Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Like instructed just show the equation on how to get the debt ratio, net profit margin, and the return on equity. Plesse do that for

Like instructed just show the equation on how to get the debt ratio, net profit margin, and the return on equity. Plesse do that for all 3 quarters which are separated by the date. Thank You!

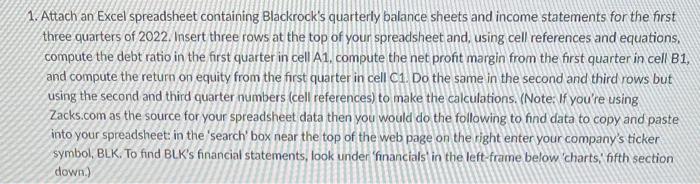

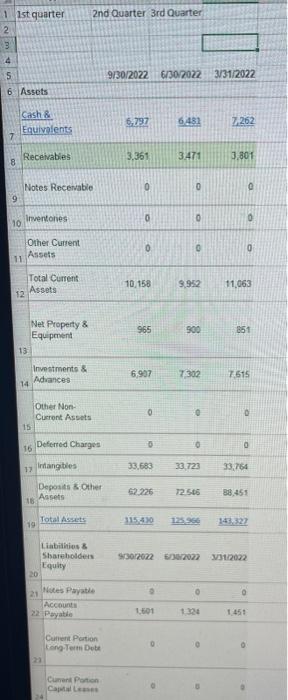

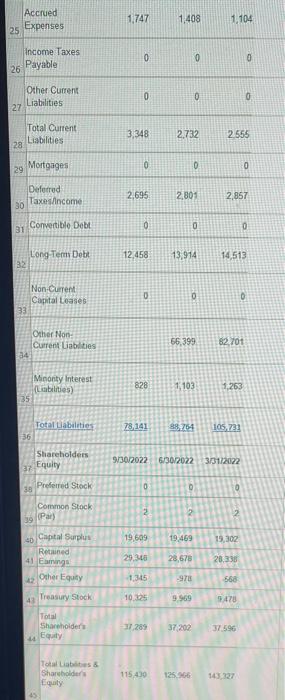

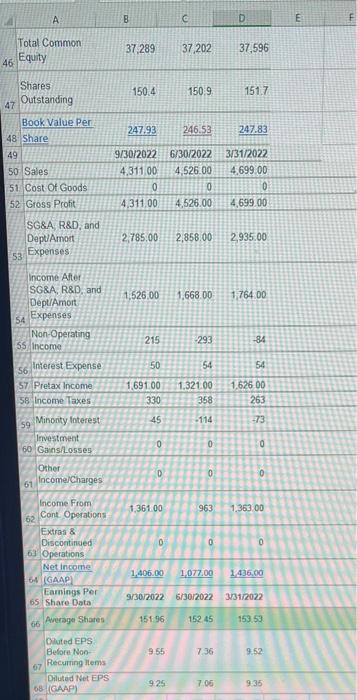

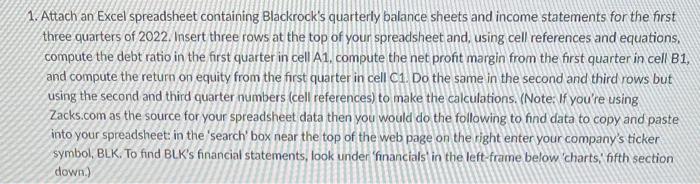

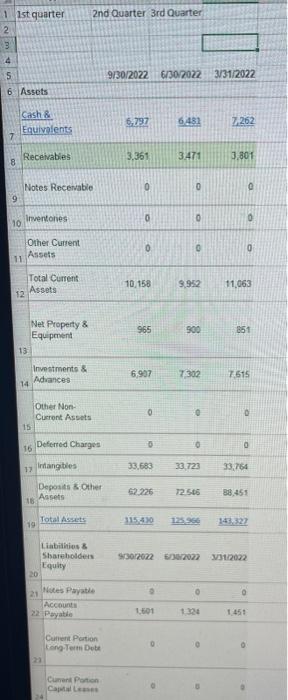

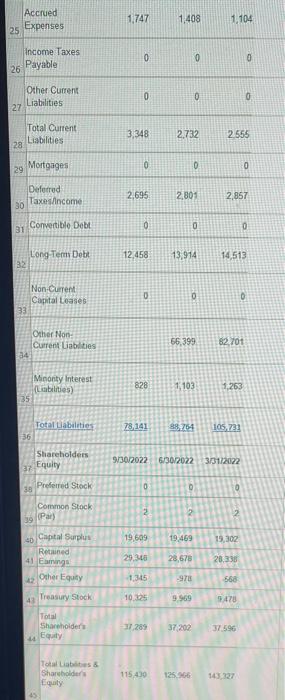

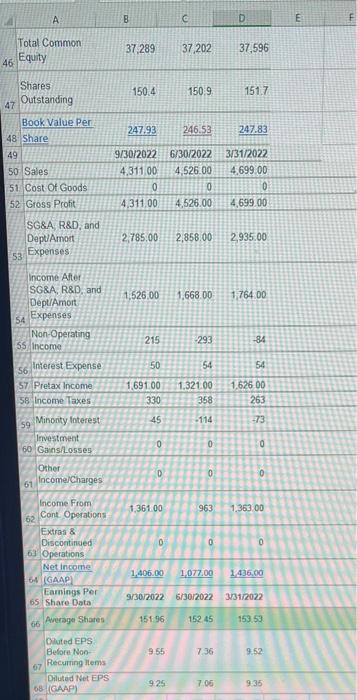

1. Attach an Excel spreadsheet containing Blackrockss quarterly balance sheets and income statements for the first three quarters of 2022 . Insert three rows at the top of your spreadsheet and, using cell references and equations. compute the debt ratio in the first quarter in cell A1, compute the net profit margin from the first quarter in cell B1, and compute the return on equity from the first quarter in cell c1. Do the same in the second and third rows but using the second and third quarter numbers (cell references) to make the calculations. (Note: If you're using Zacks.com as the source for your spreadsheet data then you would do the following to find data to copy and paste into your spreadsheet: in the 'search' box near the top of the web page on the right enter your company's ticker symbol, BLK, To find BLK's financial statements, look under 'financials' in the left frame below, charts, fifth section down.) Ist quarter 2nd Quarter 3rd Quarter 9130/2022613070223/31/2022 Assots Cash 8 Equivalents 16.797 64817,262 7 8 Receivabies 3.3613.471 3.,001 Notes Recenable \begin{tabular}{ll|l} 0 & 0 \end{tabular} 9 10 invertonies 0 0 0 Other Cument 11 Assets 0 0 0 Total Current 12 Assets 10,1569,95211,063 Net Property 8 Equipment 965900851 13. Investroents 8 14 Adrances 6,9977,3027,515 Other Non- Curront Assets =0 0 15. 