Answered step by step

Verified Expert Solution

Question

1 Approved Answer

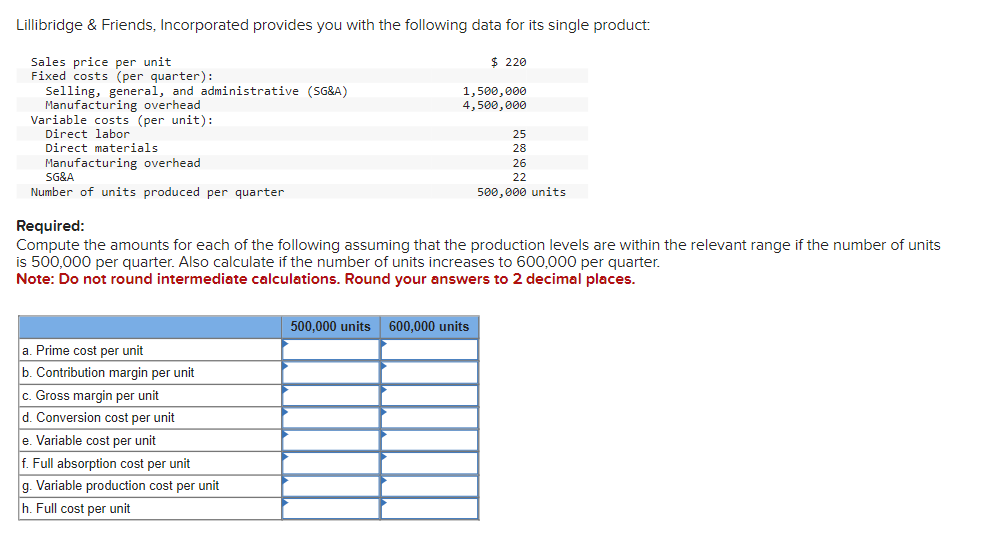

Lillibridge & Friends, Incorporated provides you with the following data for its single product: Required: Compute the amounts for each of the following assuming that

