonds that pay interest annually on December 31.

2. Zero-percent term bonds.

Lightpoints investment banker informs McManus that the zero-percent bonds would carry a risk adjustment of two percentage points, making their effective interest rate 6% annually. The investment bank also informs McManus that it can place the bonds with a private investor. Such a private placement would mean that Lightpoint could forego the time and expense normally associated with a public bond offering. The upshot of the private placement is that Lightpoint will not incur any material transaction costs.

The stated interest rate of the bonds (whether the 4% conventional bonds, or the 6% zero-coupon bonds) will equal the market rate on the date of issue. Consequently, the only discount associated with the bonds would relate to the additional two percent- age points associated with the zero-percent bonds. If Lightpoint opted to issue the conventional 4% bond, it would do so at par value. The company would receive $200 million upon issue of the par value bonds, and repay $200 million in ten years. Lightpoint would make a 4% cash payment annually, which would equal the annual accrued interest expense of $8 million under a par-value financing. If Lightpoint issued the zero-coupon bonds it would not have to pay any annual interest, but it would have to pay the future value of the $200 million borrowed on January 1, 2017.

In considering his two financing alternatives, McManus estimates that Lightpoint will generate a little over $6 million annually in excess liquidity in the near term. As McManus embarks on running the numbers for the alternatives, he gathers the following time value of money factors for ten time periods:

| 4% | 6% | |

| Future value of 1 (lump sum) | 1.48024 | 1.79085 |

| Present value of 1 (lump sum) | .67556 | .55839 |

| Future value of an annuity | 12.00611 | 13.18079 |

| Present value of an annuity | 8.11090 | 7.36009 |

One final factor that McManus considers is that the firms lack of profitability has mitigated its income tax exposure. Consequently, income taxes will not affect his calculations or recommendation.

Required: Cast yourself in the role of Richard McManus. Make a financing recommendation to Sharon Light in a memo. Be sure to discuss the financial implications of each alternative on the income statements and balance sheets for 2017 and 2018 in your memo. You must attach an Excel spreadsheet(s) that contains calculations for the full ten years under each financing arrangement in order to support your financial statement implications for the next two years and your recommendations contained in the memo.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started