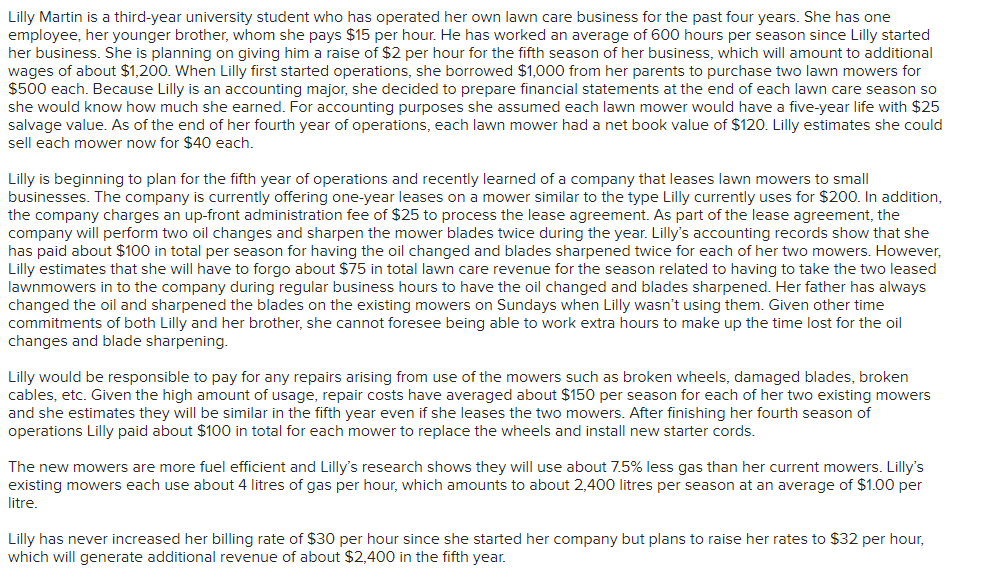

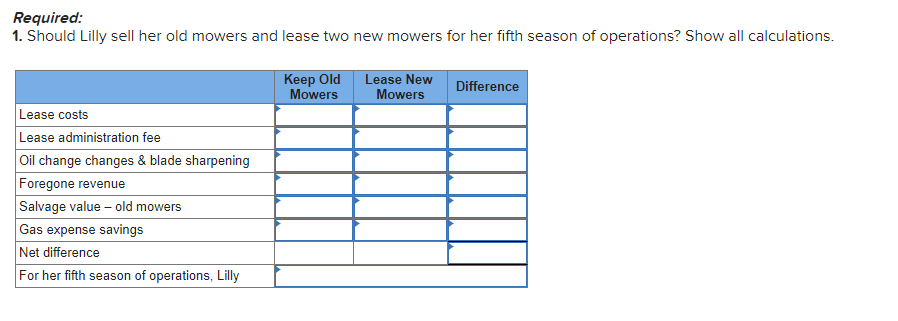

Lilly Martin is a third-year university student who has operated her own lawn care business for the past four years. She has one employee, her younger brother, whom she pays $15 per hour. He has worked an average of 600 hours per season since Lilly started her business. She is planning on giving him a raise of $2 per hour for the fifth season of her business, which will amount to additional wages of about $1,200. When Lilly first started operations, she borrowed $1,000 from her parents to purchase two lawn mowers for $500 each. Because Lilly is an accounting major, she decided to prepare financial statements at the end of each lawn care season so she would know how much she earned. For accounting purposes she assumed each lawn mower would have a five-year life with $25 salvage value. As of the end of her fourth year of operations, each lawn mower had a net book value of $120. Lilly estimates she could sell each mower now for $40 each. Lilly is beginning to plan for the fifth year of operations and recently learned of a company that leases lawn mowers to small businesses. The company is currently offering one-year leases on a mower similar to the type Lilly currently uses for $200. In addition, the company charges an up-front administration fee of $25 to process the lease agreement. As part of the lease agreement, the company will perform two oil changes and sharpen the mower blades twice during the year. Lilly's accounting records show that she has paid about $100 in total per season for having the oil changed and blades sharpened twice for each of her two mowers. However, Lilly estimates that she will have to forgo about $75 in total lawn care revenue for the season related to having to take the two leased lawnmowers in to the company during regular business hours to have the oil changed and blades sharpened. Her father has always changed the oil and sharpened the blades on the existing mowers on Sundays when Lilly wasn't using them. Given other time commitments of both Lilly and her brother, she cannot foresee being able to work extra hours to make up the time lost for the oil changes and blade sharpening. Lilly would be responsible to pay for any repairs arising from use of the mowers such as broken wheels, damaged blades, broken cables, etc. Given the high amount of usage, repair costs have averaged about $150 per season for each of her two existing mowers and she estimates they will be similar in the fifth year even if she leases the two mowers. After finishing her fourth season of operations Lilly paid about $100 in total for each mower to replace the wheels and install new starter cords. The new mowers are more fuel efficient and Lilly's research shows they will use about 7.5% less gas than her current mowers. Lilly's existing mowers each use about 4 litres of gas per hour, which amounts to about 2,400 litres per season at an average of $1.00 per litre. Lilly has never increased her billing rate of $30 per hour since she started her company but plans to raise her rates to $32 per hour, which will generate additional revenue of about $2,400 in the fifth year. Required: 1. Should Lilly sell her old mowers and lease two new mowers for her fifth season of operations? Show all calculations. Keep Old Mowers Lease New Mowers Difference Lease costs Lease administration fee Oil change changes & blade sharpening Foregone revenue Salvage value - old mowers Gas expense savings Net difference For her fifth season of operations, Lilly