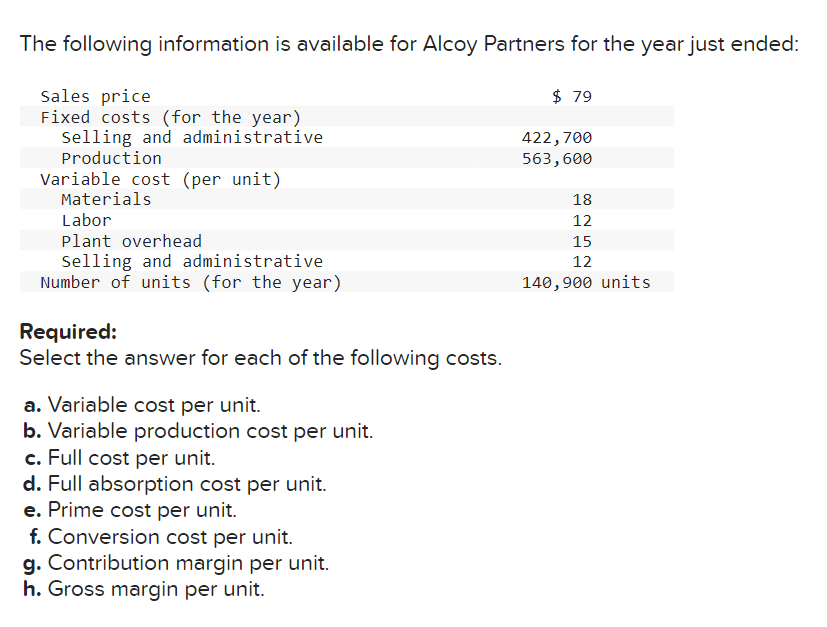

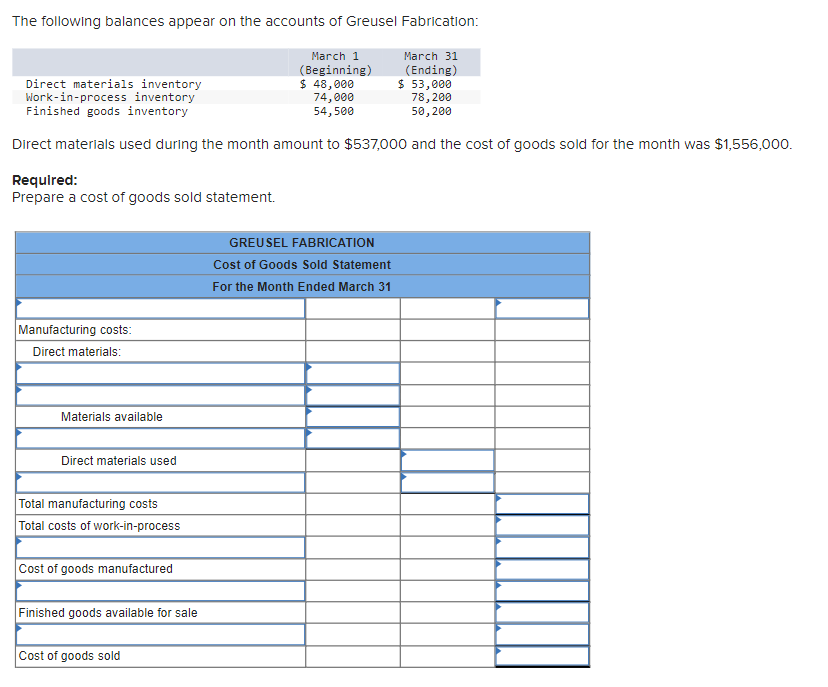

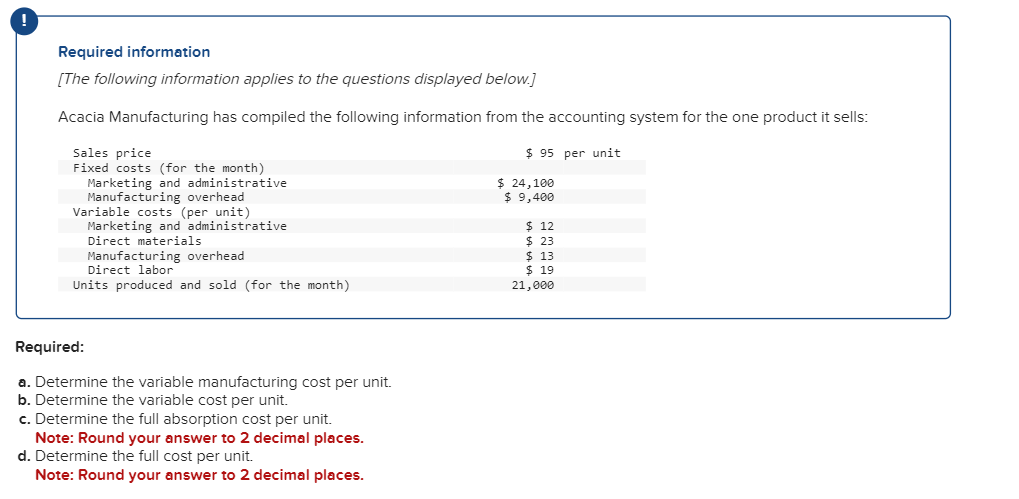

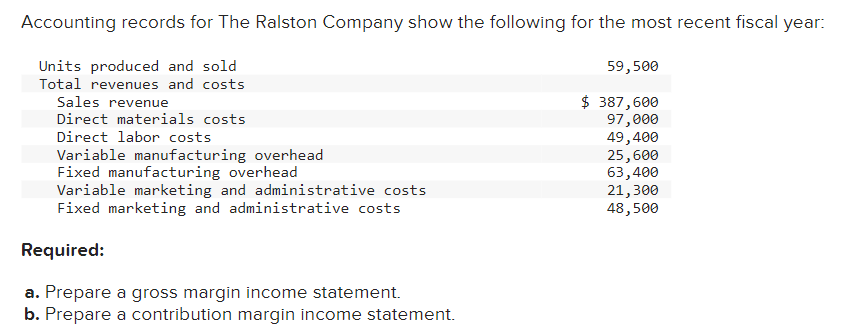

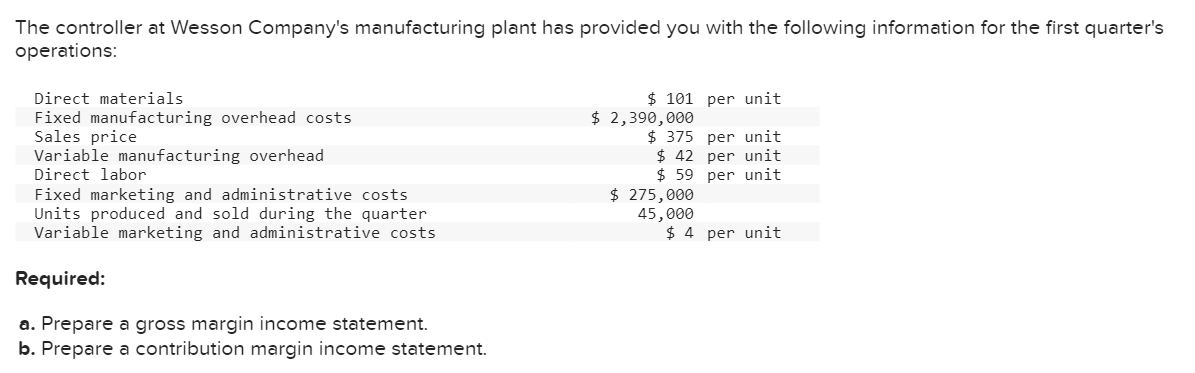

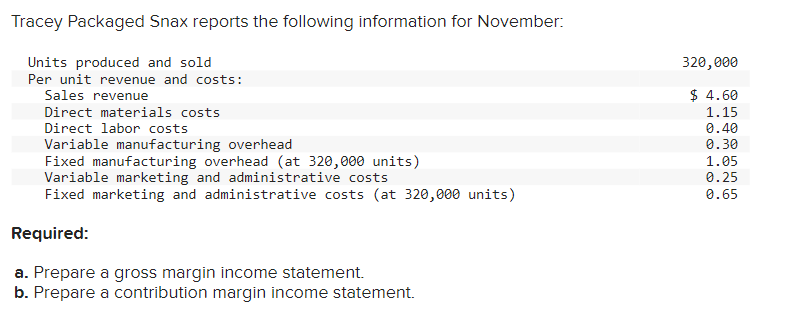

Lillibridge \& Friends, Incorporated provides you with the following data for its single product: Required: Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Tracey Packaged Snax reports the following information for November: Units produced and sold Per unit revenue and costs: Sales revenue Direct materials costs Direct labor costs Variable manufacturing overhead Fixed manufacturing overhead (at 320,000 units) Variable marketing and administrative costs Fixed marketing and administrative costs (at 320,000 units) 320,000 $4.60 1.15 0.40 0.30 1.05 0.25 0.65 Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. The controller at Wesson Company's manufacturing plant has provided you with the following information for the first quarter's operations: Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. The following balances appear on the accounts of Greusel Fabrication: Direct materials used during the month amount to $537,000 and the cost of goods sold for the month was $1,556,000. Required: Prepare a cost of goods sold statement. Accounting records for The Ralston Company show the following for the most recent fiscal year: The following information is available for Alcoy Partners for the year just ended: Required: Select the answer for each of the following costs. a. Variable cost per unit. b. Variable production cost per unit. c. Full cost per unit. d. Full absorption cost per unit. e. Prime cost per unit. f. Conversion cost per unit. g. Contribution margin per unit. h. Gross margin per unit. Required information [The following information applies to the questions displayed below.] Acacia Manufacturing has compiled the following information from the accounting system for the one product it sells: Required: a. Determine the variable manufacturing cost per unit. b. Determine the variable cost per unit. c. Determine the full absorption cost per unit. Note: Round your answer to 2 decimal places. d. Determine the full cost per unit. Note: Round your answer to 2 decimal places