16 Deferred Charges 5 0 Deponts 5 Other 6220612.545=88,455 Aasets Liabiahies 8 Equity Nistes Payatie Account Peyatie Cument Pution Feng-Tem Dote Curnen Potion Capalal Leasi Accrued Expenses 1,747 1,408 1.104 Income Taxes Payable Other Current Liabilities 0 0 0 Total Current Liabilities 3.3482.7322.555 Mortgages 0 0 0 Deforred 30 Taxesilincome: 2,6952,8012,857 31 Convertible Debt 0 0 0 LongTembebt12,45813.91414,513 32 Non-curtent Capital toases 0 D. 0 Other Non- Current Liablties 66,39982,10t 34 Minonty Interest (Listainties) 828:1,103=1,263 Preferred Stock. Common Stock 39 (Par) 2. 2(13):2 Total Sharehoider: 37,26937,20237,596 Equaty. Total Lablities 8 . Shareboidit Equaty: Total Common Equity 37,28937,20237,596 Shares 150.4150.91517 Outstanding Book Value Per 48 Share \begin{tabular}{|rrrrr} 499 & 9/30/2022 & 6/30/2022 & 3/31/2022 \\ \hline 50 & Sales & 4,311,00 & 4,526.00 & 4,699.00 \end{tabular} 51. Cost Of Goods 52. Gross Profit 4.311,004.526.004.699.00 SG8A, R\&D, and DepvAmot 2,785.002,856.002,935.00 53 Expenses: Income After SG8A, R\&D, and 1,526.001,668.00=1,764.00 DepU/Amort. E F Expenses \begin{tabular}{ccccc} 54 & Expenses \\ Non-Operating & 215 & 293 & 34 \\ \hline 55 & Income & & & \\ \hline \end{tabular} \begin{tabular}{l|rrrr} 56 & Interest Expense & 50 & 54 & 54 \\ 57 & Pretax Income & 1,691.00 & 1,321.00 & 1,62600 \\ 58 & Income Taxes & 330 & 358 & 263 \\ 59 & Minority Interest & 45 & 114 & 73 \end{tabular} Investment 60 Gains/Losses 0 0 Osher IncomelCharges Income From 62 Cont Operations 1,361.009631.363.00 Extras \& Discontinued 000 63 Operations. 64 (GAAP) Eamings Per 65 Share Dota 9/30/20225/30/20223/1/2022 66 Average Shares 15196152.45153.53 Diluted EPS: Betore Non- 9.557.369.52 67 Pecurring Hems Diluted Tet EPS 68 (CAAP)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started