Lillibridge \& Friends, Incorporated provides you with the following data for its single product: Required: Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Tracey Packaged Snax reports the following information for November: Units produced and sold Per unit revenue and costs: Sales revenue Direct materials costs Direct labor costs Variable manufacturing overhead Fixed manufacturing overhead (at 320,000 units) Variable marketing and administrative costs Fixed marketing and administrative costs (at 320,000 units) 320,000 $4.60 1.15 0.40 0.30 1.05 0.25 0.65 Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. The controller at Wesson Company's manufacturing plant has provided you with the following information for the first quarter's operations: Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. The following balances appear on the accounts of Greusel Fabrication: Direct materials used during the month amount to $537,000 and the cost of goods sold for the month was $1,556,000. Required: Prepare a cost of goods sold statement. Accounting records for The Ralston Company show the following for the most recent fiscal year: The following information is available for Alcoy Partners for the year just ended: Required: Select the answer for each of the following costs. a. Variable cost per unit. b. Variable production cost per unit. c. Full cost per unit. d. Full absorption cost per unit. e. Prime cost per unit. f. Conversion cost per unit. g. Contribution margin per unit. h. Gross margin per unit. Required information [The following information applies to the questions displayed below.] Acacia Manufacturing has compiled the following information from the accounting system for the one product it sells: Required: a. Determine the variable manufacturing cost per unit. b. Determine the variable cost per unit. c. Determine the full absorption cost per unit. Note: Round your answer to 2 decimal places. d. Determine the full cost per unit. Note: Round your answer to 2 decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started